Embedded lease accounting focuses on identifying lease components within broader contracts, ensuring precise recognition and measurement of lease liabilities and right-of-use assets under IFRS 16 or ASC 842 standards. Sale and leaseback accounting involves the sale of an asset followed by leasing it back, impacting balance sheets and income statements based on criteria such as lease classification and transaction terms. Explore further to understand the distinct impacts and compliance requirements of these accounting methods.

Why it is important

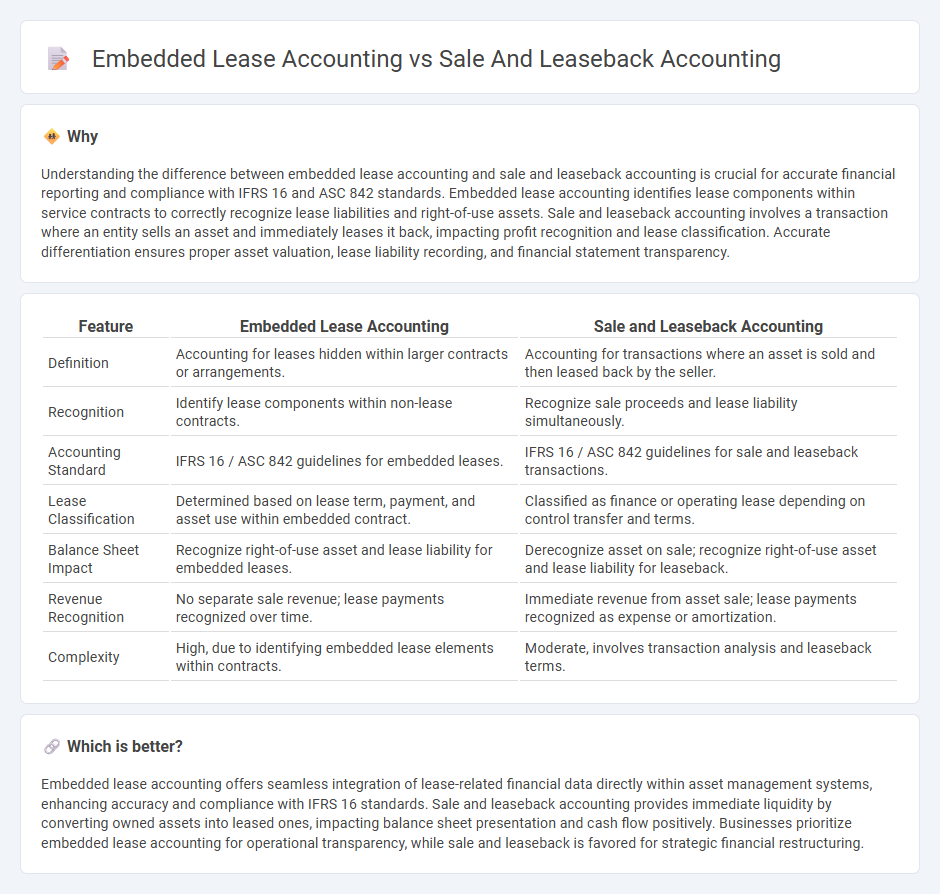

Understanding the difference between embedded lease accounting and sale and leaseback accounting is crucial for accurate financial reporting and compliance with IFRS 16 and ASC 842 standards. Embedded lease accounting identifies lease components within service contracts to correctly recognize lease liabilities and right-of-use assets. Sale and leaseback accounting involves a transaction where an entity sells an asset and immediately leases it back, impacting profit recognition and lease classification. Accurate differentiation ensures proper asset valuation, lease liability recording, and financial statement transparency.

