Neobank reconciliation focuses on matching digital banking transactions with internal records to ensure accuracy in real-time financial monitoring, leveraging automated tools unique to online banking platforms. Accruals reconciliation involves verifying accrued expenses and revenues recorded in the accounting system against actual financial events to maintain proper period reporting and compliance with accounting standards like GAAP or IFRS. Explore the differences and benefits of each reconciliation method to enhance your financial accuracy and reporting efficiency.

Why it is important

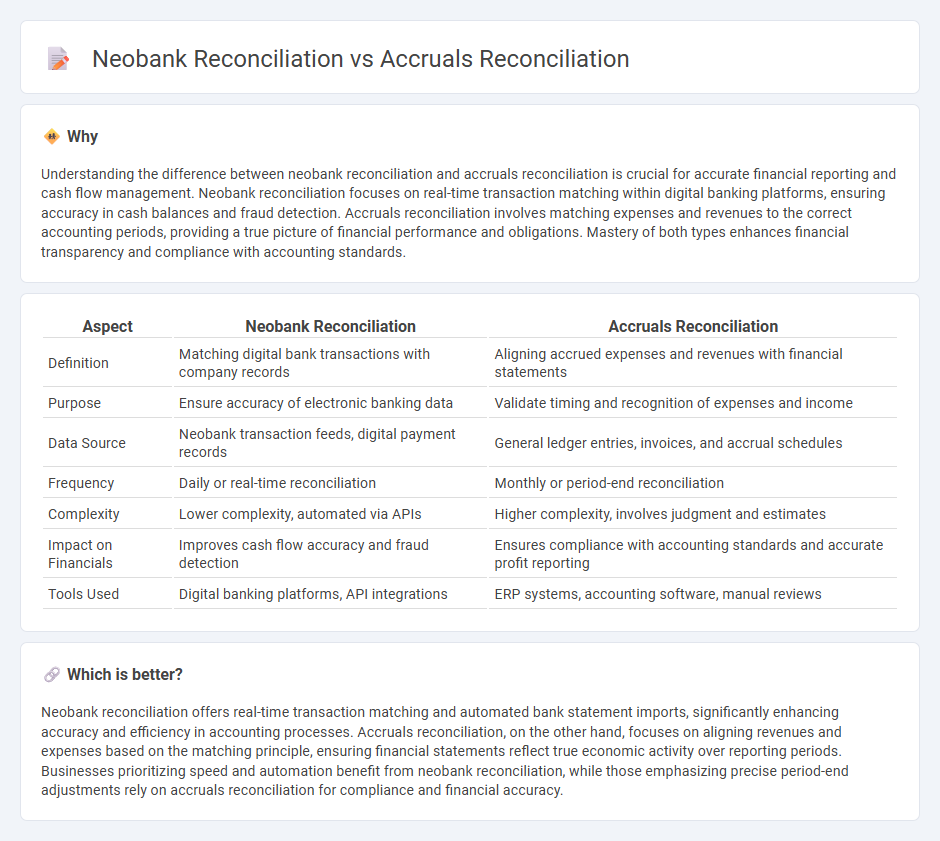

Understanding the difference between neobank reconciliation and accruals reconciliation is crucial for accurate financial reporting and cash flow management. Neobank reconciliation focuses on real-time transaction matching within digital banking platforms, ensuring accuracy in cash balances and fraud detection. Accruals reconciliation involves matching expenses and revenues to the correct accounting periods, providing a true picture of financial performance and obligations. Mastery of both types enhances financial transparency and compliance with accounting standards.

Comparison Table

| Aspect | Neobank Reconciliation | Accruals Reconciliation |

|---|---|---|

| Definition | Matching digital bank transactions with company records | Aligning accrued expenses and revenues with financial statements |

| Purpose | Ensure accuracy of electronic banking data | Validate timing and recognition of expenses and income |

| Data Source | Neobank transaction feeds, digital payment records | General ledger entries, invoices, and accrual schedules |

| Frequency | Daily or real-time reconciliation | Monthly or period-end reconciliation |

| Complexity | Lower complexity, automated via APIs | Higher complexity, involves judgment and estimates |

| Impact on Financials | Improves cash flow accuracy and fraud detection | Ensures compliance with accounting standards and accurate profit reporting |

| Tools Used | Digital banking platforms, API integrations | ERP systems, accounting software, manual reviews |

Which is better?

Neobank reconciliation offers real-time transaction matching and automated bank statement imports, significantly enhancing accuracy and efficiency in accounting processes. Accruals reconciliation, on the other hand, focuses on aligning revenues and expenses based on the matching principle, ensuring financial statements reflect true economic activity over reporting periods. Businesses prioritizing speed and automation benefit from neobank reconciliation, while those emphasizing precise period-end adjustments rely on accruals reconciliation for compliance and financial accuracy.

Connection

Neobank reconciliation and accruals reconciliation are interconnected processes essential for accurate financial reporting and cash flow management. Neobank reconciliation involves verifying electronic transactions against bank statements to ensure precise account balances, while accruals reconciliation adjusts expenses and revenues to the correct accounting periods, reflecting true financial performance. Together, these reconciliations ensure consistency between recorded transactions and actual financial activity, minimizing discrepancies and improving the reliability of accounting data.

Key Terms

Timing Differences

Accruals reconciliation involves matching expenses and revenues to the period they relate to, often revealing timing differences due to accrued but not yet actualized transactions. Neobank reconciliation focuses on real-time transaction recording, minimizing timing discrepancies by reflecting immediate electronic banking activities. Explore how timing differences impact financial accuracy and control in both reconciliation methods.

Transaction Matching

Accruals reconciliation involves verifying and matching accrued expenses and revenues against actual transactions to ensure financial statements reflect accurate financial positions. Neobank reconciliation, centered on transaction matching, leverages automated systems to align digital banking transactions with recorded entries, enhancing real-time accuracy and reducing manual errors. Explore best practices and tools to optimize transaction matching efficiency in both accruals and neobank reconciliations.

Source Documentation

Accruals reconciliation relies heavily on source documentation such as invoices, purchase orders, and expense reports to match expenses and revenues accurately within the accounting period. Neobank reconciliation emphasizes leveraging digital transaction records, real-time payment data, and automated feeds to streamline verification and reduce manual errors. Explore comprehensive strategies to optimize your reconciliation processes with cutting-edge source documentation management.

Source and External Links

Receipt Accrual, Reconciliation, and Clearing - Oracle Docs - Accrual reconciliation involves matching accrued liabilities recorded when goods are received to the corresponding supplier invoices, ensuring any remaining balances are justified, resolved, and cleared to inventory valuation, with tools provided for this process in Oracle Receipt Accounting.

Reconciling A/P Accrual Accounts Balance - Oracle Docs - The Accrual Reconciliation Report compares purchase order receipts to accounts payable invoices to identify and resolve differences such as late receipts, incorrect quantities, or supplier overbilling, facilitating accrual clearing and write-offs as needed.

Account reconciliation: Definition, steps and types - Rho Blog - Account reconciliation compares general ledger balances, including accrual accounts, with supporting documents to identify discrepancies, investigate causes, make adjustments, and ensure accurate financial reporting, typically performed at month-end and year-end closes.

dowidth.com

dowidth.com