Carbon footprint accounting measures greenhouse gas emissions generated by business activities, focusing on environmental impact and sustainability metrics. Triple bottom line accounting expands this perspective by evaluating social, environmental, and financial performance to provide a holistic assessment of a company's overall impact. Explore the key differences and benefits of these accounting methods to enhance sustainable business strategies.

Why it is important

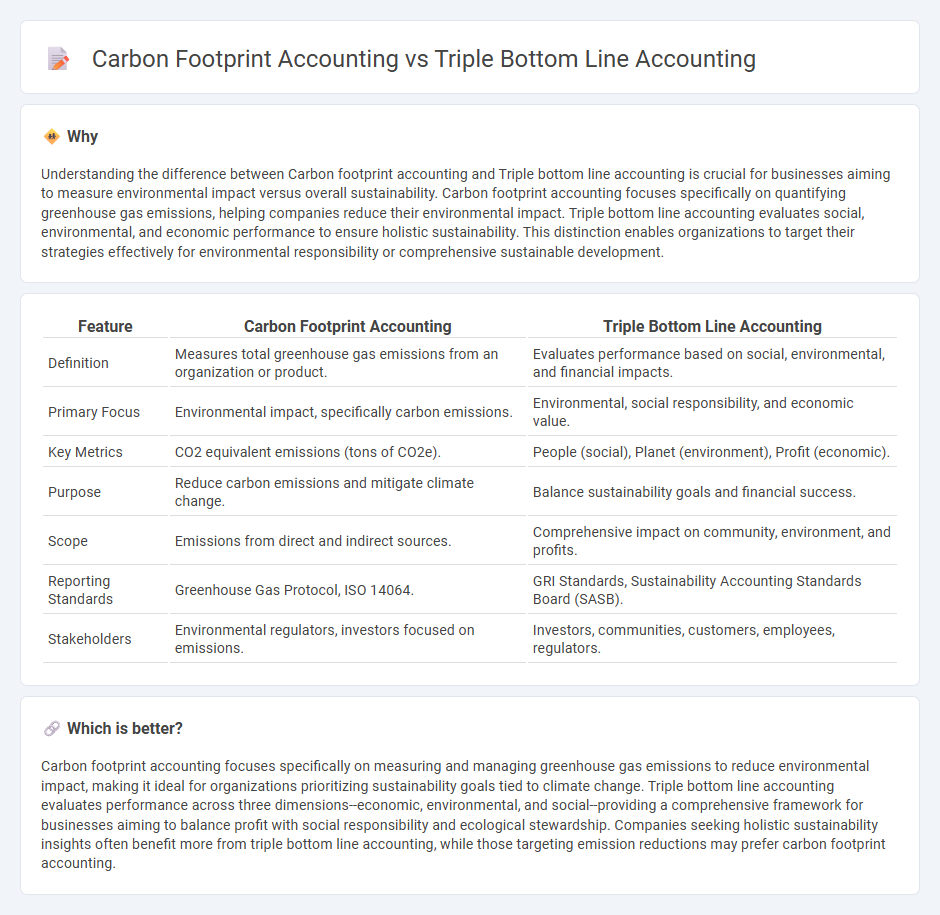

Understanding the difference between Carbon footprint accounting and Triple bottom line accounting is crucial for businesses aiming to measure environmental impact versus overall sustainability. Carbon footprint accounting focuses specifically on quantifying greenhouse gas emissions, helping companies reduce their environmental impact. Triple bottom line accounting evaluates social, environmental, and economic performance to ensure holistic sustainability. This distinction enables organizations to target their strategies effectively for environmental responsibility or comprehensive sustainable development.

Comparison Table

| Feature | Carbon Footprint Accounting | Triple Bottom Line Accounting |

|---|---|---|

| Definition | Measures total greenhouse gas emissions from an organization or product. | Evaluates performance based on social, environmental, and financial impacts. |

| Primary Focus | Environmental impact, specifically carbon emissions. | Environmental, social responsibility, and economic value. |

| Key Metrics | CO2 equivalent emissions (tons of CO2e). | People (social), Planet (environment), Profit (economic). |

| Purpose | Reduce carbon emissions and mitigate climate change. | Balance sustainability goals and financial success. |

| Scope | Emissions from direct and indirect sources. | Comprehensive impact on community, environment, and profits. |

| Reporting Standards | Greenhouse Gas Protocol, ISO 14064. | GRI Standards, Sustainability Accounting Standards Board (SASB). |

| Stakeholders | Environmental regulators, investors focused on emissions. | Investors, communities, customers, employees, regulators. |

Which is better?

Carbon footprint accounting focuses specifically on measuring and managing greenhouse gas emissions to reduce environmental impact, making it ideal for organizations prioritizing sustainability goals tied to climate change. Triple bottom line accounting evaluates performance across three dimensions--economic, environmental, and social--providing a comprehensive framework for businesses aiming to balance profit with social responsibility and ecological stewardship. Companies seeking holistic sustainability insights often benefit more from triple bottom line accounting, while those targeting emission reductions may prefer carbon footprint accounting.

Connection

Carbon footprint accounting quantifies greenhouse gas emissions associated with business activities, directly addressing the environmental aspect of Triple Bottom Line (TBL) accounting, which evaluates social, environmental, and economic impacts. By integrating carbon emissions data into TBL frameworks, companies can measure sustainability performance more holistically, aligning environmental responsibility with financial and social outcomes. This connection promotes transparent reporting and drives strategic decisions to reduce ecological impacts while enhancing overall corporate sustainability.

Key Terms

Social, Environmental, and Financial Performance (Triple Bottom Line Accounting)

Triple bottom line accounting evaluates a company's social, environmental, and financial performance, integrating sustainability metrics with traditional financial results to promote holistic value creation. In contrast, carbon footprint accounting specifically measures greenhouse gas emissions to assess environmental impact, primarily focusing on the ecological dimension of sustainability. Explore detailed methodologies and practical applications to understand how these frameworks drive corporate responsibility.

Greenhouse Gas Emissions (Carbon Footprint Accounting)

Triple bottom line accounting evaluates environmental, social, and economic impacts to measure sustainability comprehensively, while carbon footprint accounting specifically quantifies greenhouse gas emissions to assess climate impact. Carbon footprint accounting targets the reduction of CO2 equivalents across scopes 1, 2, and 3 emissions, providing precise data for carbon management and climate strategy. Explore further to understand how these accounting methods drive sustainability and emission reduction goals in organizations.

Sustainability Reporting

Triple bottom line accounting measures sustainability by evaluating social, environmental, and economic impacts, providing a comprehensive view of organizational performance. Carbon footprint accounting focuses specifically on quantifying greenhouse gas emissions to assess an entity's environmental impact. Explore these methodologies further to understand their roles in enhancing sustainability reporting accuracy and effectiveness.

Source and External Links

The Triple Bottom Line: What Is It and How Does It Work? - Triple bottom line (TBL) is an accounting framework measuring performance in three dimensions: social, environmental, and financial, aiming to support sustainability goals beyond traditional profit metrics.

What Is the Triple Bottom Line (TBL)? - IBM - The TBL framework maximizes the three P's: people (social impact), planet (environmental impact), and profit (financial performance), holding organizations accountable to all stakeholders, not just shareholders.

Triple bottom line - Wikipedia - The triple bottom line is an accounting framework comprising social, environmental, and economic parts, coined by John Elkington in 1994, encouraging companies to evaluate broader performance beyond just economic success.

dowidth.com

dowidth.com