Digital asset valuation involves estimating the worth of cryptocurrencies, NFTs, and other blockchain-based assets using market trends, demand, and technological factors. Fair value measurement in accounting refers to determining an asset's price based on an orderly transaction between market participants at the measurement date, often using market, income, or cost approaches. Explore the key differences and implications for financial reporting in digital asset accounting.

Why it is important

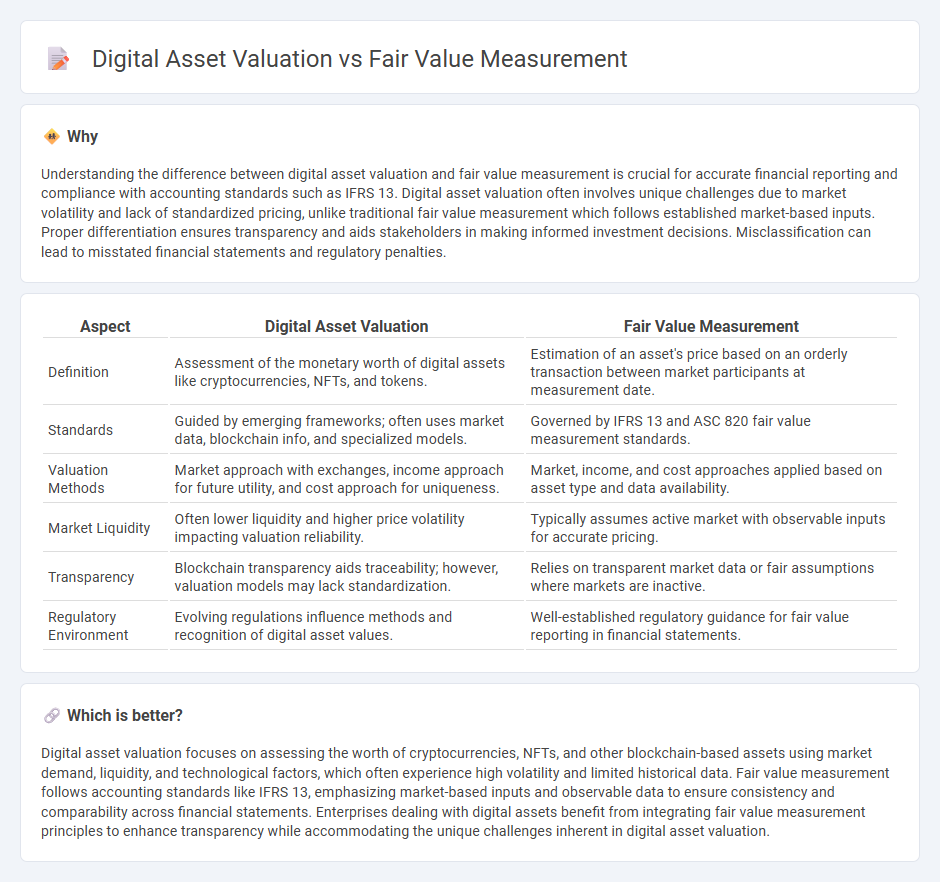

Understanding the difference between digital asset valuation and fair value measurement is crucial for accurate financial reporting and compliance with accounting standards such as IFRS 13. Digital asset valuation often involves unique challenges due to market volatility and lack of standardized pricing, unlike traditional fair value measurement which follows established market-based inputs. Proper differentiation ensures transparency and aids stakeholders in making informed investment decisions. Misclassification can lead to misstated financial statements and regulatory penalties.

Comparison Table

| Aspect | Digital Asset Valuation | Fair Value Measurement |

|---|---|---|

| Definition | Assessment of the monetary worth of digital assets like cryptocurrencies, NFTs, and tokens. | Estimation of an asset's price based on an orderly transaction between market participants at measurement date. |

| Standards | Guided by emerging frameworks; often uses market data, blockchain info, and specialized models. | Governed by IFRS 13 and ASC 820 fair value measurement standards. |

| Valuation Methods | Market approach with exchanges, income approach for future utility, and cost approach for uniqueness. | Market, income, and cost approaches applied based on asset type and data availability. |

| Market Liquidity | Often lower liquidity and higher price volatility impacting valuation reliability. | Typically assumes active market with observable inputs for accurate pricing. |

| Transparency | Blockchain transparency aids traceability; however, valuation models may lack standardization. | Relies on transparent market data or fair assumptions where markets are inactive. |

| Regulatory Environment | Evolving regulations influence methods and recognition of digital asset values. | Well-established regulatory guidance for fair value reporting in financial statements. |

Which is better?

Digital asset valuation focuses on assessing the worth of cryptocurrencies, NFTs, and other blockchain-based assets using market demand, liquidity, and technological factors, which often experience high volatility and limited historical data. Fair value measurement follows accounting standards like IFRS 13, emphasizing market-based inputs and observable data to ensure consistency and comparability across financial statements. Enterprises dealing with digital assets benefit from integrating fair value measurement principles to enhance transparency while accommodating the unique challenges inherent in digital asset valuation.

Connection

Digital asset valuation relies on fair value measurement principles to determine the accurate market price of intangible assets like cryptocurrencies and NFTs. Fair value measurement provides a standardized framework using observable market data or valuation techniques that ensure consistency and reliability in reporting digital assets on financial statements. This connection enhances transparency and compliance in accounting practices, facilitating better investment decisions and regulatory oversight.

Key Terms

Market Approach

Fair value measurement under the Market Approach relies on observable market data to determine asset prices, emphasizing active market transactions and quoted prices for similar assets. Digital asset valuation via the Market Approach faces challenges due to limited liquidity, high volatility, and fewer comparable benchmarks, making it necessary to adjust traditional methods to account for unique digital market dynamics. Explore detailed methodologies and case studies to better understand the nuances between these valuation techniques.

Observable Inputs

Fair value measurement relies on observable inputs such as market prices and comparable asset transactions to ensure accurate asset valuation under accounting standards like IFRS 13 and ASC 820. Digital asset valuation presents unique challenges due to limited market liquidity and the frequent absence of reliable, observable inputs, often necessitating alternative valuation techniques such as discounted cash flow or proprietary models. Discover how leveraging observable inputs enhances transparency and reliability in asset valuation by exploring industry best practices.

Valuation Techniques

Fair value measurement relies on established valuation techniques such as the market approach, income approach, and cost approach to determine an asset's price under current market conditions, adhering to standards like IFRS 13 and ASC 820. Digital asset valuation employs specialized methods including discounted cash flow for utility tokens, market comparables for cryptocurrencies, and hybrid approaches for NFTs, considering factors like liquidity, volatility, and unique digital characteristics. Explore how these valuation techniques adapt to evolving markets and regulatory frameworks to gain deeper insights.

Source and External Links

10.2 Definition of Fair Value | DART - Fair value measurement estimates the price at which an orderly transaction to sell an asset or transfer a liability would occur between market participants under current market conditions at the measurement date, including valuation premise and principal market considerations according to ASC 820-10 guidance.

IFRS 13 Fair Value Measurement - IFRS 13 defines fair value as the exit price in an orderly market transaction between market participants, requiring use of market participant assumptions and observable inputs whenever possible, and applies a single framework for measuring and disclosing fair value.

Fair value measurements and disclosures | Deloitte US - ASC 820 sets out a market-based, exit price framework for fair value measurements, emphasizing that fair value is not entity-specific and detailing a step-by-step approach to measure fair value and meet disclosure requirements for assets, liabilities, and equity under US GAAP.

dowidth.com

dowidth.com