Collaborative audit trails enhance transparency by enabling multiple stakeholders to verify and validate accounting records in real time, reducing errors and fraud risks. Artificial intelligence auditing leverages machine learning algorithms to analyze vast datasets quickly, identifying anomalies and patterns that traditional methods may overlook. Explore the evolving landscape of accounting technologies to understand how these innovations improve accuracy and efficiency.

Why it is important

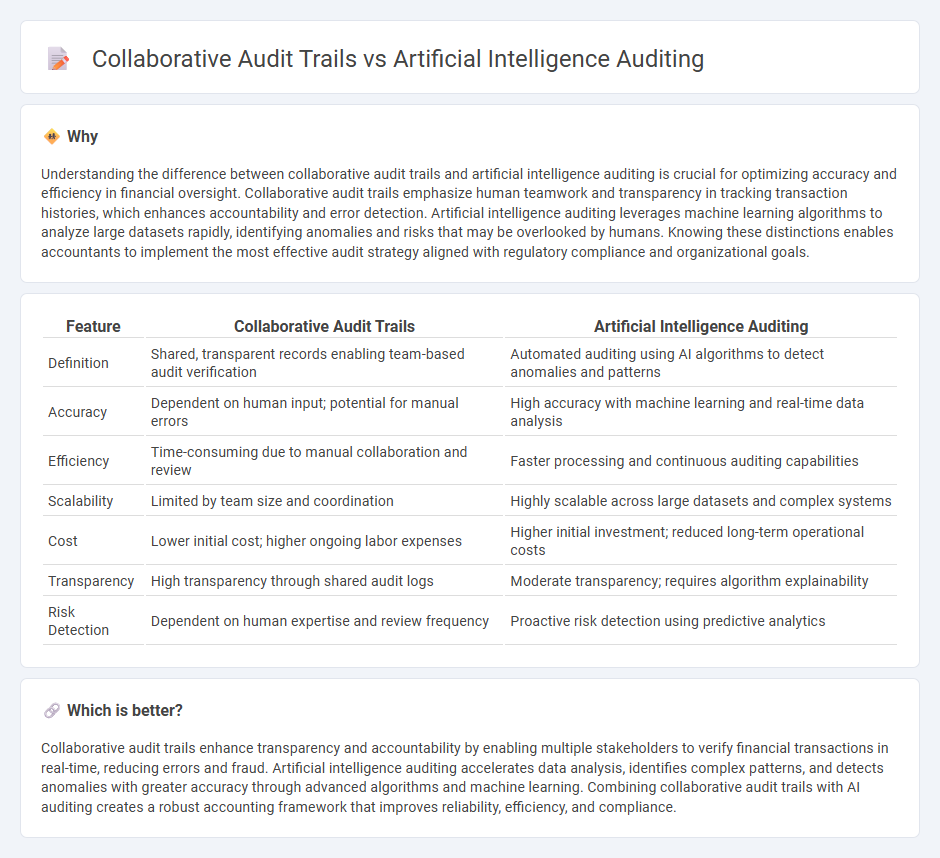

Understanding the difference between collaborative audit trails and artificial intelligence auditing is crucial for optimizing accuracy and efficiency in financial oversight. Collaborative audit trails emphasize human teamwork and transparency in tracking transaction histories, which enhances accountability and error detection. Artificial intelligence auditing leverages machine learning algorithms to analyze large datasets rapidly, identifying anomalies and risks that may be overlooked by humans. Knowing these distinctions enables accountants to implement the most effective audit strategy aligned with regulatory compliance and organizational goals.

Comparison Table

| Feature | Collaborative Audit Trails | Artificial Intelligence Auditing |

|---|---|---|

| Definition | Shared, transparent records enabling team-based audit verification | Automated auditing using AI algorithms to detect anomalies and patterns |

| Accuracy | Dependent on human input; potential for manual errors | High accuracy with machine learning and real-time data analysis |

| Efficiency | Time-consuming due to manual collaboration and review | Faster processing and continuous auditing capabilities |

| Scalability | Limited by team size and coordination | Highly scalable across large datasets and complex systems |

| Cost | Lower initial cost; higher ongoing labor expenses | Higher initial investment; reduced long-term operational costs |

| Transparency | High transparency through shared audit logs | Moderate transparency; requires algorithm explainability |

| Risk Detection | Dependent on human expertise and review frequency | Proactive risk detection using predictive analytics |

Which is better?

Collaborative audit trails enhance transparency and accountability by enabling multiple stakeholders to verify financial transactions in real-time, reducing errors and fraud. Artificial intelligence auditing accelerates data analysis, identifies complex patterns, and detects anomalies with greater accuracy through advanced algorithms and machine learning. Combining collaborative audit trails with AI auditing creates a robust accounting framework that improves reliability, efficiency, and compliance.

Connection

Collaborative audit trails enhance transparency and data accuracy by enabling multiple stakeholders to contribute and verify financial records in real-time, creating a robust foundation for artificial intelligence auditing systems. AI auditing leverages these comprehensive, accurate audit trails to identify anomalies, trends, and compliance issues with greater precision and speed. The integration of collaborative audit trails with AI auditing optimizes risk management and decision-making processes in accounting by combining human oversight with advanced machine learning algorithms.

Key Terms

Machine Learning Algorithms

Artificial intelligence auditing ensures transparency and accountability in machine learning algorithms by systematically evaluating model performance, bias, and data integrity. Collaborative audit trails enhance this process by enabling multiple stakeholders to document, verify, and trace changes in algorithmic development and deployment, fostering trust and compliance. Explore how integrating AI auditing with collaborative audit trails can optimize machine learning governance and reliability.

Blockchain Ledger

Artificial intelligence auditing leverages machine learning algorithms to analyze vast datasets within blockchain ledgers, identifying anomalies and enhancing fraud detection with unparalleled accuracy. Collaborative audit trails in blockchain ensure transparent, immutable records by enabling multiple stakeholders to verify transactions, fostering trust and accountability across decentralized networks. Explore how these technologies revolutionize blockchain ledger security and compliance frameworks.

Real-time Data Analytics

Artificial intelligence auditing leverages machine learning algorithms to analyze vast volumes of data in real-time, identifying anomalies and ensuring compliance with higher accuracy and speed. Collaborative audit trails enable multiple stakeholders to access, verify, and update records simultaneously, enhancing transparency and accountability within the audit process. Explore how integrating these technologies can revolutionize real-time data analytics for more efficient and reliable audits.

Source and External Links

What is AI Auditing ? Where to Start - AI auditing evaluates whether an AI system complies with legal, ethical, and security standards by examining its data output, algorithms, and usage, helping companies ensure transparency and regulatory compliance while detecting biases and risks within AI models.

AI Auditing Checklist for AI Auditing - AI audits inspect AI systems to assess impacts, compliance, and safety mechanisms, providing transparency, accountability, and documentation that supports regulators, developers, and users in managing risks and ensuring ethical AI deployment.

5 AI Auditing Frameworks to Encourage Accountability - AI auditing frameworks help organizations manage the entire AI lifecycle to reduce risks such as bias and misuse, integrating AI audibility into internal audit processes to ensure governance, regulatory compliance, and ethical AI development.

dowidth.com

dowidth.com