Embedded finance accounting integrates financial services directly within non-financial platforms, streamlining transactions and reducing reconciliation complexity. Payment processor accounting focuses on managing payment transactions, fees, and settlements for third-party financial services, requiring detailed tracking of transaction flows and chargebacks. Explore further to understand the distinct accounting challenges and opportunities in embedded finance versus payment processing.

Why it is important

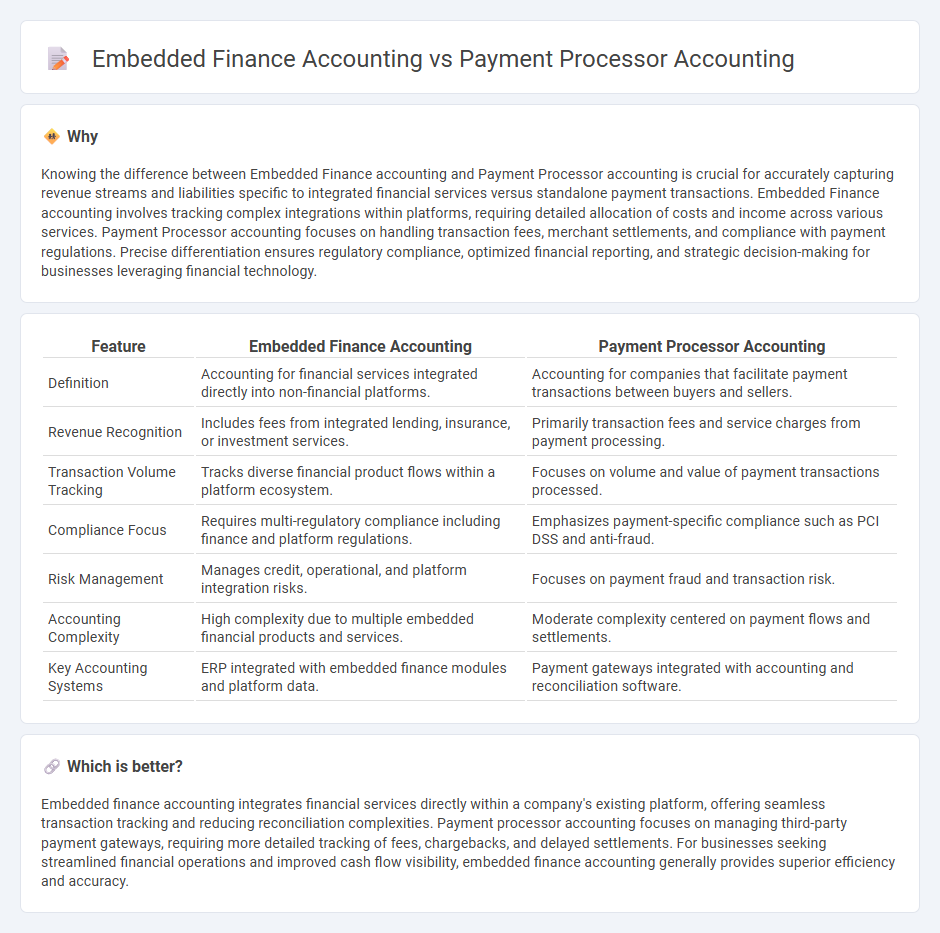

Knowing the difference between Embedded Finance accounting and Payment Processor accounting is crucial for accurately capturing revenue streams and liabilities specific to integrated financial services versus standalone payment transactions. Embedded Finance accounting involves tracking complex integrations within platforms, requiring detailed allocation of costs and income across various services. Payment Processor accounting focuses on handling transaction fees, merchant settlements, and compliance with payment regulations. Precise differentiation ensures regulatory compliance, optimized financial reporting, and strategic decision-making for businesses leveraging financial technology.

Comparison Table

| Feature | Embedded Finance Accounting | Payment Processor Accounting |

|---|---|---|

| Definition | Accounting for financial services integrated directly into non-financial platforms. | Accounting for companies that facilitate payment transactions between buyers and sellers. |

| Revenue Recognition | Includes fees from integrated lending, insurance, or investment services. | Primarily transaction fees and service charges from payment processing. |

| Transaction Volume Tracking | Tracks diverse financial product flows within a platform ecosystem. | Focuses on volume and value of payment transactions processed. |

| Compliance Focus | Requires multi-regulatory compliance including finance and platform regulations. | Emphasizes payment-specific compliance such as PCI DSS and anti-fraud. |

| Risk Management | Manages credit, operational, and platform integration risks. | Focuses on payment fraud and transaction risk. |

| Accounting Complexity | High complexity due to multiple embedded financial products and services. | Moderate complexity centered on payment flows and settlements. |

| Key Accounting Systems | ERP integrated with embedded finance modules and platform data. | Payment gateways integrated with accounting and reconciliation software. |

Which is better?

Embedded finance accounting integrates financial services directly within a company's existing platform, offering seamless transaction tracking and reducing reconciliation complexities. Payment processor accounting focuses on managing third-party payment gateways, requiring more detailed tracking of fees, chargebacks, and delayed settlements. For businesses seeking streamlined financial operations and improved cash flow visibility, embedded finance accounting generally provides superior efficiency and accuracy.

Connection

Embedded finance accounting integrates financial services directly within a platform, streamlining transaction recording and reconciliation processes. Payment processor accounting manages the detailed tracking of payment flows, fees, and settlements, providing accurate financial data essential for embedded finance systems. Both accounting methods rely on synchronized data exchange to ensure transparency, compliance, and real-time financial reporting within digital ecosystems.

Key Terms

Transaction Reconciliation

Transaction reconciliation in payment processor accounting centers on matching transactions between merchant accounts and bank statements to ensure accuracy and prevent fraud. Embedded finance accounting integrates financial services directly into platforms, streamlining reconciliation by automating data alignment between payment gateways, ledgers, and customer accounts. Explore comprehensive strategies to enhance transaction reconciliation efficiency in both systems.

Revenue Recognition

Payment processor accounting requires recognizing transaction fees and commissions as revenue when payment services are executed, aligning with ASC 606 standards. Embedded finance accounting often demands a more nuanced approach due to the integration of financial services within platforms, necessitating clear delineation of principal versus agent roles for accurate revenue recognition. Explore deeper insights into how these distinctions impact financial reporting and compliance.

Settlement Timing

Payment processor accounting records transactions based on the exact settlement timing, recognizing revenues and expenses when funds transfer is completed, ensuring real-time financial accuracy. Embedded finance accounting integrates financial services directly into platforms, often reflecting settlement timings aligned with platform-specific cash flow cycles rather than immediate settlement. Discover how these accounting approaches impact your business cash flow and financial reporting strategies.

Source and External Links

Payment processors 101: What they are and how they work - Payment processor accounting involves tracking and managing the flow of funds from customers to businesses, including authorization, settlement, fees deduction, and reporting for transaction data and chargeback management, all while ensuring security and compliance with standards like PCI DSS.

How to Start a Payment Processing Company - Payment processor accounting requires coordinating components such as payment gateways, acquiring banks, and merchant accounts to securely process payments, verify funds, and ensure the transfer of money from customer to business accounts.

Payment Processors: How They Work & Why You Need One - In accounting for payment processors, tasks include handling the funds transfer between customer and merchant banks, supporting reconciliation for credit card and ACH transactions, and differentiating roles from payment gateways and facilitators in the payment cycle.

dowidth.com

dowidth.com