Embedded lease accounting involves identifying and separating lease components within contracts to ensure accurate recognition of right-of-use assets and lease liabilities under accounting standards like IFRS 16 and ASC 842. Service contract accounting treats payments as expenses over the contract period without capitalizing assets, focusing on matching costs with service delivery. Explore the key differences and implications of embedded lease versus service contract accounting to optimize financial reporting.

Why it is important

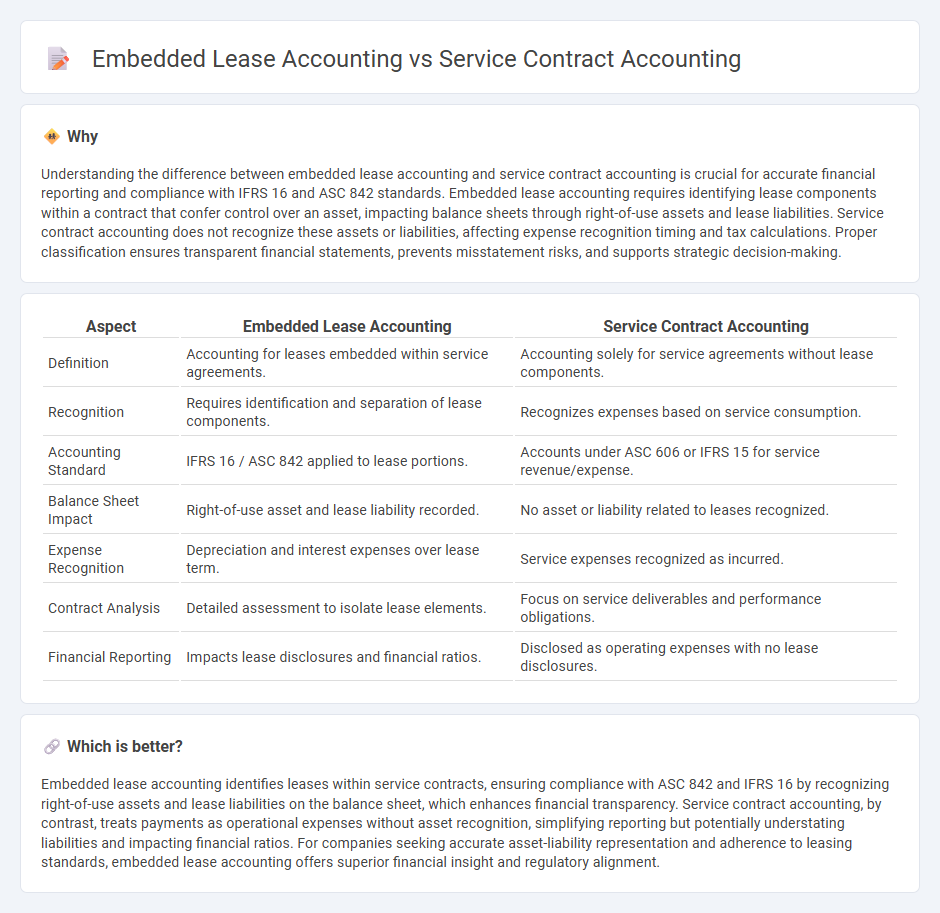

Understanding the difference between embedded lease accounting and service contract accounting is crucial for accurate financial reporting and compliance with IFRS 16 and ASC 842 standards. Embedded lease accounting requires identifying lease components within a contract that confer control over an asset, impacting balance sheets through right-of-use assets and lease liabilities. Service contract accounting does not recognize these assets or liabilities, affecting expense recognition timing and tax calculations. Proper classification ensures transparent financial statements, prevents misstatement risks, and supports strategic decision-making.

Comparison Table

| Aspect | Embedded Lease Accounting | Service Contract Accounting |

|---|---|---|

| Definition | Accounting for leases embedded within service agreements. | Accounting solely for service agreements without lease components. |

| Recognition | Requires identification and separation of lease components. | Recognizes expenses based on service consumption. |

| Accounting Standard | IFRS 16 / ASC 842 applied to lease portions. | Accounts under ASC 606 or IFRS 15 for service revenue/expense. |

| Balance Sheet Impact | Right-of-use asset and lease liability recorded. | No asset or liability related to leases recognized. |

| Expense Recognition | Depreciation and interest expenses over lease term. | Service expenses recognized as incurred. |

| Contract Analysis | Detailed assessment to isolate lease elements. | Focus on service deliverables and performance obligations. |

| Financial Reporting | Impacts lease disclosures and financial ratios. | Disclosed as operating expenses with no lease disclosures. |

Which is better?

Embedded lease accounting identifies leases within service contracts, ensuring compliance with ASC 842 and IFRS 16 by recognizing right-of-use assets and lease liabilities on the balance sheet, which enhances financial transparency. Service contract accounting, by contrast, treats payments as operational expenses without asset recognition, simplifying reporting but potentially understating liabilities and impacting financial ratios. For companies seeking accurate asset-liability representation and adherence to leasing standards, embedded lease accounting offers superior financial insight and regulatory alignment.

Connection

Embedded lease accounting and service contract accounting intersect through the evaluation of contract components under ASC 842 and IFRS 16 standards, where embedded leases require separation from service contracts to accurately recognize lease liabilities and right-of-use assets. Effective identification and classification affect financial statement presentation, impacting lease disclosures, expense recognition, and compliance with accounting regulations. This connection drives organizations to perform detailed contract analysis to ensure precise lease accounting and avoid misstated financial results.

Key Terms

Revenue Recognition

Service contract accounting recognizes revenue as services are performed over time, aligning with ASC 606 principles to match income with contract fulfillment. Embedded lease accounting identifies lease components within service contracts, requiring separate lease liability and right-of-use asset recording under ASC 842, affecting revenue recognition patterns. Explore the detailed implications of these accounting approaches to optimize financial reporting strategies.

Lease Classification

Lease classification under service contract accounting differs significantly from embedded lease accounting, as service contracts often exclude asset control transfer considerations, while embedded leases require evaluation of right-of-use asset and lease liability. The key factor in embedded lease accounting is determining whether a lease conveys control of the identified asset, influencing finance or operating lease classification. Explore deeper insights on lease classification criteria and accounting standards for comprehensive understanding.

Right-of-Use Asset

Service contract accounting treats payments as expenses without recognizing an asset, while embedded lease accounting requires the recognition of a Right-of-Use (ROU) asset representing the lessee's control over the leased asset. The ROU asset is initially measured at the present value of lease payments and subsequently amortized, reflecting the lessee's usage rights over the lease term. Explore our detailed analysis to understand the critical distinctions and compliance requirements in accounting for these contracts.

Source and External Links

What expense category does a service contract come under? - Ramp - Service contracts are generally categorized as ordinary and necessary business expenses deductible for tax purposes, and managing them properly helps with compliance and deduction maximization.

What Expense Category Does Service Contract Come Under? - Fyle - The IRS allows service contract expenses to be deducted as ordinary and necessary business expenses, with the specific category depending on the service nature, such as maintenance or professional fees.

ASC 842 Guide: Definitions, Examples + More | 8020 Consulting - Service contracts differ from leases in that they do not require asset or liability recognition on the balance sheet, as the customer receives benefit from services rather than use of an asset.

dowidth.com

dowidth.com