Smart contracts accounting leverages blockchain technology to automate, verify, and enforce contract terms with unparalleled transparency and accuracy. Revenue recognition, governed by standards such as ASC 606 and IFRS 15, requires precise timing and measurement of income to reflect economic reality accurately. Explore the integration of smart contracts with revenue recognition to enhance financial reporting and compliance.

Why it is important

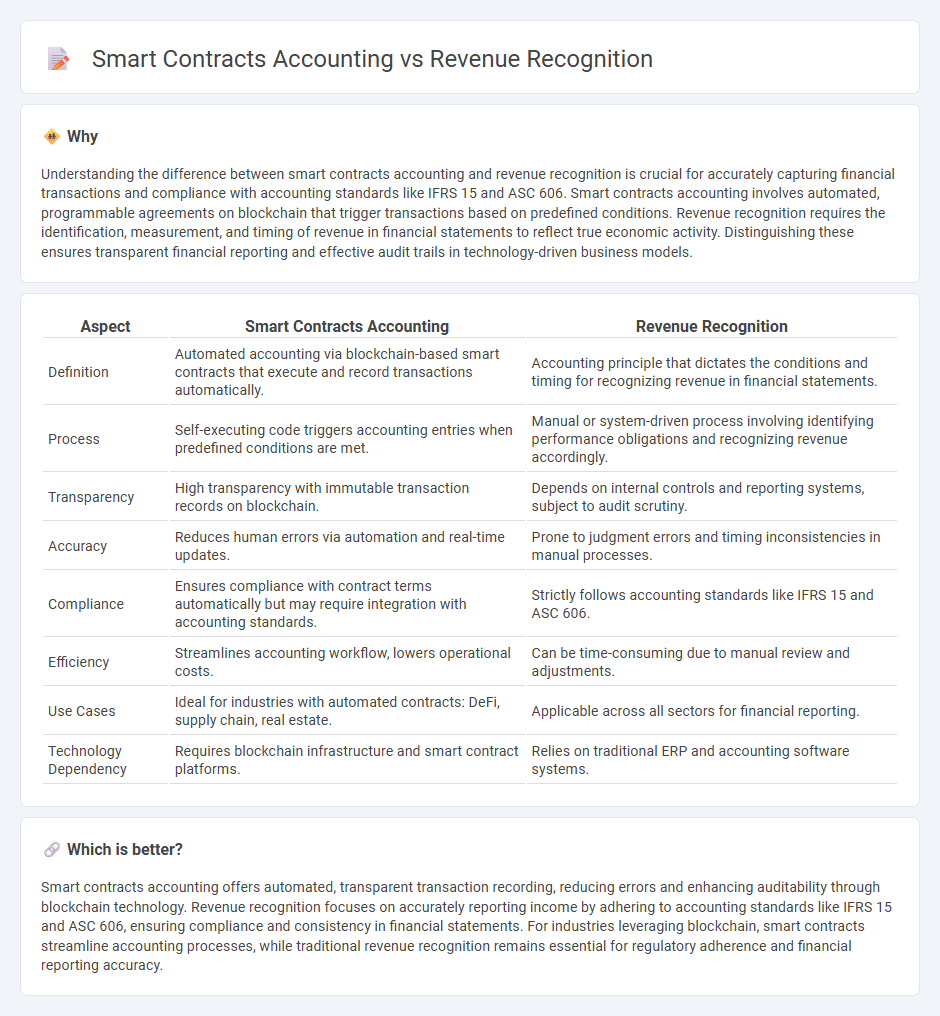

Understanding the difference between smart contracts accounting and revenue recognition is crucial for accurately capturing financial transactions and compliance with accounting standards like IFRS 15 and ASC 606. Smart contracts accounting involves automated, programmable agreements on blockchain that trigger transactions based on predefined conditions. Revenue recognition requires the identification, measurement, and timing of revenue in financial statements to reflect true economic activity. Distinguishing these ensures transparent financial reporting and effective audit trails in technology-driven business models.

