Carbon footprint accounting measures the greenhouse gas emissions associated with a company's operations, focusing on environmental impact and sustainability metrics. Cost accounting, in contrast, analyzes financial expenses to determine production costs and improve profitability through detailed cost control and budgeting. Explore the differences between these accounting methods to enhance both ecological responsibility and financial efficiency.

Why it is important

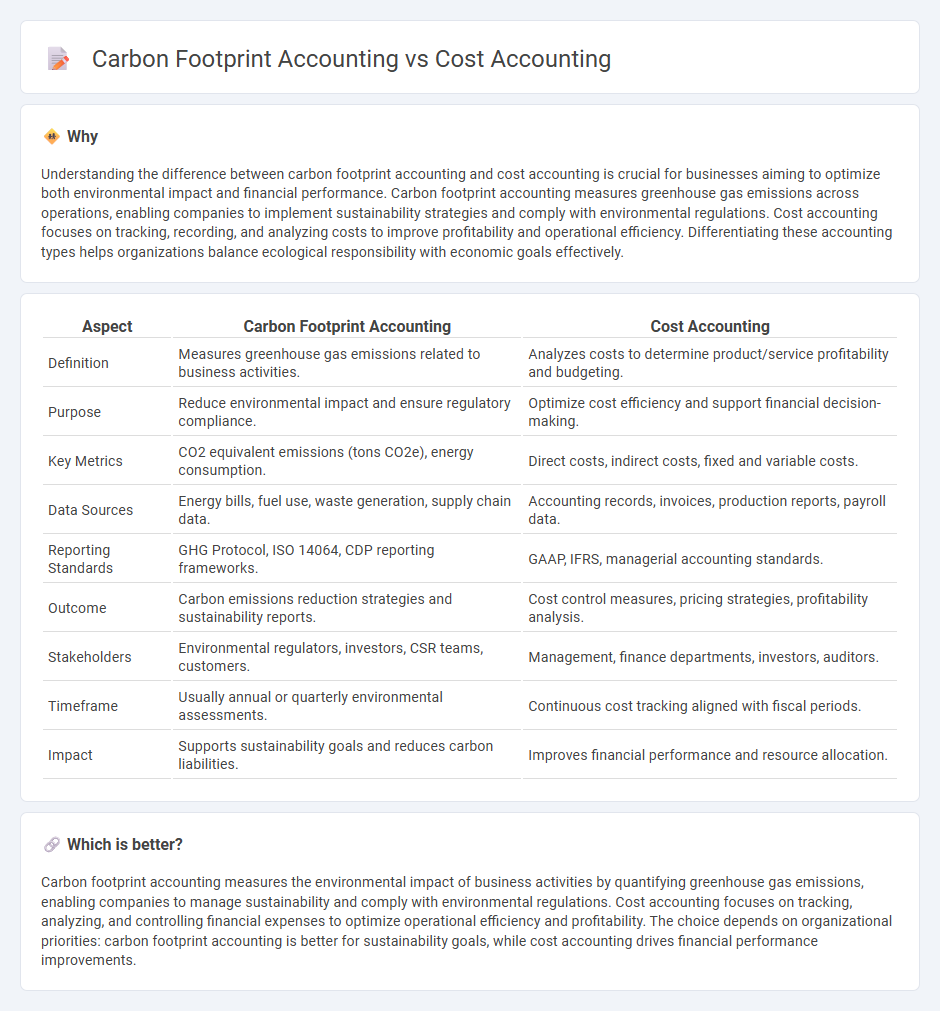

Understanding the difference between carbon footprint accounting and cost accounting is crucial for businesses aiming to optimize both environmental impact and financial performance. Carbon footprint accounting measures greenhouse gas emissions across operations, enabling companies to implement sustainability strategies and comply with environmental regulations. Cost accounting focuses on tracking, recording, and analyzing costs to improve profitability and operational efficiency. Differentiating these accounting types helps organizations balance ecological responsibility with economic goals effectively.

