Integrated ESG reporting combines environmental, social, and governance metrics with traditional financial data to provide a comprehensive view of a company's performance and long-term value creation. Unlike conventional financial reporting that focuses solely on monetary results, integrated reporting enhances transparency by including non-financial factors critical to investors and stakeholders. Discover how integrating ESG criteria with financial reports can drive sustainable business strategies and improve accountability.

Why it is important

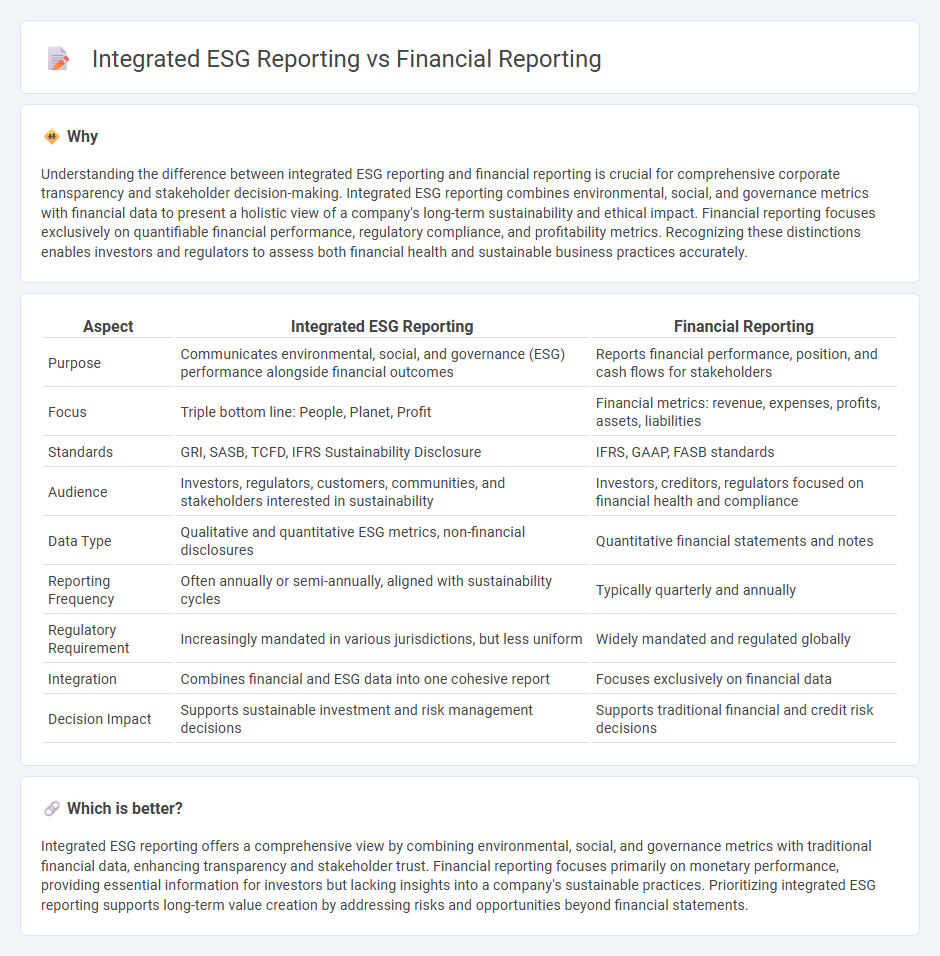

Understanding the difference between integrated ESG reporting and financial reporting is crucial for comprehensive corporate transparency and stakeholder decision-making. Integrated ESG reporting combines environmental, social, and governance metrics with financial data to present a holistic view of a company's long-term sustainability and ethical impact. Financial reporting focuses exclusively on quantifiable financial performance, regulatory compliance, and profitability metrics. Recognizing these distinctions enables investors and regulators to assess both financial health and sustainable business practices accurately.

Comparison Table

| Aspect | Integrated ESG Reporting | Financial Reporting |

|---|---|---|

| Purpose | Communicates environmental, social, and governance (ESG) performance alongside financial outcomes | Reports financial performance, position, and cash flows for stakeholders |

| Focus | Triple bottom line: People, Planet, Profit | Financial metrics: revenue, expenses, profits, assets, liabilities |

| Standards | GRI, SASB, TCFD, IFRS Sustainability Disclosure | IFRS, GAAP, FASB standards |

| Audience | Investors, regulators, customers, communities, and stakeholders interested in sustainability | Investors, creditors, regulators focused on financial health and compliance |

| Data Type | Qualitative and quantitative ESG metrics, non-financial disclosures | Quantitative financial statements and notes |

| Reporting Frequency | Often annually or semi-annually, aligned with sustainability cycles | Typically quarterly and annually |

| Regulatory Requirement | Increasingly mandated in various jurisdictions, but less uniform | Widely mandated and regulated globally |

| Integration | Combines financial and ESG data into one cohesive report | Focuses exclusively on financial data |

| Decision Impact | Supports sustainable investment and risk management decisions | Supports traditional financial and credit risk decisions |

Which is better?

Integrated ESG reporting offers a comprehensive view by combining environmental, social, and governance metrics with traditional financial data, enhancing transparency and stakeholder trust. Financial reporting focuses primarily on monetary performance, providing essential information for investors but lacking insights into a company's sustainable practices. Prioritizing integrated ESG reporting supports long-term value creation by addressing risks and opportunities beyond financial statements.

Connection

Integrated ESG reporting and financial reporting are connected through the alignment of environmental, social, and governance metrics with traditional financial performance indicators, enabling a holistic view of a company's long-term value creation. The integration ensures that ESG factors are quantified and disclosed alongside financial data, enhancing transparency for investors and stakeholders. This approach supports compliance with evolving regulatory frameworks and drives more informed decision-making based on sustainable business practices.

Key Terms

Materiality

Financial reporting primarily emphasizes quantitative data and compliance with accounting standards to provide an accurate representation of a company's financial health. Integrated ESG reporting expands this focus by addressing material environmental, social, and governance factors that impact long-term value creation and stakeholder trust. Explore how aligning materiality in ESG disclosures enhances transparency and drives sustainable business strategies.

Stakeholders

Financial reporting primarily serves investors and regulators by providing quantitative data on revenue, expenses, and profits to assess company performance and compliance. Integrated ESG reporting expands this focus, addressing a broader range of stakeholders such as employees, customers, communities, and environmental groups by including metrics on environmental impact, social responsibility, and governance practices. Explore the advantages of integrated ESG reporting to understand how it enhances transparency and stakeholder engagement beyond traditional financial disclosures.

Double materiality

Financial reporting primarily emphasizes financial materiality by disclosing information relevant to investors and stakeholders for economic decision-making. Integrated ESG reporting incorporates double materiality, addressing both the financial impact on the organization and the organization's impact on environmental, social, and governance factors. Explore the nuances of double materiality to understand its significance in shaping sustainable business strategies.

Source and External Links

What Is Financial Reporting & Why Is It Important - This article explains the basics of financial reporting, including its importance for both external and internal stakeholders, and the challenges involved in creating accurate and timely reports.

What Is Financial Reporting? Definition, Importance, and - This resource provides an overview of financial reporting, its legal requirements, and its role in ensuring a company's long-term success by providing essential financial information.

What Is Financial Reporting? Definition, Types and Importance - This article discusses the definition, types, and importance of financial reporting for companies and investors, highlighting its role in financial performance evaluation and future projections.

dowidth.com

dowidth.com