Digital twin accounting creates a virtual replica of financial processes, enabling real-time simulation and analysis to improve decision-making accuracy. Cloud accounting offers scalable, remote access to financial data with automated updates and collaboration features for enhanced efficiency. Explore the key differences and benefits of digital twin and cloud accounting to optimize your financial management strategies.

Why it is important

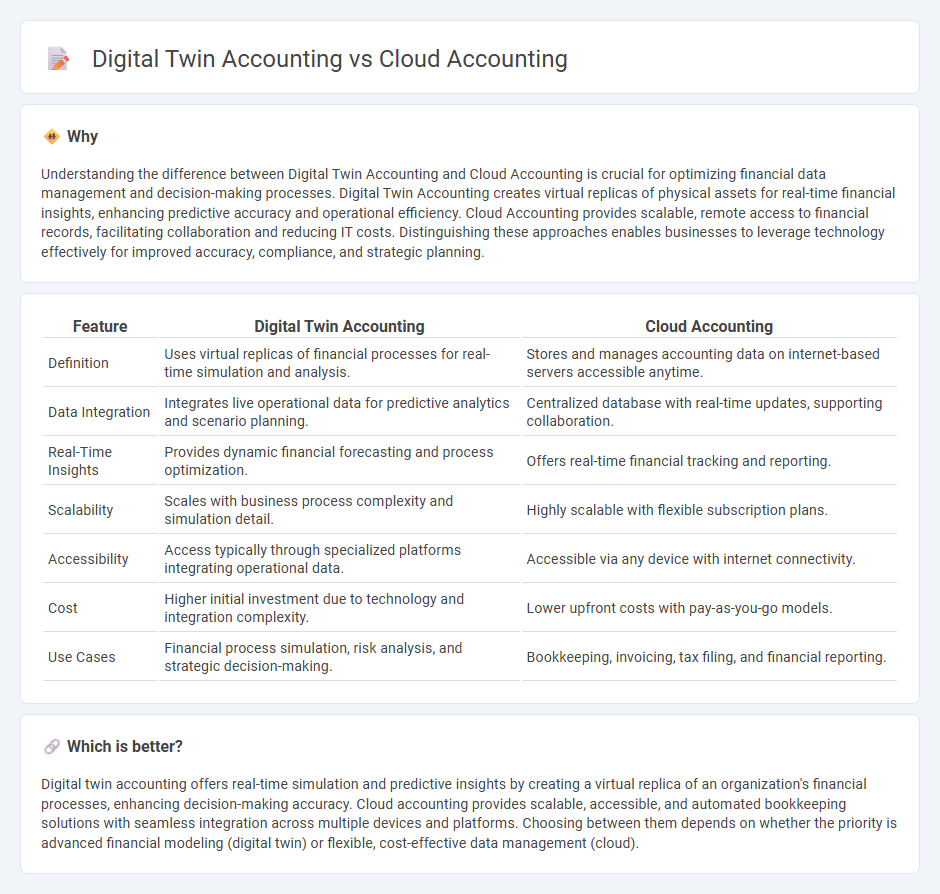

Understanding the difference between Digital Twin Accounting and Cloud Accounting is crucial for optimizing financial data management and decision-making processes. Digital Twin Accounting creates virtual replicas of physical assets for real-time financial insights, enhancing predictive accuracy and operational efficiency. Cloud Accounting provides scalable, remote access to financial records, facilitating collaboration and reducing IT costs. Distinguishing these approaches enables businesses to leverage technology effectively for improved accuracy, compliance, and strategic planning.

Comparison Table

| Feature | Digital Twin Accounting | Cloud Accounting |

|---|---|---|

| Definition | Uses virtual replicas of financial processes for real-time simulation and analysis. | Stores and manages accounting data on internet-based servers accessible anytime. |

| Data Integration | Integrates live operational data for predictive analytics and scenario planning. | Centralized database with real-time updates, supporting collaboration. |

| Real-Time Insights | Provides dynamic financial forecasting and process optimization. | Offers real-time financial tracking and reporting. |

| Scalability | Scales with business process complexity and simulation detail. | Highly scalable with flexible subscription plans. |

| Accessibility | Access typically through specialized platforms integrating operational data. | Accessible via any device with internet connectivity. |

| Cost | Higher initial investment due to technology and integration complexity. | Lower upfront costs with pay-as-you-go models. |

| Use Cases | Financial process simulation, risk analysis, and strategic decision-making. | Bookkeeping, invoicing, tax filing, and financial reporting. |

Which is better?

Digital twin accounting offers real-time simulation and predictive insights by creating a virtual replica of an organization's financial processes, enhancing decision-making accuracy. Cloud accounting provides scalable, accessible, and automated bookkeeping solutions with seamless integration across multiple devices and platforms. Choosing between them depends on whether the priority is advanced financial modeling (digital twin) or flexible, cost-effective data management (cloud).

Connection

Digital twin accounting leverages real-time data simulation to create virtual replicas of financial processes, enhancing accuracy and predictive analysis. Cloud accounting provides scalable, remote access to financial data and applications, enabling seamless integration with digital twins for continuous monitoring and synchronization. Together, they optimize financial decision-making by combining dynamic modeling with flexible, on-demand data management.

Key Terms

Real-time data integration

Cloud accounting centralizes financial data on remote servers, enabling real-time access and collaboration from anywhere, while digital twin accounting creates a virtual replica of an organization's financial processes to simulate and analyze outcomes with real-time data integration. Both technologies enhance decision-making by providing up-to-date financial insights; cloud accounting focuses on data accessibility and storage, whereas digital twin accounting emphasizes predictive analytics and scenario planning. Explore how integrating these solutions can revolutionize financial management and operational forecasting.

Automation

Cloud accounting leverages internet-based platforms to automate financial processes such as invoicing, expense tracking, and real-time reporting, increasing accuracy and reducing manual errors. Digital twin accounting integrates real-time data from physical assets into a virtual model, enabling predictive analytics and dynamic financial simulations for enhanced decision-making. Explore how these innovations transform financial automation to streamline business operations and improve strategic planning.

Predictive analytics

Cloud accounting leverages real-time data integration and automated processes to enhance financial reporting accuracy, while predictive analytics in digital twin accounting uses virtual models to simulate future financial scenarios and optimize decision-making. Digital twin accounting offers deeper insights by combining historical data with predictive algorithms, enabling proactive risk management and strategic planning. Explore how these cutting-edge technologies transform financial forecasting and business agility.

Source and External Links

Cloud Based Accounting: What is It and Why You Need It - Certinia - Cloud accounting uses software hosted on remote servers accessed via the internet, offering real-time updates, scalability, flexibility, and collaborative features that traditional desktop software lacks, making it a modern essential for businesses.

Cloud Accounting Basics: What It Is & Reasons to Use - NetSuite - Cloud accounting automates financial tasks using cloud-native software with benefits including real-time financial data, automatic updates, global tax compliance, and integration with other business functions on a unified platform.

Cloud Accounting Benefits | Xero US - Cloud accounting stores financial records online accessible anytime from any device, enhancing flexibility, collaboration, automation, and security compared to traditional desktop accounting software.

dowidth.com

dowidth.com