Blockchain-based accounting revolutionizes traditional double-entry bookkeeping by leveraging decentralized ledger technology to enhance transparency, security, and real-time transaction tracking. Unlike conventional systems that rely on centralized records prone to errors and fraud, blockchain ensures immutable, verifiable financial data across multiple parties. Explore how adopting blockchain transforms accounting accuracy and trustworthiness in modern financial management.

Why it is important

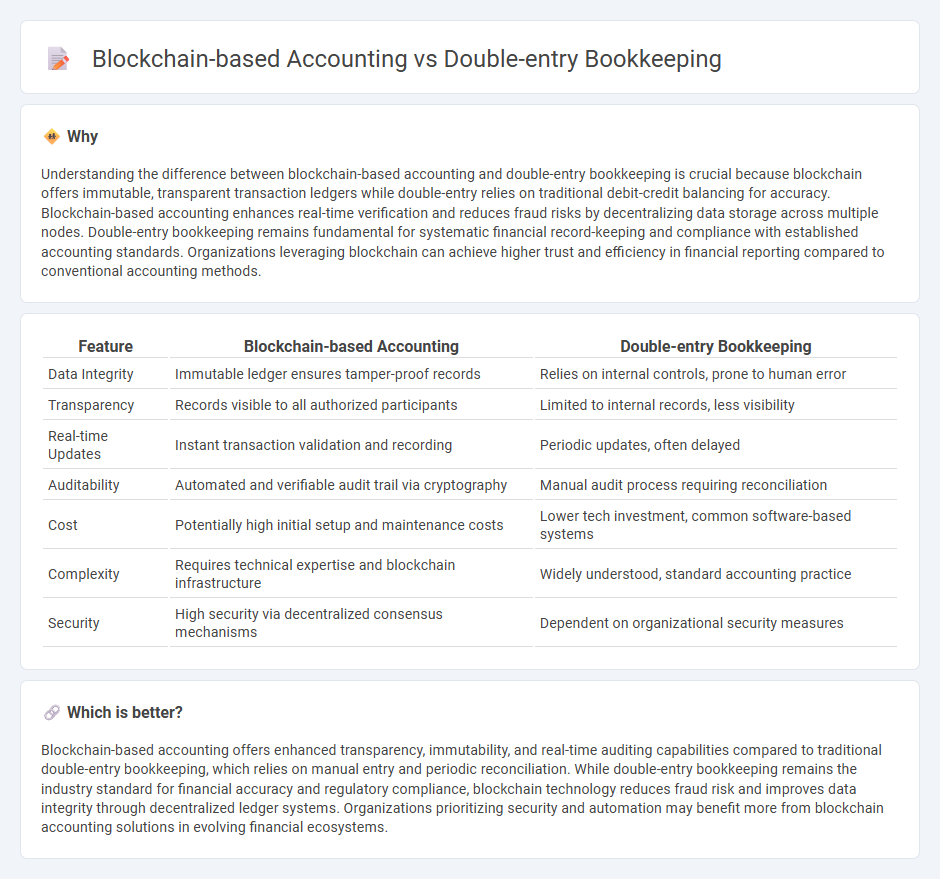

Understanding the difference between blockchain-based accounting and double-entry bookkeeping is crucial because blockchain offers immutable, transparent transaction ledgers while double-entry relies on traditional debit-credit balancing for accuracy. Blockchain-based accounting enhances real-time verification and reduces fraud risks by decentralizing data storage across multiple nodes. Double-entry bookkeeping remains fundamental for systematic financial record-keeping and compliance with established accounting standards. Organizations leveraging blockchain can achieve higher trust and efficiency in financial reporting compared to conventional accounting methods.

Comparison Table

| Feature | Blockchain-based Accounting | Double-entry Bookkeeping |

|---|---|---|

| Data Integrity | Immutable ledger ensures tamper-proof records | Relies on internal controls, prone to human error |

| Transparency | Records visible to all authorized participants | Limited to internal records, less visibility |

| Real-time Updates | Instant transaction validation and recording | Periodic updates, often delayed |

| Auditability | Automated and verifiable audit trail via cryptography | Manual audit process requiring reconciliation |

| Cost | Potentially high initial setup and maintenance costs | Lower tech investment, common software-based systems |

| Complexity | Requires technical expertise and blockchain infrastructure | Widely understood, standard accounting practice |

| Security | High security via decentralized consensus mechanisms | Dependent on organizational security measures |

Which is better?

Blockchain-based accounting offers enhanced transparency, immutability, and real-time auditing capabilities compared to traditional double-entry bookkeeping, which relies on manual entry and periodic reconciliation. While double-entry bookkeeping remains the industry standard for financial accuracy and regulatory compliance, blockchain technology reduces fraud risk and improves data integrity through decentralized ledger systems. Organizations prioritizing security and automation may benefit more from blockchain accounting solutions in evolving financial ecosystems.

Connection

Blockchain-based accounting enhances traditional double-entry bookkeeping by securely recording transactions in a decentralized ledger, ensuring data immutability and transparency. Each transaction in double-entry bookkeeping is cryptographically verified and linked in chronological blocks, reducing the risk of fraud and errors. This integration streamlines audit processes and strengthens financial accuracy through real-time, tamper-proof records.

Key Terms

Debits and Credits

Double-entry bookkeeping records each financial transaction with equal debits and credits, ensuring accuracy and balance in traditional accounting systems. Blockchain-based accounting leverages decentralized ledger technology to provide transparent, immutable transaction records, enhancing auditability and security beyond conventional methods. Explore how these distinct approaches impact financial reporting and integrity in modern business environments.

Ledger

Double-entry bookkeeping records financial transactions in two accounts, debits and credits, ensuring accuracy through balance validation. Blockchain-based accounting uses decentralized, immutable ledgers to enhance transparency and security, allowing real-time verification of transactions. Discover how integrating blockchain technology transforms traditional ledger systems for modern accounting practices.

Distributed Ledger Technology (DLT)

Double-entry bookkeeping records every financial transaction twice, ensuring accuracy by balancing debits and credits, while blockchain-based accounting leverages Distributed Ledger Technology (DLT) to create immutable, transparent transaction records across a decentralized network. DLT enhances security and reduces fraud risk by distributing data across multiple nodes, enabling real-time auditing and traceability without relying on a central authority. Explore how blockchain and DLT reshape accounting processes and transform financial transparency.

Source and External Links

What is Double-Entry Bookkeeping? - Dummies.com - Double-entry bookkeeping records every transaction twice, as both a debit and a credit, to ensure the books always balance according to the formula Assets = Liabilities + Equity.

Double-Entry Accounting: What It Is and Why It Matters - NerdWallet - Double-entry accounting requires two entries--one debit and one credit--for each transaction, creating a complete picture of how money moves through a business and maintaining balanced books.

What Is Double-Entry Bookkeeping? A Simple Guide for Small ... - In double-entry bookkeeping, every transaction is recorded in at least two accounts, with total debits always equaling total credits, and the balance sheet always remains in balance (Assets = Liabilities + Equity).

dowidth.com

dowidth.com