Blockchain audit trails provide immutable, transparent records of every transaction, enhancing accuracy and reducing fraud risks in accounting processes. Integrated payment gateways offer seamless reconciliation by automatically matching payments with invoices, accelerating financial closing cycles and minimizing manual errors. Explore how these technologies transform accounting efficiency and security.

Why it is important

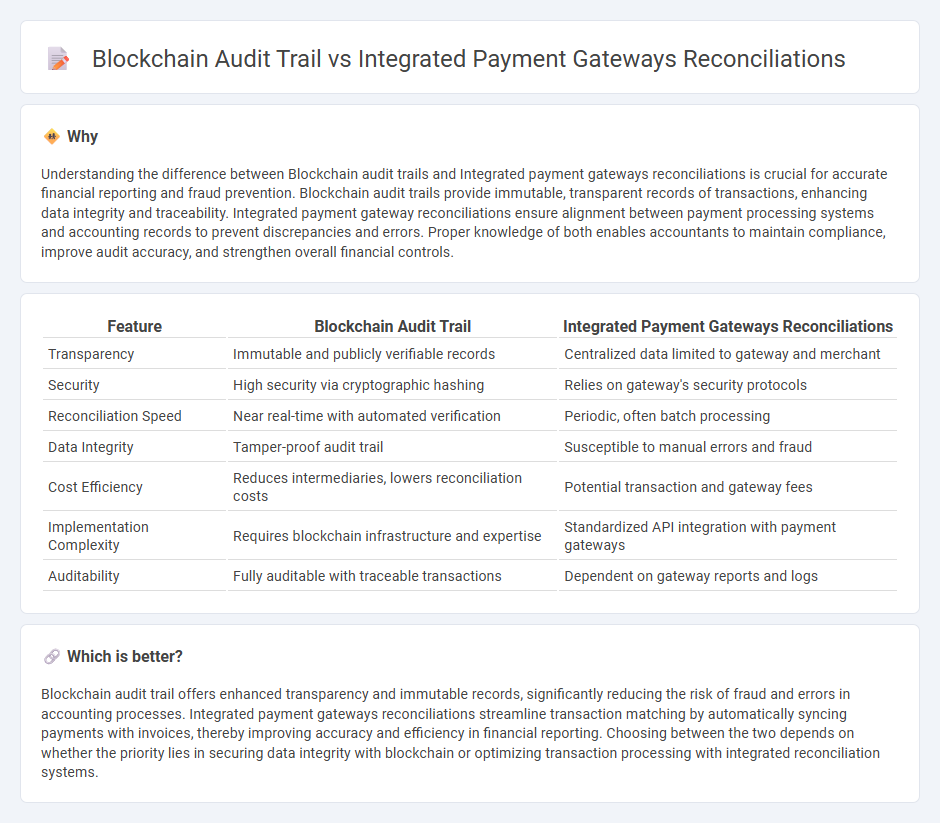

Understanding the difference between Blockchain audit trails and Integrated payment gateways reconciliations is crucial for accurate financial reporting and fraud prevention. Blockchain audit trails provide immutable, transparent records of transactions, enhancing data integrity and traceability. Integrated payment gateway reconciliations ensure alignment between payment processing systems and accounting records to prevent discrepancies and errors. Proper knowledge of both enables accountants to maintain compliance, improve audit accuracy, and strengthen overall financial controls.

Comparison Table

| Feature | Blockchain Audit Trail | Integrated Payment Gateways Reconciliations |

|---|---|---|

| Transparency | Immutable and publicly verifiable records | Centralized data limited to gateway and merchant |

| Security | High security via cryptographic hashing | Relies on gateway's security protocols |

| Reconciliation Speed | Near real-time with automated verification | Periodic, often batch processing |

| Data Integrity | Tamper-proof audit trail | Susceptible to manual errors and fraud |

| Cost Efficiency | Reduces intermediaries, lowers reconciliation costs | Potential transaction and gateway fees |

| Implementation Complexity | Requires blockchain infrastructure and expertise | Standardized API integration with payment gateways |

| Auditability | Fully auditable with traceable transactions | Dependent on gateway reports and logs |

Which is better?

Blockchain audit trail offers enhanced transparency and immutable records, significantly reducing the risk of fraud and errors in accounting processes. Integrated payment gateways reconciliations streamline transaction matching by automatically syncing payments with invoices, thereby improving accuracy and efficiency in financial reporting. Choosing between the two depends on whether the priority lies in securing data integrity with blockchain or optimizing transaction processing with integrated reconciliation systems.

Connection

Blockchain audit trails provide immutable and transparent records of every transaction, ensuring the integrity and accuracy of financial data crucial for reconciliations. Integrated payment gateways streamline the processing of transactions by automatically capturing payment details and status updates, which can be cross-referenced with blockchain records to detect discrepancies. The connection between blockchain audit trails and payment gateway reconciliations enhances real-time verification, reduces fraud risks, and improves overall accounting accuracy.

Key Terms

Transaction Matching

Integrated payment gateways use sophisticated transaction matching algorithms to streamline reconciliation by automatically linking payments to invoices, reducing errors and processing time. Blockchain audit trails provide immutable, timestamped records of each transaction, enhancing transparency and security but often lacking immediate matching capabilities. Explore the benefits and limitations of each method to optimize your transaction reconciliation process.

Immutable Ledger

Integrated payment gateways reconciliations streamline transaction validations by automatically matching payments with invoices, enhancing financial accuracy and reducing manual errors. Blockchain audit trails leverage an immutable ledger, ensuring every transaction is permanently recorded and verifiable, which significantly enhances transparency and fraud prevention. Explore how immutable ledger technology can revolutionize reconciliation processes and boost security in financial operations.

Real-time Settlement

Integrated payment gateways streamline reconciliation processes by automatically matching transactions and updating records in real time, reducing errors and delays. Blockchain audit trails enhance transparency and security with immutable, time-stamped ledger entries that provide verifiable transaction histories for compliance and fraud prevention. Explore how combining these technologies can optimize real-time settlement efficiency and accuracy.

Source and External Links

Payment Gateway Reconciliation - Cointab offers automated reconciliation that matches internal transactions with payment gateway data and bank deposits, identifying and flagging discrepancies such as missing sales, refunds, and overcharges to streamline the finance team's workflow.

Payment Gateway Reconciliation Explained - This source explains how reconciliation aligns order management systems, payment gateway reports, and bank statements to prevent revenue leakage and errors, emphasizing automation and real-time monitoring to maintain financial integrity for high-volume digital payments.

Payment gateway reconciliation process for beginners - The guide details cross-checking internal accounting records with external bank statements, focusing on matching transactions across multiple payment gateways and merchant accounts to verify that sales result in final settlements accurately.

dowidth.com

dowidth.com