Collaborative audit trails leverage real-time data sharing and decentralized verification, enhancing transparency and reducing errors compared to traditional audit trails, which rely on sequential, siloed record-keeping. This advancement supports improved compliance, faster issue resolution, and stronger fraud detection by integrating multiple stakeholders' inputs. Discover how adopting collaborative audit trails can revolutionize financial oversight and accuracy.

Why it is important

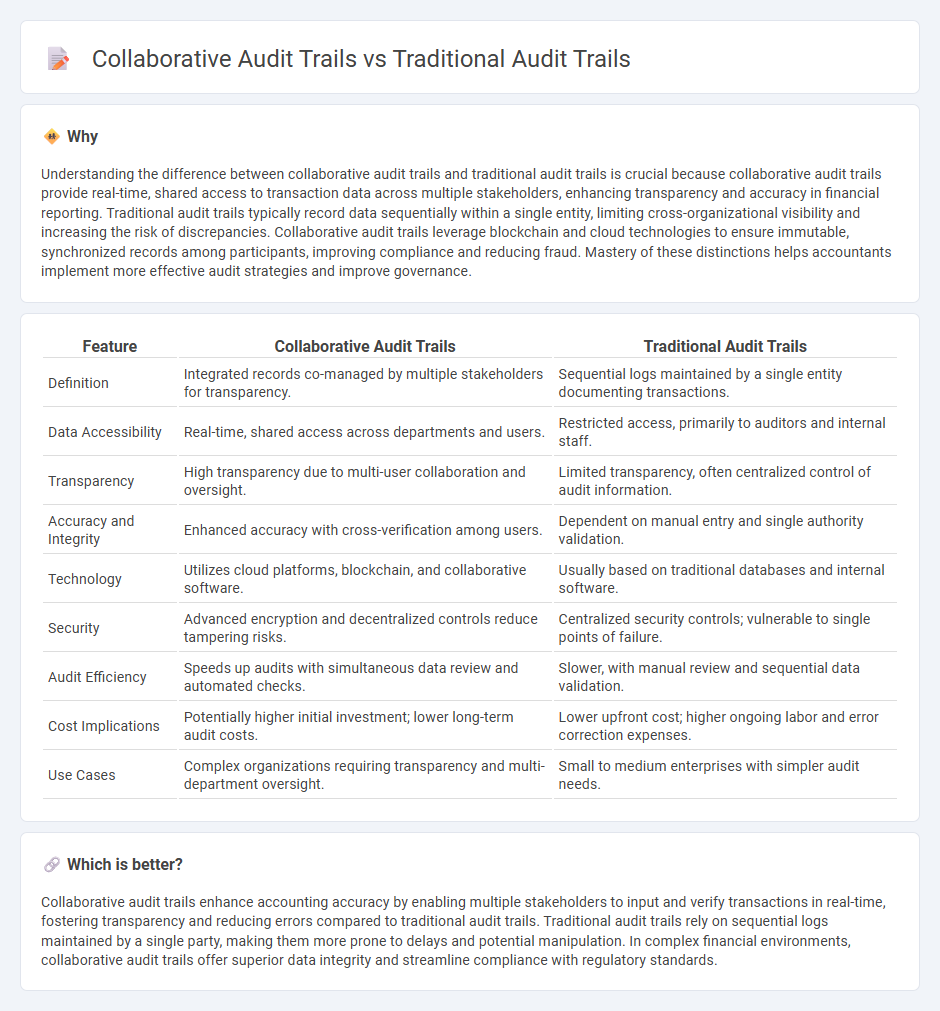

Understanding the difference between collaborative audit trails and traditional audit trails is crucial because collaborative audit trails provide real-time, shared access to transaction data across multiple stakeholders, enhancing transparency and accuracy in financial reporting. Traditional audit trails typically record data sequentially within a single entity, limiting cross-organizational visibility and increasing the risk of discrepancies. Collaborative audit trails leverage blockchain and cloud technologies to ensure immutable, synchronized records among participants, improving compliance and reducing fraud. Mastery of these distinctions helps accountants implement more effective audit strategies and improve governance.

