Crypto asset valuation requires specialized models reflecting market volatility, liquidity, and technological factors distinct from traditional assets. Fair value measurement under accounting standards focuses on exit price in active markets, often challenging for illiquid or novel crypto assets. Explore detailed methodologies to accurately assess these emerging digital financial instruments.

Why it is important

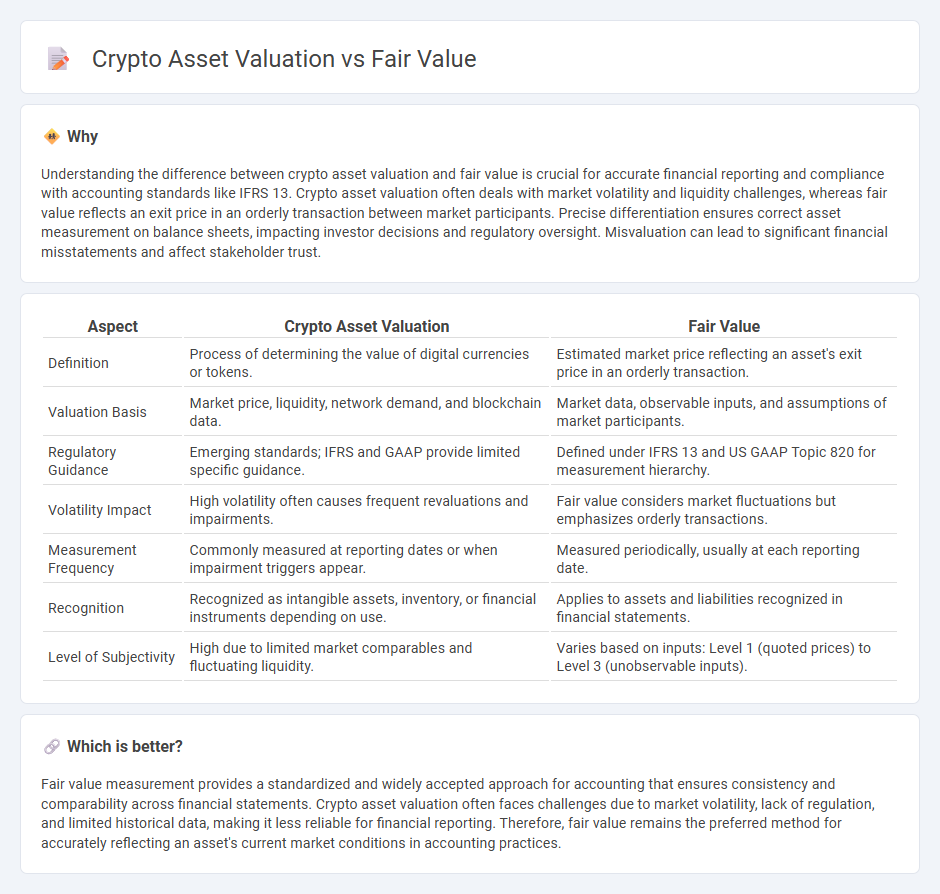

Understanding the difference between crypto asset valuation and fair value is crucial for accurate financial reporting and compliance with accounting standards like IFRS 13. Crypto asset valuation often deals with market volatility and liquidity challenges, whereas fair value reflects an exit price in an orderly transaction between market participants. Precise differentiation ensures correct asset measurement on balance sheets, impacting investor decisions and regulatory oversight. Misvaluation can lead to significant financial misstatements and affect stakeholder trust.

Comparison Table

| Aspect | Crypto Asset Valuation | Fair Value |

|---|---|---|

| Definition | Process of determining the value of digital currencies or tokens. | Estimated market price reflecting an asset's exit price in an orderly transaction. |

| Valuation Basis | Market price, liquidity, network demand, and blockchain data. | Market data, observable inputs, and assumptions of market participants. |

| Regulatory Guidance | Emerging standards; IFRS and GAAP provide limited specific guidance. | Defined under IFRS 13 and US GAAP Topic 820 for measurement hierarchy. |

| Volatility Impact | High volatility often causes frequent revaluations and impairments. | Fair value considers market fluctuations but emphasizes orderly transactions. |

| Measurement Frequency | Commonly measured at reporting dates or when impairment triggers appear. | Measured periodically, usually at each reporting date. |

| Recognition | Recognized as intangible assets, inventory, or financial instruments depending on use. | Applies to assets and liabilities recognized in financial statements. |

| Level of Subjectivity | High due to limited market comparables and fluctuating liquidity. | Varies based on inputs: Level 1 (quoted prices) to Level 3 (unobservable inputs). |

Which is better?

Fair value measurement provides a standardized and widely accepted approach for accounting that ensures consistency and comparability across financial statements. Crypto asset valuation often faces challenges due to market volatility, lack of regulation, and limited historical data, making it less reliable for financial reporting. Therefore, fair value remains the preferred method for accurately reflecting an asset's current market conditions in accounting practices.

Connection

Crypto asset valuation and fair value are intrinsically connected through the application of market-based measurement techniques. Accounting standards like IFRS 13 require that crypto assets be measured at fair value, reflecting current market conditions and ensuring transparent financial reporting. This approach enhances accuracy in asset valuation by incorporating real-time price signals from active cryptocurrency exchanges.

Key Terms

Market Price

Market price serves as a critical indicator in crypto asset valuation, reflecting the real-time value at which digital currencies are traded on exchanges globally. Fair value assessments integrate market price with intrinsic factors such as asset utility, network growth, and market sentiment to provide a more comprehensive valuation framework. Explore deeper insights into how market price influences crypto asset valuation and the methodologies behind fair value calculations.

Volatility

Fair value assessment of crypto assets hinges on volatility metrics, with price fluctuations directly impacting valuation accuracy and investor confidence. Traditional assets rely on stable benchmarks, while crypto markets require advanced models to capture rapid and unpredictable value changes. Explore comprehensive strategies to understand the interplay between volatility and fair value in crypto asset valuation.

Observable Inputs

Fair value measurement of crypto assets relies heavily on observable inputs such as market prices, trading volume, and liquidity data to ensure accurate valuation. These inputs enhance transparency and comparability, crucial for investors and regulators navigating volatile digital asset markets. Explore more to understand how observable inputs shape fair value assessments in crypto asset valuation.

Source and External Links

Fair Value - CFI - Fair value refers to the mutually agreed-upon value of an asset between a buyer and a seller, applicable in normal market conditions.

Calculating Fair Value - CME Group - The fair value of futures contracts is calculated using factors like current index levels, dividends, and interest rates.

IFRS 13 Fair Value Measurement - IFRS 13 defines fair value as the price obtained in an orderly transaction between market participants at the measurement date.

dowidth.com

dowidth.com