Comparison Table

| Aspect | Carbon Footprint Accounting | Cost Accounting |

|---|---|---|

| Definition | Measures greenhouse gas emissions related to business activities. | Analyzes costs to determine product/service profitability and budgeting. |

| Purpose | Reduce environmental impact and ensure regulatory compliance. | Optimize cost efficiency and support financial decision-making. |

| Key Metrics | CO2 equivalent emissions (tons CO2e), energy consumption. | Direct costs, indirect costs, fixed and variable costs. |

| Data Sources | Energy bills, fuel use, waste generation, supply chain data. | Accounting records, invoices, production reports, payroll data. |

| Reporting Standards | GHG Protocol, ISO 14064, CDP reporting frameworks. | GAAP, IFRS, managerial accounting standards. |

| Outcome | Carbon emissions reduction strategies and sustainability reports. | Cost control measures, pricing strategies, profitability analysis. |

| Stakeholders | Environmental regulators, investors, CSR teams, customers. | Management, finance departments, investors, auditors. |

| Timeframe | Usually annual or quarterly environmental assessments. | Continuous cost tracking aligned with fiscal periods. |

| Impact | Supports sustainability goals and reduces carbon liabilities. | Improves financial performance and resource allocation. |

Which is better?

Carbon footprint accounting measures the environmental impact of business activities by quantifying greenhouse gas emissions, enabling companies to manage sustainability and comply with environmental regulations. Cost accounting focuses on tracking, analyzing, and controlling financial expenses to optimize operational efficiency and profitability. The choice depends on organizational priorities: carbon footprint accounting is better for sustainability goals, while cost accounting drives financial performance improvements.

Connection

Carbon footprint accounting integrates environmental costs into financial records, linking directly with cost accounting by quantifying the expenses related to carbon emissions and resource consumption. This connection enables businesses to track and manage sustainability-related costs alongside traditional financial metrics, improving decision-making for eco-efficient operations. Accurate carbon accounting supports cost accounting by identifying potential savings from reducing emissions, ultimately aligning environmental impact with economic performance.

Key Terms

**Cost accounting:**

Cost accounting systematically tracks, records, and analyzes all expenses involved in producing goods or services, helping businesses optimize operational efficiency and profitability. It incorporates direct costs like materials and labor, along with indirect costs such as overhead, providing detailed insights into cost behavior and allocation. Explore more about cost accounting methodologies and their impact on financial decision-making.

Variable costs

Variable costs in cost accounting represent expenses that fluctuate directly with production volume, such as raw materials and direct labor. In carbon footprint accounting, variable costs focus on emissions generated by operational activities that increase with output, like fuel consumption and electricity usage. Explore detailed methodologies to optimize both financial efficiency and environmental impact.

Overhead allocation

Cost accounting allocates overhead expenses to products or services based on direct labor, machine hours, or material usage, optimizing financial performance analysis. Carbon footprint accounting assigns indirect emissions to processes or products, emphasizing environmental impact and guiding sustainability efforts through precise overhead allocation of greenhouse gases. Explore how integrating these overhead allocation methods enhances both cost efficiency and carbon management strategies.

Source and External Links

What Is Cost Accounting | A Guide for Businesses - BPM - Cost accounting is a specialized field focused on analyzing, forecasting, and comparing cost data to determine the true cost of products or services, enabling businesses to improve profitability and operational efficiency through detailed cost tracking and management.

Cost Accounting Defined: What It Is & Why It Matters - NetSuite - Cost accounting tracks and summarizes all fixed and variable costs related to product production or service delivery, helping internal management control costs and make informed pricing decisions, differing from financial accounting by its internal focus and flexibility.

How to Become a Cost Accountant | University of Phoenix - Cost accountants manage and evaluate business expenses to increase profitability, working primarily with internal departments to track, set standard costs, and help optimize financial performance across diverse industries.

dowidth.com

dowidth.com