Comparison Table

| Feature | Collaborative Audit Trails | Traditional Audit Trails |

|---|---|---|

| Definition | Integrated records co-managed by multiple stakeholders for transparency. | Sequential logs maintained by a single entity documenting transactions. |

| Data Accessibility | Real-time, shared access across departments and users. | Restricted access, primarily to auditors and internal staff. |

| Transparency | High transparency due to multi-user collaboration and oversight. | Limited transparency, often centralized control of audit information. |

| Accuracy and Integrity | Enhanced accuracy with cross-verification among users. | Dependent on manual entry and single authority validation. |

| Technology | Utilizes cloud platforms, blockchain, and collaborative software. | Usually based on traditional databases and internal software. |

| Security | Advanced encryption and decentralized controls reduce tampering risks. | Centralized security controls; vulnerable to single points of failure. |

| Audit Efficiency | Speeds up audits with simultaneous data review and automated checks. | Slower, with manual review and sequential data validation. |

| Cost Implications | Potentially higher initial investment; lower long-term audit costs. | Lower upfront cost; higher ongoing labor and error correction expenses. |

| Use Cases | Complex organizations requiring transparency and multi-department oversight. | Small to medium enterprises with simpler audit needs. |

Which is better?

Collaborative audit trails enhance accounting accuracy by enabling multiple stakeholders to input and verify transactions in real-time, fostering transparency and reducing errors compared to traditional audit trails. Traditional audit trails rely on sequential logs maintained by a single party, making them more prone to delays and potential manipulation. In complex financial environments, collaborative audit trails offer superior data integrity and streamline compliance with regulatory standards.

Connection

Collaborative audit trails integrate multiple stakeholders' inputs to enhance transparency and accuracy, complementing traditional audit trails that record sequential transactional data within accounting systems. Both types of audit trails are essential for ensuring compliance, detecting discrepancies, and maintaining the integrity of financial records. The synergy between collaborative and traditional audit trails strengthens audit accountability and supports comprehensive financial reporting in accounting practices.

Key Terms

Recordkeeping

Traditional audit trails rely on centralized recordkeeping, ensuring a sequential log of transactions maintained by a single authority, which can limit transparency and accessibility. Collaborative audit trails utilize decentralized technologies like blockchain to create immutable, distributed records accessible to multiple stakeholders, enhancing trust and data integrity in recordkeeping. Explore the advantages of collaborative audit trails for a more transparent and secure recordkeeping system.

Transparency

Traditional audit trails provide a chronological record of individual actions within a system but often lack real-time visibility and collaborative input, limiting transparency. Collaborative audit trails integrate multiple stakeholders' inputs, enabling shared access to audit records and enhancing accountability through transparent communication and continuous updates. Explore how collaborative audit trails revolutionize transparency in auditing processes.

Real-time Updates

Traditional audit trails typically record transactions sequentially, leading to delayed updates and limited visibility in real time. Collaborative audit trails leverage cloud-based platforms and blockchain technology to enable instantaneous data synchronization, enhancing transparency and accuracy across multiple users. Explore how real-time updates in collaborative audit trails transform auditing efficiency and decision-making.

Source and External Links

The pitfalls of traditional databases: Audit and Compliance - Traditional audit trails often rely on separate history or audit tables that developers must manually update, which can lead to errors, inconsistencies, and vulnerabilities such as unauthorized data manipulation, compromising the audit trail's integrity and reliability.

NIST SP 800-12: Chapter 18 - Audit Trails - Traditional audit trails are typically analyzed in batch at regular intervals and serve to maintain individual accountability by recording user activities, enabling reconstruction of events, intrusion detection, and problem analysis, often by logging "before" and "after" record versions.

Oracle Auditing Part 1: Standard Auditing - In Oracle databases, traditional audit trails are enabled via the AUDIT_TRAIL parameter and can be stored in data dictionary tables or OS files, capturing audit records based on user activity, object, or privilege, though they need explicit configuration and management to maintain an effective audit trail.

dowidth.com

dowidth.com