Embedded finance reconciliation involves integrating financial services directly within operational systems to streamline transaction tracking and cash flow management, enhancing real-time visibility and accuracy. Invoice reconciliation focuses on matching invoices with payment records to ensure billing accuracy and prevent discrepancies in accounts payable and receivable. Explore the key differences and benefits of embedded finance reconciliation versus invoice reconciliation to optimize your accounting processes.

Why it is important

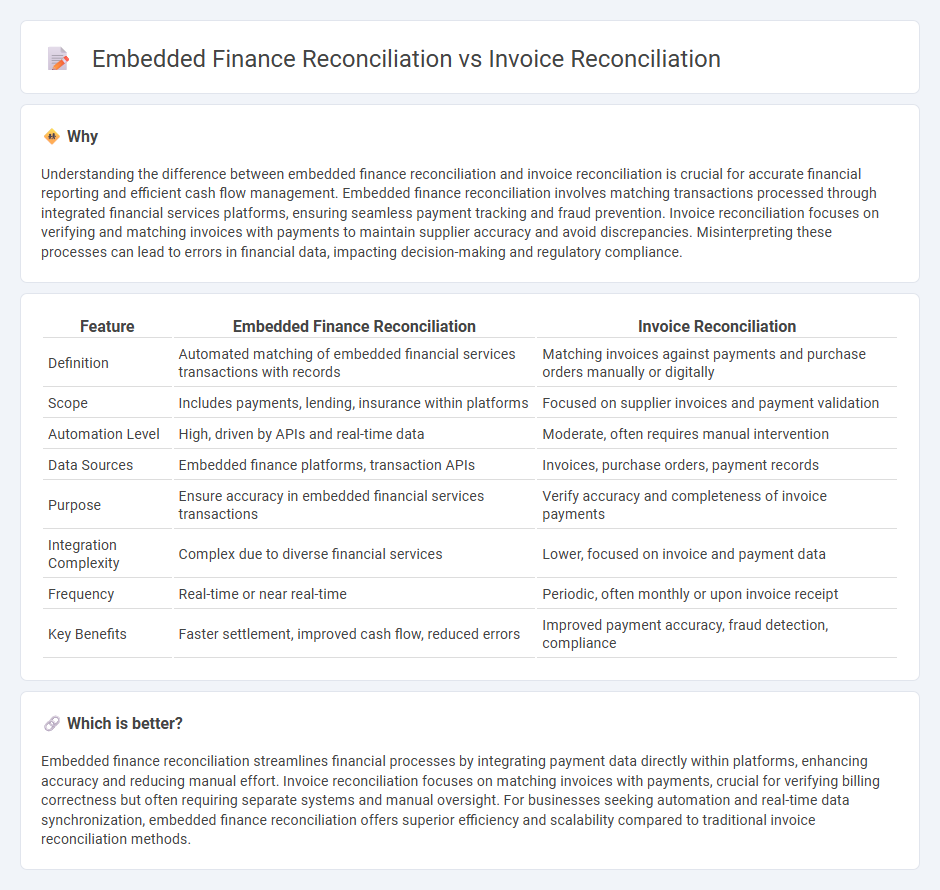

Understanding the difference between embedded finance reconciliation and invoice reconciliation is crucial for accurate financial reporting and efficient cash flow management. Embedded finance reconciliation involves matching transactions processed through integrated financial services platforms, ensuring seamless payment tracking and fraud prevention. Invoice reconciliation focuses on verifying and matching invoices with payments to maintain supplier accuracy and avoid discrepancies. Misinterpreting these processes can lead to errors in financial data, impacting decision-making and regulatory compliance.

Comparison Table

| Feature | Embedded Finance Reconciliation | Invoice Reconciliation |

|---|---|---|

| Definition | Automated matching of embedded financial services transactions with records | Matching invoices against payments and purchase orders manually or digitally |

| Scope | Includes payments, lending, insurance within platforms | Focused on supplier invoices and payment validation |

| Automation Level | High, driven by APIs and real-time data | Moderate, often requires manual intervention |

| Data Sources | Embedded finance platforms, transaction APIs | Invoices, purchase orders, payment records |

| Purpose | Ensure accuracy in embedded financial services transactions | Verify accuracy and completeness of invoice payments |

| Integration Complexity | Complex due to diverse financial services | Lower, focused on invoice and payment data |

| Frequency | Real-time or near real-time | Periodic, often monthly or upon invoice receipt |

| Key Benefits | Faster settlement, improved cash flow, reduced errors | Improved payment accuracy, fraud detection, compliance |

Which is better?

Embedded finance reconciliation streamlines financial processes by integrating payment data directly within platforms, enhancing accuracy and reducing manual effort. Invoice reconciliation focuses on matching invoices with payments, crucial for verifying billing correctness but often requiring separate systems and manual oversight. For businesses seeking automation and real-time data synchronization, embedded finance reconciliation offers superior efficiency and scalability compared to traditional invoice reconciliation methods.

Connection

Embedded finance reconciliation streamlines payment processing by integrating financial services directly within business platforms, enabling real-time tracking of transactions. Invoice reconciliation matches incoming payments against issued invoices, ensuring accurate financial records and reducing discrepancies. Together, these processes enhance accounting accuracy by automating data synchronization and minimizing errors in transaction recording.

Key Terms

**Invoice Reconciliation:**

Invoice reconciliation entails the process of verifying and matching invoice details against purchase orders and payment records to ensure accuracy and prevent discrepancies. It involves comparing quantities, prices, and terms to identify errors or fraud, ultimately streamlining accounts payable and improving cash flow management. Explore more about how invoice reconciliation drives financial accuracy and operational efficiency.

Accounts Payable

Invoice reconciliation in Accounts Payable involves matching purchase orders, invoices, and payment details to ensure accurate payment processing and avoid discrepancies. Embedded finance reconciliation streamlines this process by integrating financial services directly into business platforms, enhancing real-time payment validation and automated ledger updates. Explore how embedding finance can optimize your Accounts Payable reconciliation for improved efficiency and reduced errors.

Purchase Order Matching

Invoice reconciliation involves verifying that invoices correspond accurately with purchase orders and received goods or services to ensure payment accuracy. Embedded finance reconciliation integrates financial services within procurement platforms, automating purchase order matching and payment processes to streamline operations and reduce errors. Explore how purchase order matching enhances efficiency in both invoice and embedded finance reconciliation for more insights.

Source and External Links

What Is Invoice Reconciliation & How To Reconcile ... - Invoice reconciliation is a process where an accountant ensures each invoice matches purchase orders and payments by gathering invoices, matching them to the general ledger, identifying and resolving discrepancies, authorizing payments, and archiving records to maintain accurate financial records.

What Is Invoice Reconciliation And Why Is It Important? - altLINE - This process involves reviewing invoices, matching them with purchase orders or delivery receipts, checking for discrepancies such as price or quantity differences, and resolving any issues to ensure bills are accurate before payment.

Invoice reconciliation: What businesses should know - Best practices for invoice reconciliation include conducting regular reconciliations, establishing clear standardized procedures, and using methods like three-way matching--comparing invoices, purchase orders, and receiving reports--to verify that billed items were actually ordered and received.

dowidth.com

dowidth.com