Comparison Table

| Feature | Embedded Lease Accounting | Sale and Leaseback Accounting |

|---|---|---|

| Definition | Accounting for leases hidden within larger contracts or arrangements. | Accounting for transactions where an asset is sold and then leased back by the seller. |

| Recognition | Identify lease components within non-lease contracts. | Recognize sale proceeds and lease liability simultaneously. |

| Accounting Standard | IFRS 16 / ASC 842 guidelines for embedded leases. | IFRS 16 / ASC 842 guidelines for sale and leaseback transactions. |

| Lease Classification | Determined based on lease term, payment, and asset use within embedded contract. | Classified as finance or operating lease depending on control transfer and terms. |

| Balance Sheet Impact | Recognize right-of-use asset and lease liability for embedded leases. | Derecognize asset on sale; recognize right-of-use asset and lease liability for leaseback. |

| Revenue Recognition | No separate sale revenue; lease payments recognized over time. | Immediate revenue from asset sale; lease payments recognized as expense or amortization. |

| Complexity | High, due to identifying embedded lease elements within contracts. | Moderate, involves transaction analysis and leaseback terms. |

Which is better?

Embedded lease accounting offers seamless integration of lease-related financial data directly within asset management systems, enhancing accuracy and compliance with IFRS 16 standards. Sale and leaseback accounting provides immediate liquidity by converting owned assets into leased ones, impacting balance sheet presentation and cash flow positively. Businesses prioritize embedded lease accounting for operational transparency, while sale and leaseback is favored for strategic financial restructuring.

Connection

Embedded lease accounting involves identifying lease components within a broader contract to separate lease and non-lease elements for accurate financial reporting. Sale and leaseback accounting requires recognizing the sale of an asset followed by leasing it back, impacting asset classification and lease liability measurement. Both processes ensure compliance with IFRS 16 and ASC 842 by accurately reflecting lease obligations and right-of-use assets on the balance sheet.

Key Terms

Right-of-Use Asset

Sale and leaseback accounting requires recognition of the right-of-use (ROU) asset and lease liability based on the terms of the leaseback arrangement, reflecting a finance or operating lease classification under IFRS 16 or ASC 842. Embedded lease accounting identifies lease components within non-lease contracts, necessitating separation of lease and non-lease components to measure the ROU asset accurately. Explore the nuances of ROU asset recognition in both methodologies to optimize lease accounting compliance and financial reporting.

Lease Liability

Sale and leaseback accounting involves recognizing a lease liability based on the purchase price and lease payments, reflecting the transfer of an asset followed by a leaseback arrangement. Embedded lease accounting requires identifying lease components within a contract and measuring lease liabilities separately under IFRS 16 or ASC 842 standards. Explore detailed guidance on lease liability measurement, recognition criteria, and disclosure requirements to deepen your understanding.

Gain on Sale

Sale and leaseback accounting recognizes the gain on sale only if the sale qualifies under ASC 842 or IFRS 16 criteria, ensuring the transaction reflects a true sale and leaseback arrangement. In embedded lease accounting, the gain on sale may not be separately recognized because the arrangement is accounted for as a lease from inception, with the asset remaining on the seller-lessee's balance sheet. Explore the key differences and criteria to accurately apply gain on sale accounting in these transactions.

Source and External Links

How sale-leaseback accounting works (with examples) - Netgain - Sale-leaseback accounting under ASC 842 requires the seller-lessee to recognize the sale and gain or loss, derecognize the asset, and recognize lease liability and ROU asset; the buyer-lessor accounts for the asset purchase and recognizes the lease as per ASC 842 standards.

Leases - Sale and leaseback - KPMG International - Under IFRS 16, sale-leaseback accounting depends on whether control of the asset transfers to the buyer-lessor per IFRS 15, affecting how the transaction's profit or loss is calculated and how both parties account for the leaseback.

FORsights - Sale & Leaseback Transactions Accounting Refresher - Sale-leaseback accounting under ASC 606 and ASC 842 requires the transaction to qualify as a sale with control transferring to the buyer-lessor and the leaseback not classified as finance or sale-type lease, allowing seller-lessees to recognize gain at sale date.

dowidth.com

dowidth.com