Real-time auditing leverages continuous data monitoring and automated analytics to identify discrepancies instantly, enhancing the immediacy and accuracy of financial oversight. Risk-based auditing prioritizes audit resources by focusing on areas with the highest potential for errors or fraud, maximizing efficiency through targeted evaluation. Explore deeper insights to understand how these auditing approaches revolutionize financial governance.

Why it is important

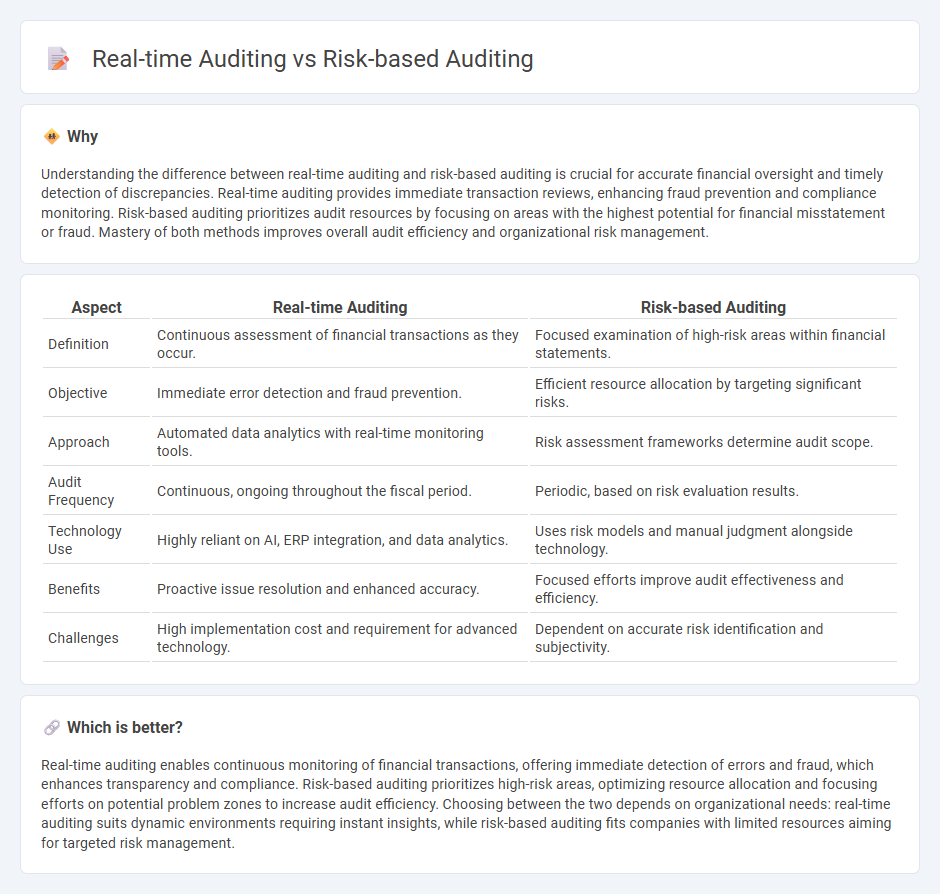

Understanding the difference between real-time auditing and risk-based auditing is crucial for accurate financial oversight and timely detection of discrepancies. Real-time auditing provides immediate transaction reviews, enhancing fraud prevention and compliance monitoring. Risk-based auditing prioritizes audit resources by focusing on areas with the highest potential for financial misstatement or fraud. Mastery of both methods improves overall audit efficiency and organizational risk management.

Comparison Table

| Aspect | Real-time Auditing | Risk-based Auditing |

|---|---|---|

| Definition | Continuous assessment of financial transactions as they occur. | Focused examination of high-risk areas within financial statements. |

| Objective | Immediate error detection and fraud prevention. | Efficient resource allocation by targeting significant risks. |

| Approach | Automated data analytics with real-time monitoring tools. | Risk assessment frameworks determine audit scope. |

| Audit Frequency | Continuous, ongoing throughout the fiscal period. | Periodic, based on risk evaluation results. |

| Technology Use | Highly reliant on AI, ERP integration, and data analytics. | Uses risk models and manual judgment alongside technology. |

| Benefits | Proactive issue resolution and enhanced accuracy. | Focused efforts improve audit effectiveness and efficiency. |

| Challenges | High implementation cost and requirement for advanced technology. | Dependent on accurate risk identification and subjectivity. |

Which is better?

Real-time auditing enables continuous monitoring of financial transactions, offering immediate detection of errors and fraud, which enhances transparency and compliance. Risk-based auditing prioritizes high-risk areas, optimizing resource allocation and focusing efforts on potential problem zones to increase audit efficiency. Choosing between the two depends on organizational needs: real-time auditing suits dynamic environments requiring instant insights, while risk-based auditing fits companies with limited resources aiming for targeted risk management.

Connection

Real-time auditing leverages continuous data monitoring systems, enabling immediate detection of anomalies, which directly supports risk-based auditing by prioritizing high-risk areas for detailed examination. Risk-based auditing focuses audit resources on potential risk factors identified through real-time data analysis, improving the efficiency and effectiveness of the audit process. Both approaches integrate advanced analytics and automated controls to enhance accuracy and reduce audit cycle times in financial reporting.

Key Terms

Risk Assessment

Risk-based auditing prioritizes risk assessment by identifying and evaluating areas with the highest potential for significant financial or operational impact, enabling auditors to allocate resources efficiently and focus on critical control weaknesses. Real-time auditing continuously monitors transactions and controls, using automated tools to detect anomalies and risks as they occur, thus providing immediate insights into risk exposure. Explore how integrating these approaches can enhance audit effectiveness and risk management.

Continuous Monitoring

Risk-based auditing prioritizes high-risk areas by assessing potential threats and allocating resources accordingly, enhancing efficiency in identifying significant issues. Real-time auditing employs continuous monitoring tools and automated data analysis to detect anomalies as they occur, enabling swift responses to compliance and operational breaches. Explore how integrating continuous monitoring into auditing strategies can improve organizational resilience and decision-making.

Audit Evidence

Risk-based auditing prioritizes audit evidence by targeting high-risk areas, ensuring efficient allocation of resources to identify material misstatements. Real-time auditing gathers continuous audit evidence through automated systems, enabling immediate detection and response to anomalies. Explore the advantages of each approach to enhance your audit strategy and evidence collection methods.

Source and External Links

Risk-based auditing - Risk-based auditing is a style of auditing focused on analyzing and managing risks, prioritizing audit activities based on their potential impact rather than mere compliance checks, with frameworks such as COSO and ISO 31000 widely used for guidance.

5 Risk-Based Internal Auditing Approaches - This approach relies on assessing an organization's risk appetite and inherent risks to focus audits on high-risk processes, often guided by frameworks such as ISO 31000, COSO ERM, and NIST RMF to help mitigate internal and external risks.

Fundamentals of Risk-Based Auditing: A Strategic Approach - Risk-based auditing involves prioritizing audit activities by identifying, assessing, and ranking risks, then planning and executing audits focused on the highest-priority risks, using approaches like top-down, bottom-up, hybrid, threat-based, and vulnerability-based methods.

dowidth.com

dowidth.com