Digital asset valuation requires precise methods to determine market value fluctuations, while amortization policies focus on systematically allocating the cost of intangible assets over time. Accurate digital asset valuation supports informed financial reporting and investment decisions, contrasting with amortization that ensures expense recognition aligns with asset usage. Explore more to understand how these accounting practices impact financial strategy and compliance.

Why it is important

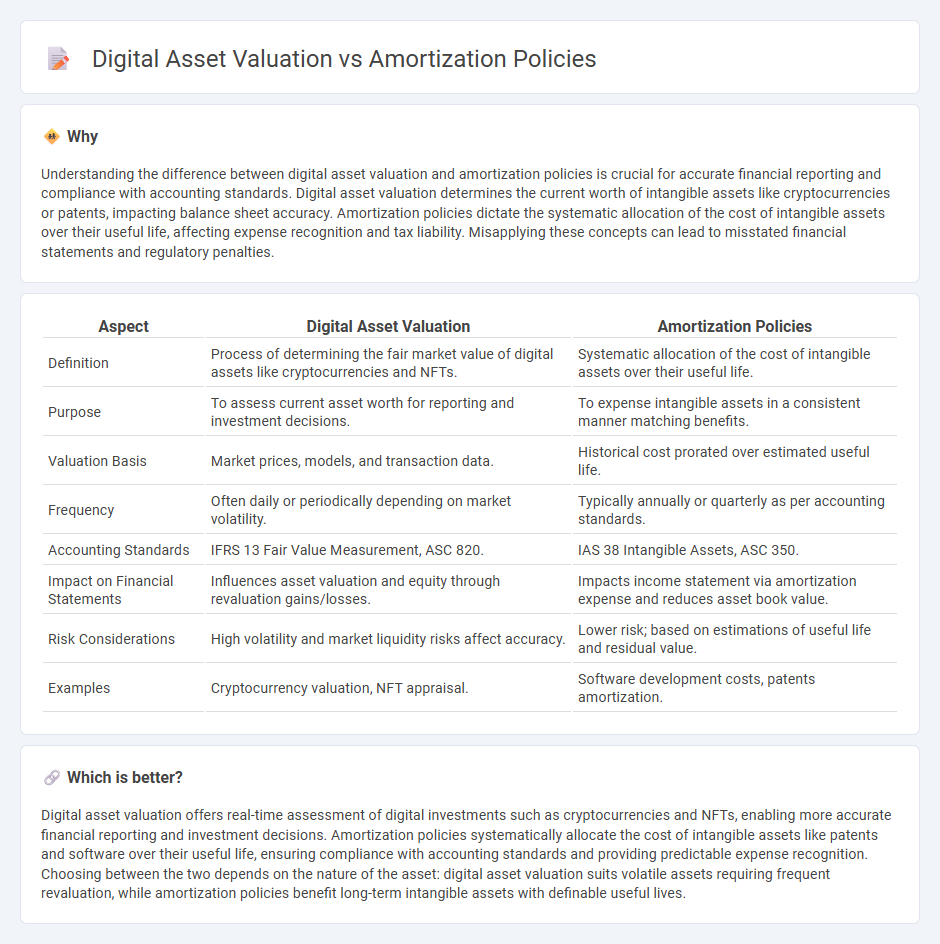

Understanding the difference between digital asset valuation and amortization policies is crucial for accurate financial reporting and compliance with accounting standards. Digital asset valuation determines the current worth of intangible assets like cryptocurrencies or patents, impacting balance sheet accuracy. Amortization policies dictate the systematic allocation of the cost of intangible assets over their useful life, affecting expense recognition and tax liability. Misapplying these concepts can lead to misstated financial statements and regulatory penalties.

Comparison Table

| Aspect | Digital Asset Valuation | Amortization Policies |

|---|---|---|

| Definition | Process of determining the fair market value of digital assets like cryptocurrencies and NFTs. | Systematic allocation of the cost of intangible assets over their useful life. |

| Purpose | To assess current asset worth for reporting and investment decisions. | To expense intangible assets in a consistent manner matching benefits. |

| Valuation Basis | Market prices, models, and transaction data. | Historical cost prorated over estimated useful life. |

| Frequency | Often daily or periodically depending on market volatility. | Typically annually or quarterly as per accounting standards. |

| Accounting Standards | IFRS 13 Fair Value Measurement, ASC 820. | IAS 38 Intangible Assets, ASC 350. |

| Impact on Financial Statements | Influences asset valuation and equity through revaluation gains/losses. | Impacts income statement via amortization expense and reduces asset book value. |

| Risk Considerations | High volatility and market liquidity risks affect accuracy. | Lower risk; based on estimations of useful life and residual value. |

| Examples | Cryptocurrency valuation, NFT appraisal. | Software development costs, patents amortization. |

Which is better?

Digital asset valuation offers real-time assessment of digital investments such as cryptocurrencies and NFTs, enabling more accurate financial reporting and investment decisions. Amortization policies systematically allocate the cost of intangible assets like patents and software over their useful life, ensuring compliance with accounting standards and providing predictable expense recognition. Choosing between the two depends on the nature of the asset: digital asset valuation suits volatile assets requiring frequent revaluation, while amortization policies benefit long-term intangible assets with definable useful lives.

Connection

Digital asset valuation directly influences amortization policies by determining the initial cost basis and useful life assigned to intangible assets, ensuring accurate expense recognition over time. Precise valuation methods, such as discounted cash flow or market comparison, impact amortization schedules that reflect asset consumption and impairment risks. Integration of advanced accounting software enables consistent application of these policies, enhancing financial statement reliability and compliance with relevant accounting standards like IFRS or GAAP.

Key Terms

Useful Life

Amortization policies determine the systematic allocation of a digital asset's cost over its useful life, impacting financial reporting and tax obligations. Accurate assessment of the useful life for digital assets is crucial for valuation, influencing depreciation schedules and investors' perception of asset worth. Explore our detailed guide to understand how useful life estimation affects amortization practices and digital asset valuation.

Impairment

Amortization policies dictate the systematic allocation of intangible asset costs over their useful life, impacting financial statements and tax reporting. Digital asset valuation, specifically involving impairment testing, requires assessing whether the carrying amount exceeds recoverable value, triggering necessary write-downs to reflect true asset worth. Explore how mastering these concepts can enhance accurate financial reporting and investment decisions.

Fair Value

Amortization policies determine the systematic allocation of a digital asset's cost over its useful life, impacting reported expenses and balance sheet values. Fair value measurement of digital assets requires assessing market conditions and asset-specific factors to reflect current exit prices accurately, often challenging due to market volatility and lack of standardized valuation models. Explore how integrating amortization strategies with fair value assessments optimizes financial reporting and enhances transparency in digital asset valuation.

Source and External Links

Overview of Public Pension Plan Amortization Policies - This document discusses the amortization policies for public pension plans, focusing on eliminating unfunded liabilities over a structured period.

Actuarial Amortization Policy - CalPERS - The Actuarial Amortization Policy by CalPERS outlines methods to manage unfunded liabilities, ensuring benefit security while minimizing fluctuations in employer contribution rates.

What is Amortization? How is it Calculated? - This article explains the concept of amortization in accounting, focusing on its application to intangible assets and its differences from depreciation.

dowidth.com

dowidth.com