Triple entry bookkeeping enhances financial transparency by incorporating a cryptographic receipt for each transaction, creating a decentralized and tamper-proof ledger beyond traditional double entry systems. Automated reconciliation uses advanced software to instantly match and verify transactions across multiple accounts, reducing manual errors and accelerating financial close processes. Explore how these innovative accounting methods can transform your business accuracy and efficiency.

Why it is important

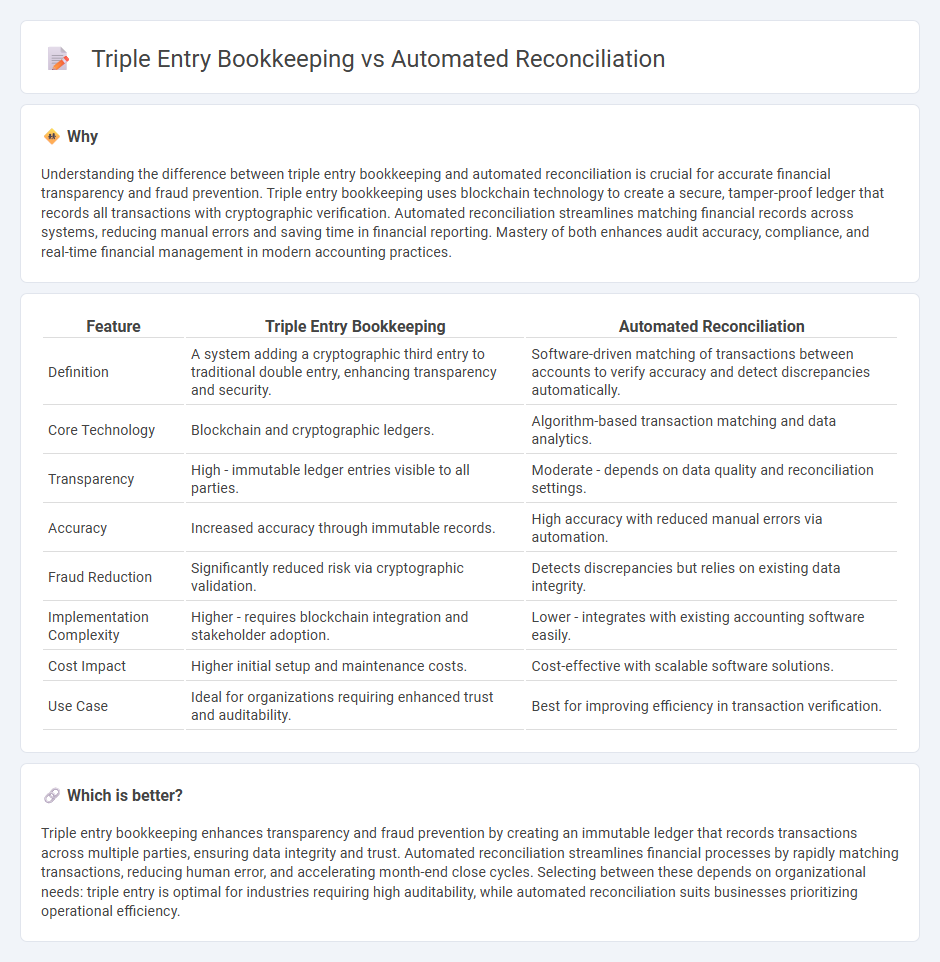

Understanding the difference between triple entry bookkeeping and automated reconciliation is crucial for accurate financial transparency and fraud prevention. Triple entry bookkeeping uses blockchain technology to create a secure, tamper-proof ledger that records all transactions with cryptographic verification. Automated reconciliation streamlines matching financial records across systems, reducing manual errors and saving time in financial reporting. Mastery of both enhances audit accuracy, compliance, and real-time financial management in modern accounting practices.

Comparison Table

| Feature | Triple Entry Bookkeeping | Automated Reconciliation |

|---|---|---|

| Definition | A system adding a cryptographic third entry to traditional double entry, enhancing transparency and security. | Software-driven matching of transactions between accounts to verify accuracy and detect discrepancies automatically. |

| Core Technology | Blockchain and cryptographic ledgers. | Algorithm-based transaction matching and data analytics. |

| Transparency | High - immutable ledger entries visible to all parties. | Moderate - depends on data quality and reconciliation settings. |

| Accuracy | Increased accuracy through immutable records. | High accuracy with reduced manual errors via automation. |

| Fraud Reduction | Significantly reduced risk via cryptographic validation. | Detects discrepancies but relies on existing data integrity. |

| Implementation Complexity | Higher - requires blockchain integration and stakeholder adoption. | Lower - integrates with existing accounting software easily. |

| Cost Impact | Higher initial setup and maintenance costs. | Cost-effective with scalable software solutions. |

| Use Case | Ideal for organizations requiring enhanced trust and auditability. | Best for improving efficiency in transaction verification. |

Which is better?

Triple entry bookkeeping enhances transparency and fraud prevention by creating an immutable ledger that records transactions across multiple parties, ensuring data integrity and trust. Automated reconciliation streamlines financial processes by rapidly matching transactions, reducing human error, and accelerating month-end close cycles. Selecting between these depends on organizational needs: triple entry is optimal for industries requiring high auditability, while automated reconciliation suits businesses prioritizing operational efficiency.

Connection

Triple entry bookkeeping enhances transparency by recording transactions with cryptographic proofs, creating an immutable ledger that facilitates automated reconciliation processes. Automated reconciliation leverages these secure, verifiable entries to quickly match and verify transactions, reducing errors and manual intervention. This integration streamlines accounting workflows, improves accuracy, and accelerates financial reporting.

Key Terms

**Automated Reconciliation:**

Automated reconciliation leverages advanced algorithms and AI to swiftly match financial transactions across multiple accounts, reducing human error and saving time in the accounting process. It ensures real-time accuracy by continuously updating records and flagging discrepancies, enhancing financial transparency and compliance. Discover how automated reconciliation can transform your accounting efficiency and accuracy.

Matching Algorithms

Automated reconciliation employs advanced matching algorithms to compare transactions by date, amount, and description, significantly reducing manual errors and increasing efficiency. Triple entry bookkeeping integrates encrypted transaction data using blockchain technology, enabling real-time matching and verification across all parties involved, enhancing transparency and trust. Explore the nuances of matching algorithms in financial processes to improve accuracy and reliability.

Data Integration

Automated reconciliation leverages APIs and machine learning algorithms to integrate data from multiple financial systems, ensuring real-time accuracy and reducing manual errors. Triple entry bookkeeping enhances data integration by embedding cryptographic verification within blockchain technology, creating a decentralized and immutable ledger that synchronizes transaction records across all parties. Explore how these advanced data integration methods optimize financial transparency and operational efficiency.

Source and External Links

What is Automated Reconciliation? - Kolleno - Automated reconciliation software automates the matching of transactions to ensure financial records align with bank statements, reducing manual work and errors by leveraging algorithms and machine learning for real-time discrepancy resolution and reliable audit trails.

Account Reconciliation Automation for Businesses - Invoiced - Automated account reconciliation uses technology such as AI and automation software to compare financial records with external data sources quickly and accurately, minimizing errors and saving time compared to manual spreadsheet-based processes.

Manual vs. Automated Reconciliation: Why Automation Wins - Nominal - Automated reconciliation utilizes AI-powered software to perform real-time data matching and flag exceptions, enhancing speed, accuracy, and visibility while enabling finance teams to focus on exceptions instead of repetitive manual matching tasks.

dowidth.com

dowidth.com