Comparison Table

| Aspect | Smart Contracts Accounting | Revenue Recognition |

|---|---|---|

| Definition | Automated accounting via blockchain-based smart contracts that execute and record transactions automatically. | Accounting principle that dictates the conditions and timing for recognizing revenue in financial statements. |

| Process | Self-executing code triggers accounting entries when predefined conditions are met. | Manual or system-driven process involving identifying performance obligations and recognizing revenue accordingly. |

| Transparency | High transparency with immutable transaction records on blockchain. | Depends on internal controls and reporting systems, subject to audit scrutiny. |

| Accuracy | Reduces human errors via automation and real-time updates. | Prone to judgment errors and timing inconsistencies in manual processes. |

| Compliance | Ensures compliance with contract terms automatically but may require integration with accounting standards. | Strictly follows accounting standards like IFRS 15 and ASC 606. |

| Efficiency | Streamlines accounting workflow, lowers operational costs. | Can be time-consuming due to manual review and adjustments. |

| Use Cases | Ideal for industries with automated contracts: DeFi, supply chain, real estate. | Applicable across all sectors for financial reporting. |

| Technology Dependency | Requires blockchain infrastructure and smart contract platforms. | Relies on traditional ERP and accounting software systems. |

Which is better?

Smart contracts accounting offers automated, transparent transaction recording, reducing errors and enhancing auditability through blockchain technology. Revenue recognition focuses on accurately reporting income by adhering to accounting standards like IFRS 15 and ASC 606, ensuring compliance and consistency in financial statements. For industries leveraging blockchain, smart contracts streamline accounting processes, while traditional revenue recognition remains essential for regulatory adherence and financial reporting accuracy.

Connection

Smart contracts automate revenue recognition by embedding predefined financial terms and conditions on blockchain platforms, ensuring accurate and timely recording of transactions. These contracts enhance accounting accuracy by reducing manual errors and enabling real-time updates to financial records according to recognized accounting standards like ASC 606 and IFRS 15. Integration of smart contracts in accounting systems streamlines compliance, audit trails, and revenue validation processes, fostering transparency and trust in financial reporting.

Key Terms

Timing of Recognition

Revenue recognition traditionally follows established accounting standards such as ASC 606 or IFRS 15, recognizing revenue when control of goods or services transfers to the customer, which may involve assessing performance obligations and contract terms. Smart contracts accounting enables automated and real-time revenue recognition by embedding contractual conditions directly on blockchain platforms, ensuring precise timing aligned with actual contractual events and reducing manual intervention. Discover how leveraging smart contracts can enhance accuracy and compliance in revenue timing recognition.

Contract Automation

Revenue recognition in traditional accounting relies on manual processes and regulatory compliance, often leading to delays and errors in contract management. Smart contracts automate revenue recognition by embedding business rules directly into blockchain-based agreements, ensuring real-time, transparent, and immutable contract execution. Discover how contract automation through smart contracts revolutionizes financial reporting and compliance.

Auditability

Revenue recognition under traditional accounting standards like IFRS 15 requires detailed documentation and systematic validation to ensure accurate reporting and auditability. Smart contracts accounting automates the enforcement and recording of contract terms on a blockchain, providing real-time transparency and an immutable audit trail that enhances verification processes. Explore how integrating smart contracts can revolutionize auditability and compliance in revenue recognition.

Source and External Links

Revenue Recognition: Principles and 5-Step Model - NetSuite - Revenue recognition is an accounting principle that asserts revenue must be recognized as earned, following a systematic five-step model involving contract identification, performance obligations, transaction price, allocation, and recognizing revenue when obligations are satisfied.

Revenue recognition principles & best practices - Stripe - Revenue recognition mandates businesses recognize revenue when earned under accrual accounting, aligned with GAAP and IFRS rules such as ASC 606 and IFRS 15, to ensure transparency, fairness, and comparability across industries worldwide.

Revenue recognition examples: 4 different ways to recognize revenue - The principle distinguishes between cash and revenue, emphasizing that revenue is not recorded upon cash receipt but only once goods or services have been delivered, with deferred revenue accounting for prepayments until delivery completes the obligation.

dowidth.com

dowidth.com