Continuous auditing utilizes automated tools to provide real-time monitoring of financial transactions, ensuring ongoing compliance and early detection of anomalies. Forensic auditing, by contrast, involves detailed investigation of financial records to uncover fraud, errors, or legal violations, often conducted post-incident. Explore key differences and applications in auditing practices to enhance organizational transparency and security.

Why it is important

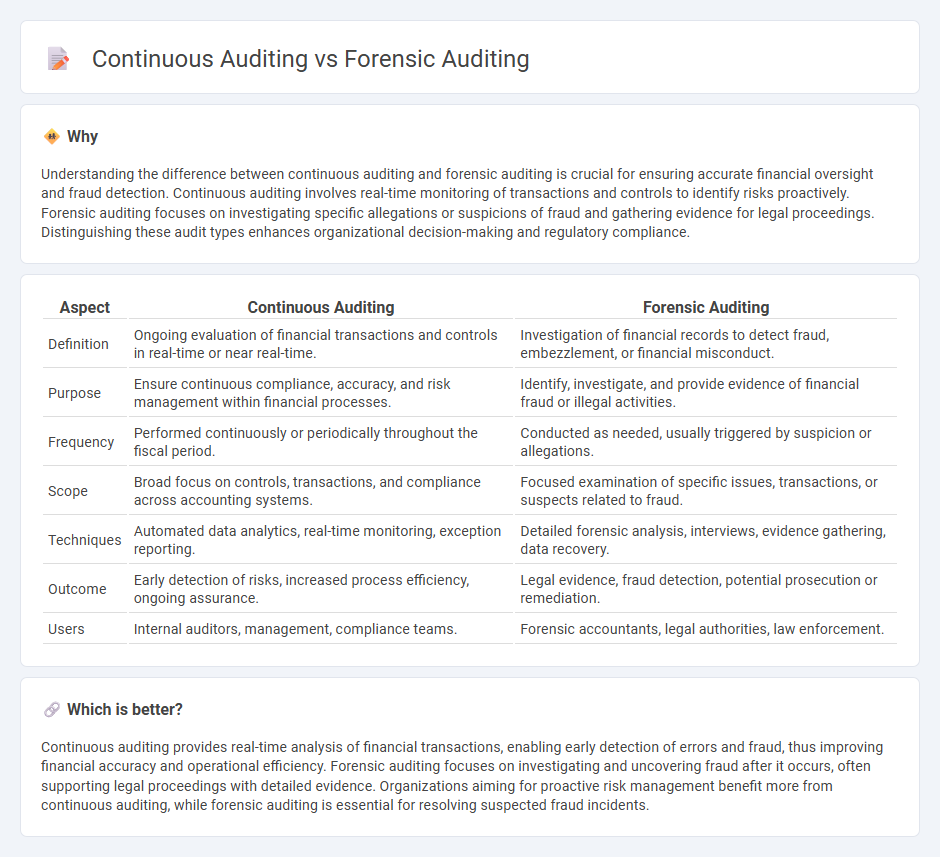

Understanding the difference between continuous auditing and forensic auditing is crucial for ensuring accurate financial oversight and fraud detection. Continuous auditing involves real-time monitoring of transactions and controls to identify risks proactively. Forensic auditing focuses on investigating specific allegations or suspicions of fraud and gathering evidence for legal proceedings. Distinguishing these audit types enhances organizational decision-making and regulatory compliance.

Comparison Table

| Aspect | Continuous Auditing | Forensic Auditing |

|---|---|---|

| Definition | Ongoing evaluation of financial transactions and controls in real-time or near real-time. | Investigation of financial records to detect fraud, embezzlement, or financial misconduct. |

| Purpose | Ensure continuous compliance, accuracy, and risk management within financial processes. | Identify, investigate, and provide evidence of financial fraud or illegal activities. |

| Frequency | Performed continuously or periodically throughout the fiscal period. | Conducted as needed, usually triggered by suspicion or allegations. |

| Scope | Broad focus on controls, transactions, and compliance across accounting systems. | Focused examination of specific issues, transactions, or suspects related to fraud. |

| Techniques | Automated data analytics, real-time monitoring, exception reporting. | Detailed forensic analysis, interviews, evidence gathering, data recovery. |

| Outcome | Early detection of risks, increased process efficiency, ongoing assurance. | Legal evidence, fraud detection, potential prosecution or remediation. |

| Users | Internal auditors, management, compliance teams. | Forensic accountants, legal authorities, law enforcement. |

Which is better?

Continuous auditing provides real-time analysis of financial transactions, enabling early detection of errors and fraud, thus improving financial accuracy and operational efficiency. Forensic auditing focuses on investigating and uncovering fraud after it occurs, often supporting legal proceedings with detailed evidence. Organizations aiming for proactive risk management benefit more from continuous auditing, while forensic auditing is essential for resolving suspected fraud incidents.

Connection

Continuous auditing and forensic auditing intersect through their shared focus on detecting and preventing financial fraud by using real-time data analysis and automated monitoring systems. Continuous auditing enables early identification of discrepancies and suspicious activities, providing forensic auditors with timely evidence for in-depth investigations. Integration of these auditing methods enhances organizational risk management and strengthens internal controls against fraudulent practices.

Key Terms

Forensic Auditing:

Forensic auditing meticulously investigates financial discrepancies and fraud by analyzing accounting records, transactions, and compliance with legal standards to uncover intentional misstatements or criminal activities. It employs specialized techniques such as data mining, forensic accounting, and interviewing witnesses to gather evidence for potential litigation or regulatory action. Explore more to understand how forensic auditing strengthens fraud detection and legal accountability.

Fraud Detection

Forensic auditing involves a detailed examination of financial records to identify fraud after suspicious activities have occurred, leveraging specialized techniques to gather evidence for legal proceedings. Continuous auditing uses automated tools to monitor transactions in real-time, enabling early detection and prevention of fraudulent activities through ongoing data analysis and anomaly detection. Explore more about how these auditing methods enhance fraud detection strategies and safeguard organizational assets.

Evidence Collection

Forensic auditing involves detailed examination and collection of evidence to detect fraud, emphasizing accuracy, documentation, and legal admissibility of findings. Continuous auditing integrates automated processes and real-time data analysis, enabling ongoing evidence collection to identify anomalies quickly and improve risk management. Explore deeper insights into how these auditing approaches differ in their evidence collection techniques.

Source and External Links

Forensic Audits: All You Need to Know - This article provides an overview of forensic audits, including their purpose, steps, and the role of forensic auditors in investigating financial records for fraudulent activities.

Forensic Audit Guide - Definition, Steps, Reasons - This guide explains the definition, steps, and reasons for conducting a forensic audit, highlighting its use in legal proceedings to investigate fraud.

Forensic Accounting vs. Auditing - This article discusses the differences between forensic accounting and auditing, focusing on their roles in detecting fraud and managing risk.

dowidth.com

dowidth.com