Deferred revenue recognition records income when cash is received before goods or services are delivered, ensuring liabilities are accurately reported until obligations are fulfilled. The matching principle dictates that expenses are recognized in the same period as the revenues they help generate, promoting accurate profit measurement. Explore more to understand how these accounting concepts impact financial reporting.

Why it is important

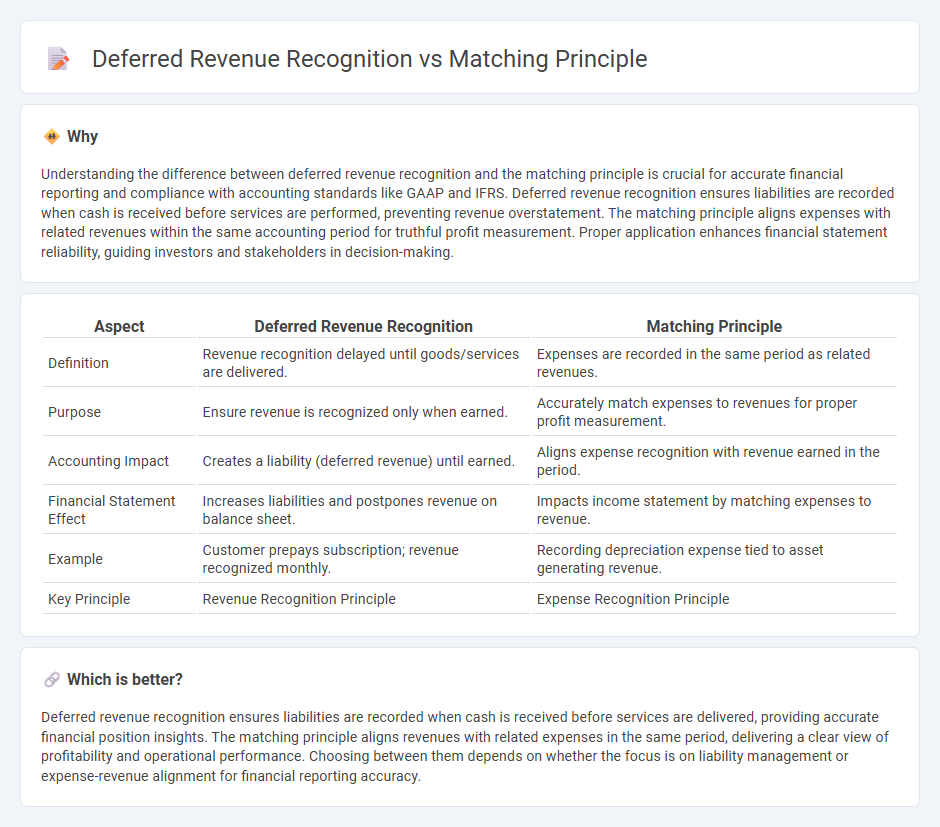

Understanding the difference between deferred revenue recognition and the matching principle is crucial for accurate financial reporting and compliance with accounting standards like GAAP and IFRS. Deferred revenue recognition ensures liabilities are recorded when cash is received before services are performed, preventing revenue overstatement. The matching principle aligns expenses with related revenues within the same accounting period for truthful profit measurement. Proper application enhances financial statement reliability, guiding investors and stakeholders in decision-making.

Comparison Table

| Aspect | Deferred Revenue Recognition | Matching Principle |

|---|---|---|

| Definition | Revenue recognition delayed until goods/services are delivered. | Expenses are recorded in the same period as related revenues. |

| Purpose | Ensure revenue is recognized only when earned. | Accurately match expenses to revenues for proper profit measurement. |

| Accounting Impact | Creates a liability (deferred revenue) until earned. | Aligns expense recognition with revenue earned in the period. |

| Financial Statement Effect | Increases liabilities and postpones revenue on balance sheet. | Impacts income statement by matching expenses to revenue. |

| Example | Customer prepays subscription; revenue recognized monthly. | Recording depreciation expense tied to asset generating revenue. |

| Key Principle | Revenue Recognition Principle | Expense Recognition Principle |

Which is better?

Deferred revenue recognition ensures liabilities are recorded when cash is received before services are delivered, providing accurate financial position insights. The matching principle aligns revenues with related expenses in the same period, delivering a clear view of profitability and operational performance. Choosing between them depends on whether the focus is on liability management or expense-revenue alignment for financial reporting accuracy.

Connection

Deferred revenue recognition and the matching principle are connected through the timing of revenue and expense recognition to accurately reflect financial performance. Deferred revenue represents cash received before goods or services are delivered, requiring recognition as a liability until earned. This aligns with the matching principle, which dictates that expenses must be recorded in the same period as the related revenue to ensure accurate profit measurement.

Key Terms

Expense Recognition

The matching principle mandates that expenses be recognized in the same period as the revenues they help generate, ensuring accurate profit measurement. Deferred revenue recognition involves recording cash received before earning it as a liability, with the expense recognized only when associated revenue is realized. Explore more to understand how these concepts impact financial statements and compliance.

Unearned Revenue

Unearned revenue, classified as a liability on the balance sheet, is recorded when payment is received before goods or services are delivered, aligning with the matching principle that expenses must be recognized in the same period as related revenues. The matching principle ensures revenue recognition occurs when earned, while deferred revenue recognition postpones revenue until the obligation is fulfilled. Explore detailed accounting treatments and implications of unearned revenue for a comprehensive understanding.

Accrual Basis

The matching principle in accrual accounting requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate financial performance measurement. Deferred revenue recognition involves recording cash received before earning the revenue as a liability, recognizing it as revenue only when the service or product delivery is complete. Explore detailed differences and practical applications of these concepts to deepen your understanding of accrual basis accounting.

Source and External Links

The Matching Principle - Requires that revenues and related expenses be recognized together in the same reporting period to ensure accurate financial reporting.

What Is the Matching Principle and Why Is It Important? - Explains the matching principle as an essential accounting concept for recording revenues and expenses within the same period.

What Is the Matching Principle? (Definition and Examples) - Provides a definition and examples of the matching principle, which aligns expenses with revenues in the same reporting period for accurate financial analysis.

dowidth.com

dowidth.com