Forensic data analytics involves examining financial data to detect fraud, errors, and irregularities through advanced analytical techniques and tools. Internal audit focuses on evaluating an organization's internal controls, risk management, and governance processes to ensure accuracy and compliance. Discover more about the distinct roles and benefits of forensic data analytics and internal audit in strengthening financial integrity.

Why it is important

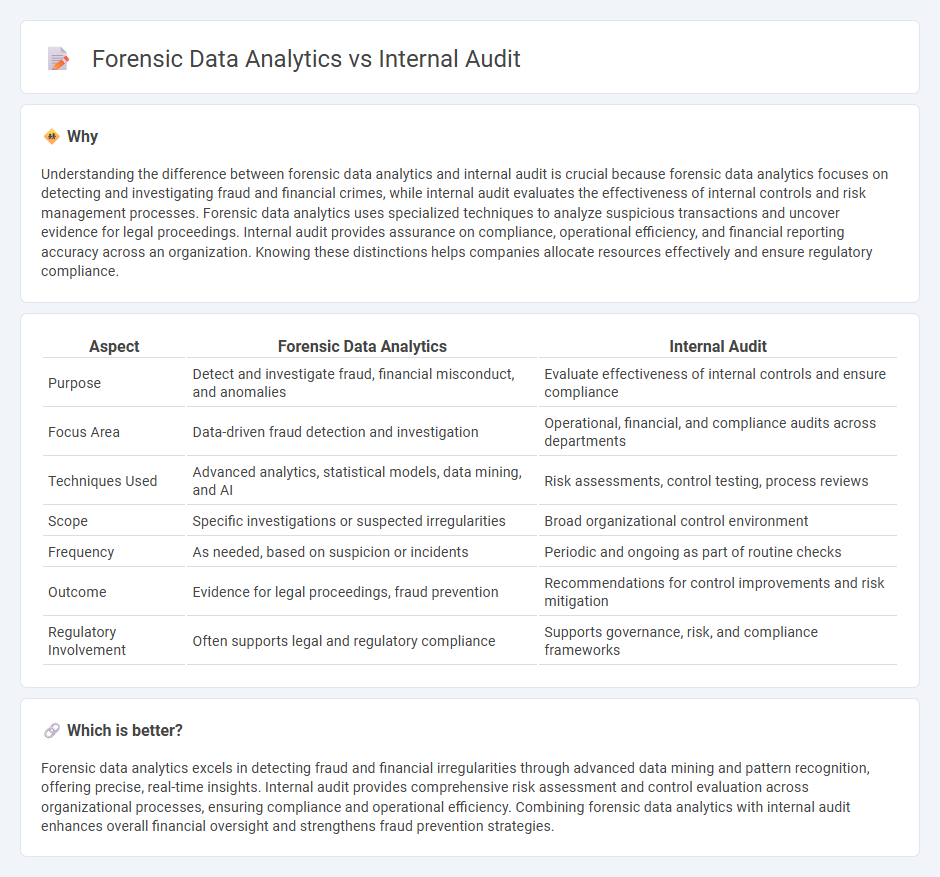

Understanding the difference between forensic data analytics and internal audit is crucial because forensic data analytics focuses on detecting and investigating fraud and financial crimes, while internal audit evaluates the effectiveness of internal controls and risk management processes. Forensic data analytics uses specialized techniques to analyze suspicious transactions and uncover evidence for legal proceedings. Internal audit provides assurance on compliance, operational efficiency, and financial reporting accuracy across an organization. Knowing these distinctions helps companies allocate resources effectively and ensure regulatory compliance.

Comparison Table

| Aspect | Forensic Data Analytics | Internal Audit |

|---|---|---|

| Purpose | Detect and investigate fraud, financial misconduct, and anomalies | Evaluate effectiveness of internal controls and ensure compliance |

| Focus Area | Data-driven fraud detection and investigation | Operational, financial, and compliance audits across departments |

| Techniques Used | Advanced analytics, statistical models, data mining, and AI | Risk assessments, control testing, process reviews |

| Scope | Specific investigations or suspected irregularities | Broad organizational control environment |

| Frequency | As needed, based on suspicion or incidents | Periodic and ongoing as part of routine checks |

| Outcome | Evidence for legal proceedings, fraud prevention | Recommendations for control improvements and risk mitigation |

| Regulatory Involvement | Often supports legal and regulatory compliance | Supports governance, risk, and compliance frameworks |

Which is better?

Forensic data analytics excels in detecting fraud and financial irregularities through advanced data mining and pattern recognition, offering precise, real-time insights. Internal audit provides comprehensive risk assessment and control evaluation across organizational processes, ensuring compliance and operational efficiency. Combining forensic data analytics with internal audit enhances overall financial oversight and strengthens fraud prevention strategies.

Connection

Forensic data analytics plays a crucial role in internal audit by enhancing fraud detection and risk assessment through the analysis of large data sets for anomalies and irregularities. Internal audit leverages forensic data analytics tools to uncover financial misstatements, compliance violations, and potential fraud schemes, thereby improving the accuracy and effectiveness of audit findings. Integrating forensic data analytics into internal audit processes strengthens organizational governance and supports regulatory compliance by providing detailed, data-driven insights.

Key Terms

**Internal audit:**

Internal audit systematically evaluates an organization's financial and operational processes to ensure compliance, risk management, and control effectiveness. It relies on data analytics to identify anomalies, enhance accuracy, and support decision-making processes. Discover how internal audit leverages advanced data techniques for improved organizational governance.

Risk assessment

Internal audit data analytics primarily targets risk assessment by examining routine financial transactions and controls to identify operational inefficiencies and compliance gaps. Forensic data analytics emphasizes detecting fraud and irregularities by analyzing suspicious patterns, anomalies, and transactional inconsistencies that may indicate criminal behavior. Explore comprehensive strategies to leverage both approaches for enhanced organizational risk management and fraud prevention.

Compliance

Internal audit uses systematic processes to ensure compliance with regulatory standards and organizational policies, identifying control weaknesses and risks. Forensic data analytics, on the other hand, employs advanced techniques such as data mining and pattern recognition to detect fraud, misconduct, and legal violations within compliance frameworks. Discover more about how these approaches enhance regulatory adherence and risk mitigation.

Source and External Links

Internal Audit - Wikipedia - Internal auditing is an independent activity designed to add value and improve an organization's operations by assessing its systems, processes, and controls.

Internal Audit 101: Everything You Need to Know - AuditBoard - This article provides a comprehensive overview of internal auditing, including its fundamentals, types, and best practices.

What is Internal Audit? Types, Value, Process & Standards - This resource explains the role of internal audit in providing unbiased reviews of systems, business organizations, and processes to enhance operational effectiveness and compliance.

dowidth.com

dowidth.com