Payroll automation streamlines salary calculations, tax compliance, and employee record management using software, reducing errors and saving time. Payroll outsourcing bureaus handle these tasks externally, offering expert services, compliance assurance, and scalability for businesses. Explore how each approach can optimize your accounting processes and improve operational efficiency.

Why it is important

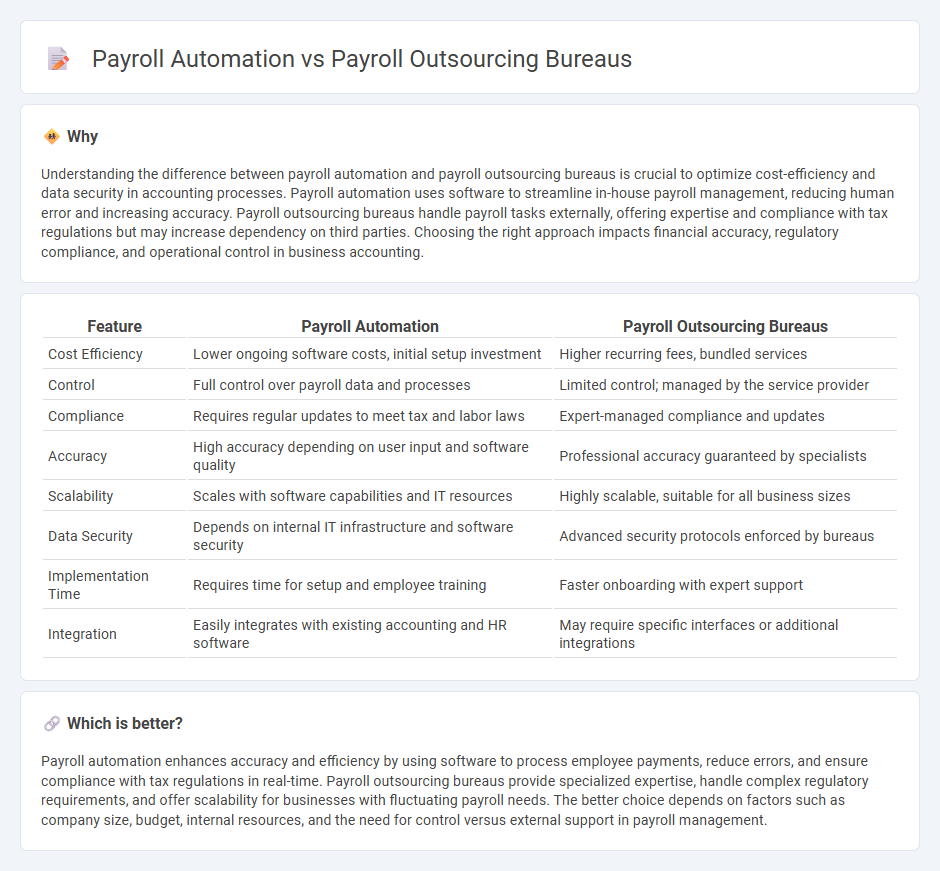

Understanding the difference between payroll automation and payroll outsourcing bureaus is crucial to optimize cost-efficiency and data security in accounting processes. Payroll automation uses software to streamline in-house payroll management, reducing human error and increasing accuracy. Payroll outsourcing bureaus handle payroll tasks externally, offering expertise and compliance with tax regulations but may increase dependency on third parties. Choosing the right approach impacts financial accuracy, regulatory compliance, and operational control in business accounting.

Comparison Table

| Feature | Payroll Automation | Payroll Outsourcing Bureaus |

|---|---|---|

| Cost Efficiency | Lower ongoing software costs, initial setup investment | Higher recurring fees, bundled services |

| Control | Full control over payroll data and processes | Limited control; managed by the service provider |

| Compliance | Requires regular updates to meet tax and labor laws | Expert-managed compliance and updates |

| Accuracy | High accuracy depending on user input and software quality | Professional accuracy guaranteed by specialists |

| Scalability | Scales with software capabilities and IT resources | Highly scalable, suitable for all business sizes |

| Data Security | Depends on internal IT infrastructure and software security | Advanced security protocols enforced by bureaus |

| Implementation Time | Requires time for setup and employee training | Faster onboarding with expert support |

| Integration | Easily integrates with existing accounting and HR software | May require specific interfaces or additional integrations |

Which is better?

Payroll automation enhances accuracy and efficiency by using software to process employee payments, reduce errors, and ensure compliance with tax regulations in real-time. Payroll outsourcing bureaus provide specialized expertise, handle complex regulatory requirements, and offer scalability for businesses with fluctuating payroll needs. The better choice depends on factors such as company size, budget, internal resources, and the need for control versus external support in payroll management.

Connection

Payroll automation streamlines the calculation, distribution, and reporting of employee salaries, reducing errors and saving time. Payroll outsourcing bureaus leverage advanced automation tools to manage payroll processes efficiently for multiple clients, ensuring compliance with tax regulations and labor laws. Integrating payroll automation within outsourcing bureaus enhances accuracy, data security, and real-time payroll analytics for businesses.

Key Terms

Service Level Agreement (SLA)

Payroll outsourcing bureaus typically offer customized Service Level Agreements (SLAs) guaranteeing accuracy, compliance, and timely payroll processing, backed by human oversight and support. Payroll automation solutions deliver SLAs emphasizing system uptime, real-time data processing, and error reduction with automated workflows and integration capabilities. Explore the nuanced differences in SLA terms to determine the best fit for your organization's payroll needs.

Payroll Software Integration

Payroll outsourcing bureaus handle payroll processing through external specialists, offering hands-off management but often limited customization and slower integration with existing systems. Payroll automation leverages advanced payroll software integration, enabling seamless synchronization with HR, time tracking, and accounting platforms for real-time data accuracy and operational efficiency. Explore how payroll software integration can transform your payroll management by visiting our detailed comparison.

Data Security Compliance

Payroll outsourcing bureaus rely on specialized teams to manage payroll processes, ensuring compliance with data security regulations such as GDPR and HIPAA through strict protocols and encrypted data storage. Payroll automation leverages advanced software solutions to minimize human error and enhance real-time monitoring of data security compliance with SOC 2 and ISO 27001 standards. Explore how these approaches safeguard sensitive employee information and maintain regulatory compliance in your organization.

Source and External Links

Top Payroll Outsourcing Providers for Accounting Firms - This webpage lists top payroll outsourcing providers such as Invedus, EQtax, Paychex, Gusto, and ADP, highlighting their services and benefits.

6 of the Best Payroll Outsourcing Companies of 2025 - This article features companies like Oyster, ADP, Gusto, Paychex, Square Payroll, and TriNet, focusing on their features and pricing models.

10 Best Payroll Outsourcing Companies - This resource lists companies like Any Hire (Upwork), ADP, Paychex, Gusto, and Intuit QuickBooks Payroll, comparing their features and benefiting businesses of all sizes.

dowidth.com

dowidth.com