Cryptocurrency valuation involves assessing digital assets based on market demand, liquidity, and price volatility, contrasting with Net Realizable Value (NRV) which calculates the expected selling price minus costs of completion and sale. While NRV focuses on physical inventory and receivables, cryptocurrency valuation requires dynamic approaches reflecting rapid market fluctuations and regulatory impacts. Explore the differences between these valuation methods to enhance your accounting strategies.

Why it is important

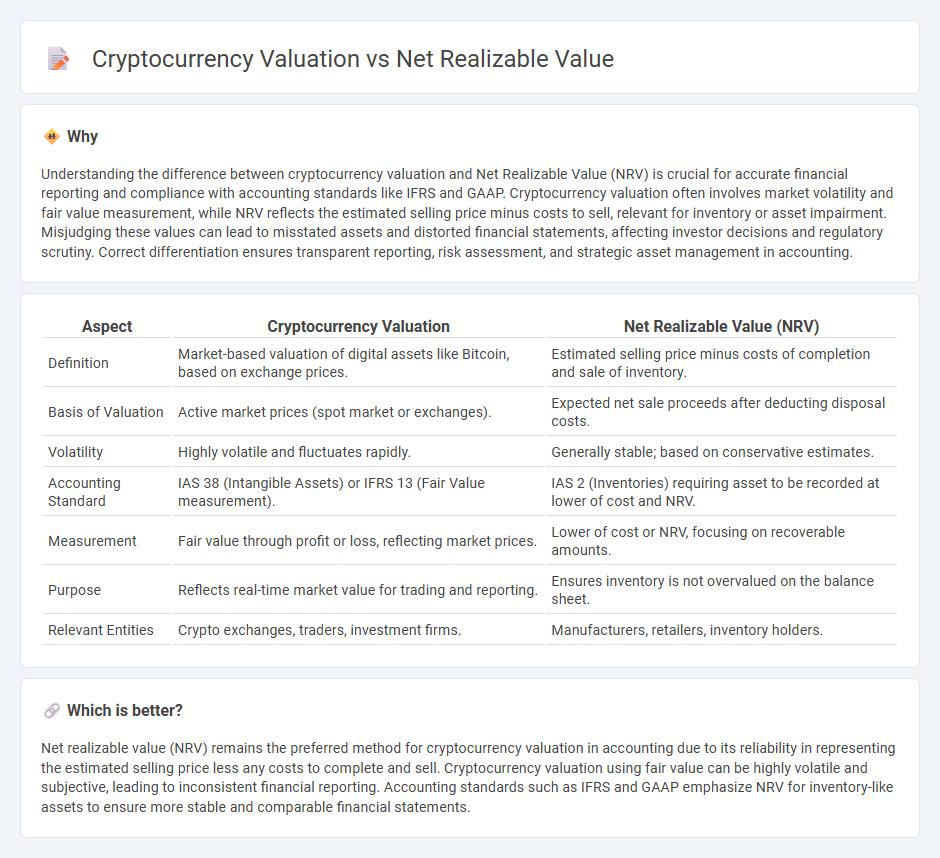

Understanding the difference between cryptocurrency valuation and Net Realizable Value (NRV) is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Cryptocurrency valuation often involves market volatility and fair value measurement, while NRV reflects the estimated selling price minus costs to sell, relevant for inventory or asset impairment. Misjudging these values can lead to misstated assets and distorted financial statements, affecting investor decisions and regulatory scrutiny. Correct differentiation ensures transparent reporting, risk assessment, and strategic asset management in accounting.

Comparison Table

| Aspect | Cryptocurrency Valuation | Net Realizable Value (NRV) |

|---|---|---|

| Definition | Market-based valuation of digital assets like Bitcoin, based on exchange prices. | Estimated selling price minus costs of completion and sale of inventory. |

| Basis of Valuation | Active market prices (spot market or exchanges). | Expected net sale proceeds after deducting disposal costs. |

| Volatility | Highly volatile and fluctuates rapidly. | Generally stable; based on conservative estimates. |

| Accounting Standard | IAS 38 (Intangible Assets) or IFRS 13 (Fair Value measurement). | IAS 2 (Inventories) requiring asset to be recorded at lower of cost and NRV. |

| Measurement | Fair value through profit or loss, reflecting market prices. | Lower of cost or NRV, focusing on recoverable amounts. |

| Purpose | Reflects real-time market value for trading and reporting. | Ensures inventory is not overvalued on the balance sheet. |

| Relevant Entities | Crypto exchanges, traders, investment firms. | Manufacturers, retailers, inventory holders. |

Which is better?

Net realizable value (NRV) remains the preferred method for cryptocurrency valuation in accounting due to its reliability in representing the estimated selling price less any costs to complete and sell. Cryptocurrency valuation using fair value can be highly volatile and subjective, leading to inconsistent financial reporting. Accounting standards such as IFRS and GAAP emphasize NRV for inventory-like assets to ensure more stable and comparable financial statements.

Connection

Cryptocurrency valuation hinges on determining the fair market value, which directly impacts the calculation of Net Realizable Value (NRV) used in accounting for digital asset inventories. NRV represents the estimated selling price of cryptocurrency minus any expected costs of completion, disposal, and transportation, ensuring accurate financial reporting under inventory valuation standards. Accurate cryptocurrency valuation methods such as mark-to-market or cost basis critically influence NRV to reflect realistic asset values on balance sheets.

Key Terms

Fair Value

Fair value plays a crucial role in both net realizable value (NRV) and cryptocurrency valuation, serving as the estimated selling price less any costs to complete and sell assets. For cryptocurrencies, fair value often relies on market prices from active exchanges, reflecting the most accurate and current valuation amid high volatility. Explore detailed methodologies to better understand the nuances of fair value in digital assets and traditional inventory assessments.

Impairment

Net realizable value (NRV) represents the estimated selling price of an asset minus any costs required to complete and sell it, crucial for impairment testing in financial reporting. Cryptocurrency valuation faces challenges under NRV due to extreme price volatility and lack of established market prices, making impairment recognition complex and subjective. Explore detailed methodologies and regulatory guidance to better understand impairment assessment in cryptocurrency valuations.

Market Volatility

Net realizable value (NRV) considers the expected selling price of an asset minus any costs for completion and sale, providing a conservative estimate primarily used in accounting for inventory. In contrast, cryptocurrency valuation heavily depends on market volatility, with prices influenced by rapid supply-demand shifts, investor sentiment, and regulatory news, making NRV less applicable. Explore further to understand how market volatility shapes cryptocurrency risk assessment and investment strategies.

Source and External Links

How To Calculate a Net Realizable Value in 3 Steps - This guide outlines the steps to calculate net realizable value, which includes determining the expected sale value and subtracting associated costs.

Net Realizable Value (NRV) | Formula + Calculator - This resource provides a detailed explanation of the NRV formula and includes an example calculation.

Net Realizable Value - Definition, How to Calculate, Example - This page explains the concept of NRV, its importance in accounting, and how it is used to prevent overstatement of assets.

dowidth.com

dowidth.com