Fair value measurement reflects the estimated price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, emphasizing current market conditions. Settlement value, on the other hand, focuses on the amount that would be paid to settle an obligation in a specific transaction, often reflecting entity-specific or contractual terms. Explore the distinctions and applications of these valuation concepts to enhance your understanding of financial reporting standards.

Why it is important

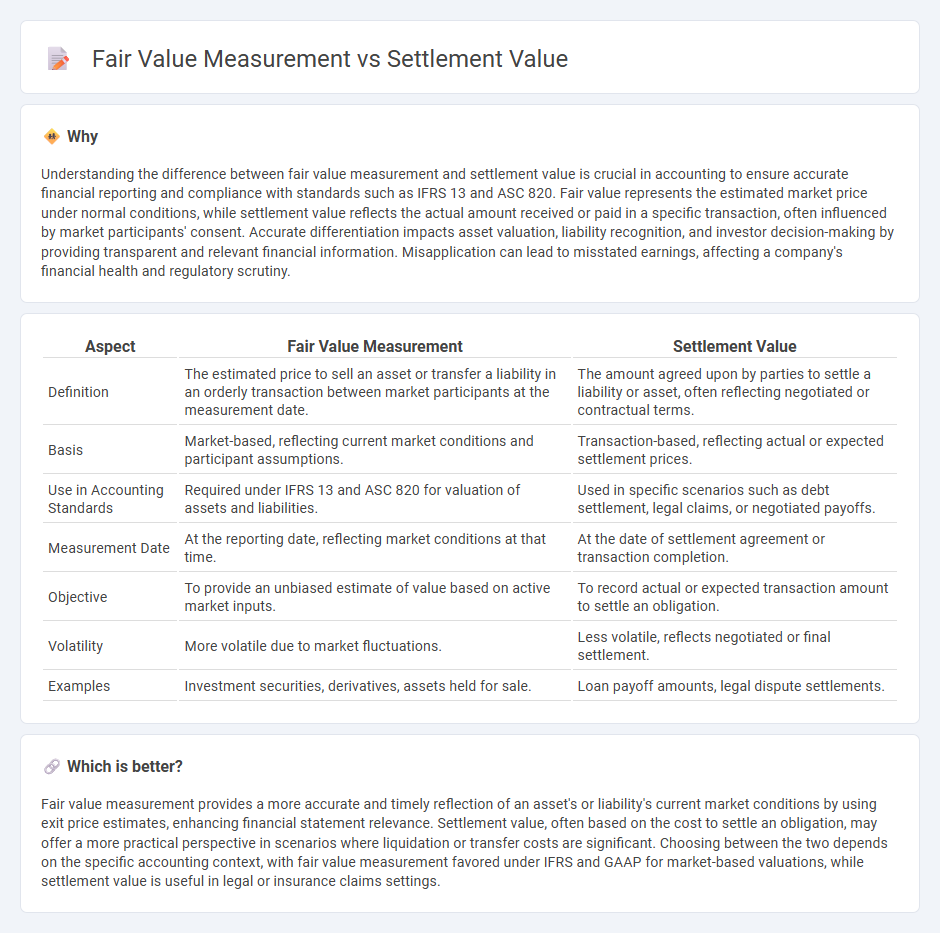

Understanding the difference between fair value measurement and settlement value is crucial in accounting to ensure accurate financial reporting and compliance with standards such as IFRS 13 and ASC 820. Fair value represents the estimated market price under normal conditions, while settlement value reflects the actual amount received or paid in a specific transaction, often influenced by market participants' consent. Accurate differentiation impacts asset valuation, liability recognition, and investor decision-making by providing transparent and relevant financial information. Misapplication can lead to misstated earnings, affecting a company's financial health and regulatory scrutiny.

Comparison Table

| Aspect | Fair Value Measurement | Settlement Value |

|---|---|---|

| Definition | The estimated price to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date. | The amount agreed upon by parties to settle a liability or asset, often reflecting negotiated or contractual terms. |

| Basis | Market-based, reflecting current market conditions and participant assumptions. | Transaction-based, reflecting actual or expected settlement prices. |

| Use in Accounting Standards | Required under IFRS 13 and ASC 820 for valuation of assets and liabilities. | Used in specific scenarios such as debt settlement, legal claims, or negotiated payoffs. |

| Measurement Date | At the reporting date, reflecting market conditions at that time. | At the date of settlement agreement or transaction completion. |

| Objective | To provide an unbiased estimate of value based on active market inputs. | To record actual or expected transaction amount to settle an obligation. |

| Volatility | More volatile due to market fluctuations. | Less volatile, reflects negotiated or final settlement. |

| Examples | Investment securities, derivatives, assets held for sale. | Loan payoff amounts, legal dispute settlements. |

Which is better?

Fair value measurement provides a more accurate and timely reflection of an asset's or liability's current market conditions by using exit price estimates, enhancing financial statement relevance. Settlement value, often based on the cost to settle an obligation, may offer a more practical perspective in scenarios where liquidation or transfer costs are significant. Choosing between the two depends on the specific accounting context, with fair value measurement favored under IFRS and GAAP for market-based valuations, while settlement value is useful in legal or insurance claims settings.

Connection

Fair value measurement reflects the estimated price at which an asset or liability could be exchanged in an orderly transaction between market participants at the measurement date. Settlement value represents the amount that would be paid to transfer a liability or received to transfer an asset in an actual settlement scenario. Both concepts align in financial reporting by ensuring that the recorded values on the balance sheet approximate real market exit prices, enhancing transparency and comparability.

Key Terms

Exit Price

Settlement value represents the amount paid to settle a liability, often influenced by negotiated terms and legal considerations, while fair value measurement uses an exit price reflecting the market participant perspective at the measurement date. Exit price focuses on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. Explore detailed differences and applications of these valuation concepts to enhance your financial reporting accuracy.

Present Value

Settlement value represents the amount agreed upon to resolve a liability or asset transfer, often reflecting negotiated terms and potential discounts. Fair value measurement estimates the price at which an asset or liability could be exchanged in an orderly transaction between market participants, typically based on an exit price concept. Explore deeper insights on how present value calculations influence these valuation approaches.

Market Participants

Settlement value refers to the price agreed upon by willing market participants in an actual transaction, reflecting the amount to be received or paid to transfer an asset or liability. Fair value measurement, as defined by accounting standards such as IFRS 13, represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Understanding the perspectives and assumptions of market participants in both concepts is crucial for accurate valuation; explore our detailed analysis to deepen your insight.

Source and External Links

Calculate Your Personal Injury Settlement Value - Settlement value in personal injury cases is typically calculated by adding economic losses (like medical bills and lost income) to estimated non-economic damages (such as pain and suffering), often using a multiplier method to estimate the latter.

Calculating Settlement Value of a Case - Settlement value can be determined by analyzing all possible litigation outcomes, assigning probabilities to each outcome, and calculating an expected value by weighting potential damages by their likelihood, while also factoring in legal costs.

Personal Injury Settlement Amount Examples: 2025 - Settlement values depend on factors including injury severity, policy limits, negligence laws, jurisdiction, methods for calculating pain and suffering, and quality of documentation supporting damages.

dowidth.com

dowidth.com