Real-time expense recognition records expenses immediately as transactions occur, ensuring up-to-date financial statements and improved decision-making accuracy. Adjusting entries, typically made at the end of an accounting period, correct or allocate income and expenses to adhere to the matching principle and proper revenue recognition. Explore the benefits and practical applications of these methods to enhance your accounting practices.

Why it is important

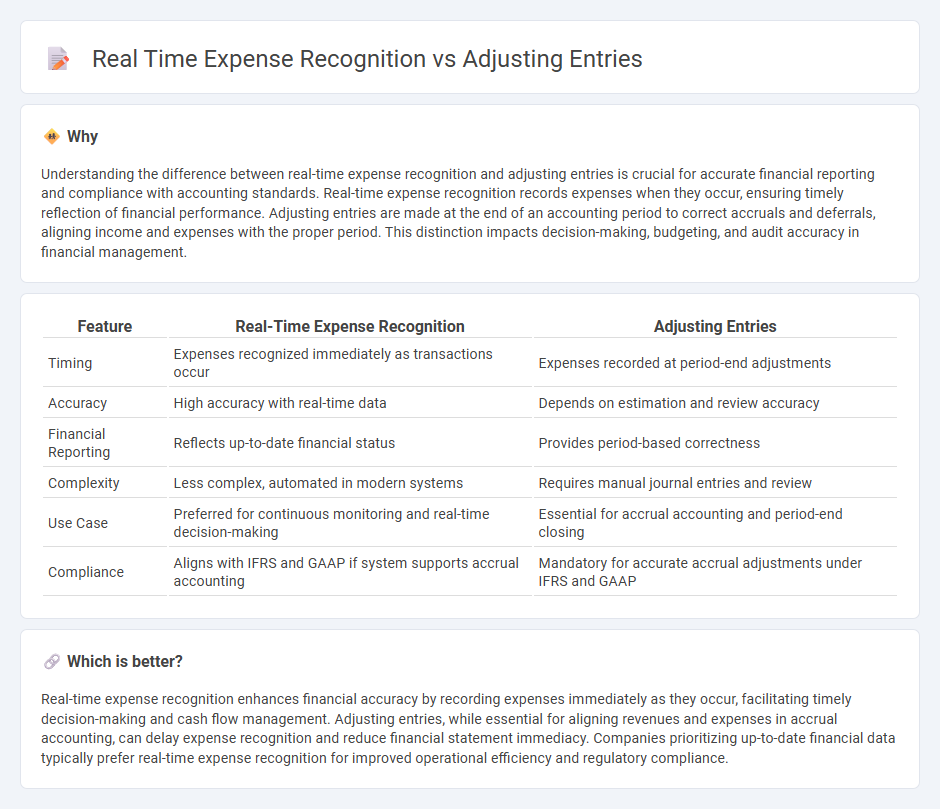

Understanding the difference between real-time expense recognition and adjusting entries is crucial for accurate financial reporting and compliance with accounting standards. Real-time expense recognition records expenses when they occur, ensuring timely reflection of financial performance. Adjusting entries are made at the end of an accounting period to correct accruals and deferrals, aligning income and expenses with the proper period. This distinction impacts decision-making, budgeting, and audit accuracy in financial management.

Comparison Table

| Feature | Real-Time Expense Recognition | Adjusting Entries |

|---|---|---|

| Timing | Expenses recognized immediately as transactions occur | Expenses recorded at period-end adjustments |

| Accuracy | High accuracy with real-time data | Depends on estimation and review accuracy |

| Financial Reporting | Reflects up-to-date financial status | Provides period-based correctness |

| Complexity | Less complex, automated in modern systems | Requires manual journal entries and review |

| Use Case | Preferred for continuous monitoring and real-time decision-making | Essential for accrual accounting and period-end closing |

| Compliance | Aligns with IFRS and GAAP if system supports accrual accounting | Mandatory for accurate accrual adjustments under IFRS and GAAP |

Which is better?

Real-time expense recognition enhances financial accuracy by recording expenses immediately as they occur, facilitating timely decision-making and cash flow management. Adjusting entries, while essential for aligning revenues and expenses in accrual accounting, can delay expense recognition and reduce financial statement immediacy. Companies prioritizing up-to-date financial data typically prefer real-time expense recognition for improved operational efficiency and regulatory compliance.

Connection

Real-time expense recognition ensures that financial statements reflect current costs as they are incurred, improving accuracy in financial reporting. Adjusting entries are necessary to align expenses with the correct accounting periods, especially when real-time data reveals discrepancies or timing differences. This connection streamlines the matching principle, ensuring expenses are recorded in the period in which they contribute to revenue generation.

Key Terms

Accruals

Accrual accounting requires adjusting entries to record expenses incurred but not yet paid, ensuring financial statements accurately reflect the true financial position. Real-time expense recognition captures expenses immediately when transactions occur, minimizing the need for later adjustments but may not always align with the accrual basis requirements. Discover the nuances of accrual adjustments and their impact on financial accuracy by exploring detailed accounting practices.

Timing

Adjusting entries occur at the end of an accounting period to allocate revenues and expenses to the correct period, ensuring accurate financial statements. Real-time expense recognition captures expenses immediately as transactions happen, providing up-to-date financial information but requiring robust systems. Explore the advantages and challenges of each method to optimize your accounting practices.

Matching principle

Adjusting entries ensure expenses are recorded in the same period as the revenues they help generate, adhering closely to the Matching Principle by recognizing incurred costs before payment. Real-time expense recognition records expenses immediately as transactions occur, which may not always align with the Matching Principle if revenues are recognized later. Explore the detailed impacts of these methods on financial statement accuracy and compliance with accounting standards.

Source and External Links

Adjusting entries: Definition, examples, and basics - Netgain - Adjusting entries are journal entries made at the end of an accounting period to recognize revenues and expenses in the correct period, ensuring financial statements accurately reflect the company's financial position by recording accrued revenues, accrued expenses, prepaid expenses, depreciation, and other necessary adjustments.

Adjusting entries definition - AccountingTools - Adjusting entries alter ending balances in ledger accounts at period-end, often including accruals and deferrals, and can be reversed at the start of the next accounting period to simplify bookkeeping and accurately match revenues and expenses.

The Importance of Adjusting Entries (Plus Types and Tips) - Indeed - Adjusting entries ensure expenses and revenues are recognized in the periods they relate to, following the matching principle, and are essential for accurate financial reporting including recording unrecognized income, expenses, and asset depreciation between accounting periods.

dowidth.com

dowidth.com