Continuous assurance employs real-time data monitoring and automated controls to enhance accuracy and timeliness in financial reporting, contrasting with traditional audits that rely on periodic sampling and retrospective analysis. This modern approach reduces risks and improves transparency by providing ongoing verification of transactions and compliance. Explore how continuous assurance transforms audit effectiveness and supports proactive decision-making in accounting.

Why it is important

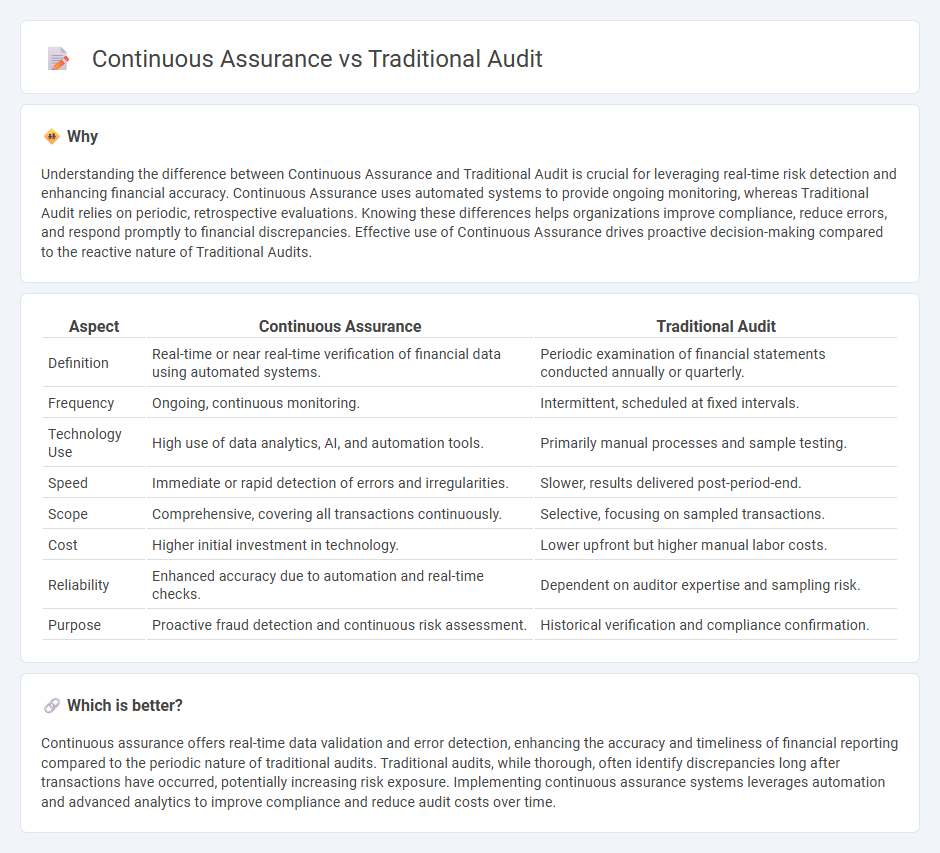

Understanding the difference between Continuous Assurance and Traditional Audit is crucial for leveraging real-time risk detection and enhancing financial accuracy. Continuous Assurance uses automated systems to provide ongoing monitoring, whereas Traditional Audit relies on periodic, retrospective evaluations. Knowing these differences helps organizations improve compliance, reduce errors, and respond promptly to financial discrepancies. Effective use of Continuous Assurance drives proactive decision-making compared to the reactive nature of Traditional Audits.

Comparison Table

| Aspect | Continuous Assurance | Traditional Audit |

|---|---|---|

| Definition | Real-time or near real-time verification of financial data using automated systems. | Periodic examination of financial statements conducted annually or quarterly. |

| Frequency | Ongoing, continuous monitoring. | Intermittent, scheduled at fixed intervals. |

| Technology Use | High use of data analytics, AI, and automation tools. | Primarily manual processes and sample testing. |

| Speed | Immediate or rapid detection of errors and irregularities. | Slower, results delivered post-period-end. |

| Scope | Comprehensive, covering all transactions continuously. | Selective, focusing on sampled transactions. |

| Cost | Higher initial investment in technology. | Lower upfront but higher manual labor costs. |

| Reliability | Enhanced accuracy due to automation and real-time checks. | Dependent on auditor expertise and sampling risk. |

| Purpose | Proactive fraud detection and continuous risk assessment. | Historical verification and compliance confirmation. |

Which is better?

Continuous assurance offers real-time data validation and error detection, enhancing the accuracy and timeliness of financial reporting compared to the periodic nature of traditional audits. Traditional audits, while thorough, often identify discrepancies long after transactions have occurred, potentially increasing risk exposure. Implementing continuous assurance systems leverages automation and advanced analytics to improve compliance and reduce audit costs over time.

Connection

Continuous assurance enhances traditional audit by providing real-time data analysis and continuous monitoring, enabling auditors to identify discrepancies and risks more promptly. Traditional audits rely on periodic, retrospective reviews, while continuous assurance integrates advanced technologies like data analytics and automated controls to support comprehensive, ongoing evaluation. The connection lies in the fusion of continuous assurance techniques with traditional audit methodologies to improve accuracy, timeliness, and overall audit quality.

Key Terms

Audit Frequency

Traditional audits are typically conducted annually or semi-annually, providing a snapshot of financial accuracy at a specific point in time. Continuous assurance leverages real-time data analysis and automated tools to offer ongoing audit monitoring, enhancing risk detection and operational insight. Explore how continuous assurance transforms audit frequency and improves business reliability.

Real-Time Monitoring

Traditional audit relies on periodic sampling and retrospective analysis, often leading to delayed risk identification and compliance issues. Continuous assurance leverages real-time data analytics and automated monitoring tools to provide ongoing verification of financial transactions and controls. Explore how real-time monitoring transforms audit processes by enhancing accuracy, timeliness, and decision-making insights.

Sampling Methods

Traditional audits rely heavily on sampling methods such as random and judgmental sampling to review a subset of transactions, which may risk overlooking anomalies in unexamined data. Continuous assurance employs technology-driven techniques like automated data analytics and real-time monitoring, enabling comprehensive and ongoing examination of entire data sets for more accurate and timely insights. Explore how continuous assurance transforms audit quality and risk mitigation by enhancing sampling methodologies.

Source and External Links

Six Biggest Challenges of Traditional Audit Techniques - Traditional audits rely heavily on manual, time-consuming processes that are prone to human error and often use sample-based testing, which can miss critical issues in the broader dataset.

Continuous vs. Traditional Auditing: Which Is Best? - Traditional auditing is typically performed periodically (e.g., annually or biannually), focuses on manual analysis of controls and processes at specific points in time, and may fail to detect emerging risks outside the audit period.

Factual Investigation vs. Traditional Audit: Key Differences - Traditional audits primarily involve reviewing financial transactions, assessing compliance with accounting standards, evaluating risks and controls, and performing analytical procedures to ensure accuracy and regulatory adherence.

dowidth.com

dowidth.com