Forensic accounting software specializes in detecting, analyzing, and preventing financial fraud by utilizing advanced data analysis, audit trail tracking, and transaction monitoring features. Credit management software focuses on streamlining credit risk assessment, debt collection, and customer credit monitoring to improve cash flow and reduce bad debt. Explore the distinct advantages and applications of forensic accounting versus credit management software to enhance your financial operations.

Why it is important

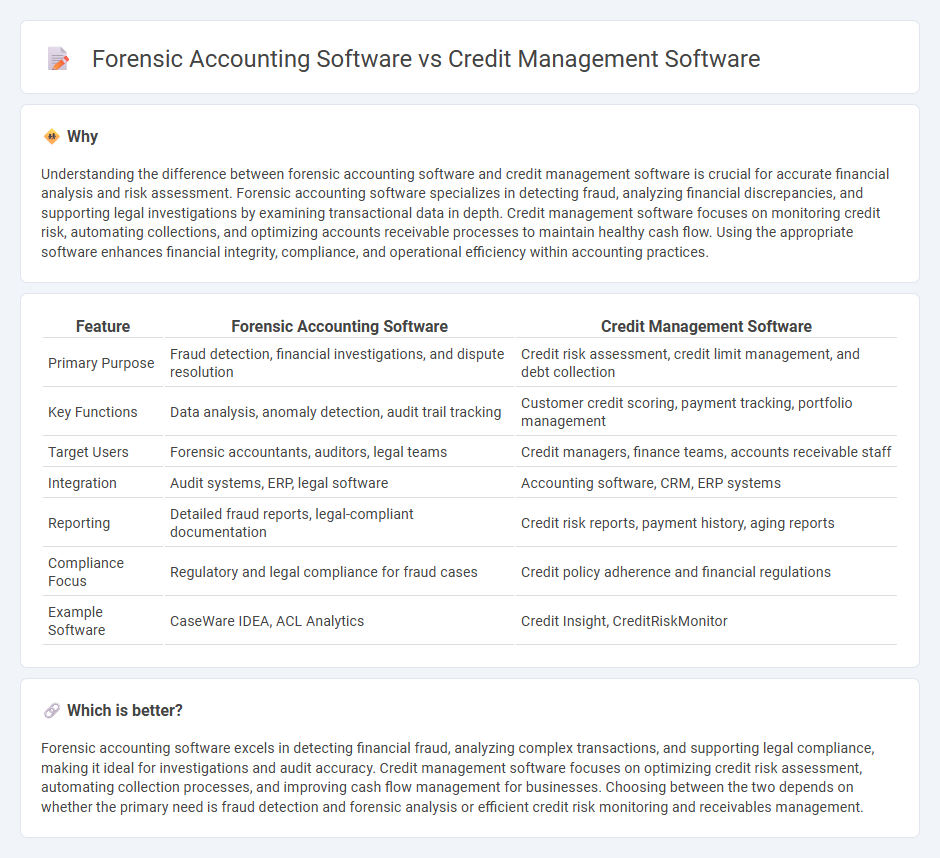

Understanding the difference between forensic accounting software and credit management software is crucial for accurate financial analysis and risk assessment. Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by examining transactional data in depth. Credit management software focuses on monitoring credit risk, automating collections, and optimizing accounts receivable processes to maintain healthy cash flow. Using the appropriate software enhances financial integrity, compliance, and operational efficiency within accounting practices.

Comparison Table

| Feature | Forensic Accounting Software | Credit Management Software |

|---|---|---|

| Primary Purpose | Fraud detection, financial investigations, and dispute resolution | Credit risk assessment, credit limit management, and debt collection |

| Key Functions | Data analysis, anomaly detection, audit trail tracking | Customer credit scoring, payment tracking, portfolio management |

| Target Users | Forensic accountants, auditors, legal teams | Credit managers, finance teams, accounts receivable staff |

| Integration | Audit systems, ERP, legal software | Accounting software, CRM, ERP systems |

| Reporting | Detailed fraud reports, legal-compliant documentation | Credit risk reports, payment history, aging reports |

| Compliance Focus | Regulatory and legal compliance for fraud cases | Credit policy adherence and financial regulations |

| Example Software | CaseWare IDEA, ACL Analytics | Credit Insight, CreditRiskMonitor |

Which is better?

Forensic accounting software excels in detecting financial fraud, analyzing complex transactions, and supporting legal compliance, making it ideal for investigations and audit accuracy. Credit management software focuses on optimizing credit risk assessment, automating collection processes, and improving cash flow management for businesses. Choosing between the two depends on whether the primary need is fraud detection and forensic analysis or efficient credit risk monitoring and receivables management.

Connection

Forensic accounting software enhances credit management software by providing detailed fraud detection and financial analysis tools that improve the accuracy of credit risk assessments. Integration of both software types enables real-time monitoring of financial transactions, helping to identify discrepancies and prevent credit defaults. This synergy supports more informed decision-making and strengthens overall financial compliance within organizations.

Key Terms

Risk Assessment

Credit management software enhances risk assessment by analyzing customer creditworthiness, payment history, and outstanding debts to minimize financial exposure and prevent defaults. Forensic accounting software focuses on identifying fraudulent transactions, discrepancies, and financial irregularities through detailed data analysis and audit trails to mitigate risk in legal and compliance contexts. Explore how these tools differ in strengthening risk management across finance and accounting sectors.

Fraud Detection

Credit management software specializes in monitoring and managing credit risk by analyzing payment behaviors and credit scores, helping to prevent potential defaults and late payments. Forensic accounting software, on the other hand, is designed to detect and investigate fraud by analyzing financial records for suspicious transactions, inconsistencies, and patterns indicative of misconduct. Explore detailed comparisons and functionalities to understand which solution best suits your fraud detection needs.

Accounts Receivable

Credit management software streamlines accounts receivable by automating credit risk assessment, payment tracking, and collections, enhancing cash flow visibility. Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and providing audit trails within accounts receivable records. Explore the key differences and benefits of these tools to optimize your accounts receivable processes.

Source and External Links

Esker Credit Management - Esker's credit management software optimizes the entire risk management process by automating credit decisions and providing actionable data for better decision-making.

Emagia Credit Risk Management Software - Emagia's AI-powered solution automates credit decisions, accelerates customer onboarding, and provides real-time insights for smarter credit choices.

HighRadius Credit Cloud Software - HighRadius offers AI-powered credit management that mitigates risk through real-time visibility and comprehensive workflows, improving credit approval times and reducing bad debt.

dowidth.com

dowidth.com