Ledger tokenization transforms traditional financial records into secure, blockchain-based digital assets, enhancing transparency and traceability in accounting processes. Private equity digitization streamlines investment management by converting ownership stakes into digital shares, improving liquidity and efficiency within private markets. Explore further to understand how these innovations are reshaping modern accounting practices.

Why it is important

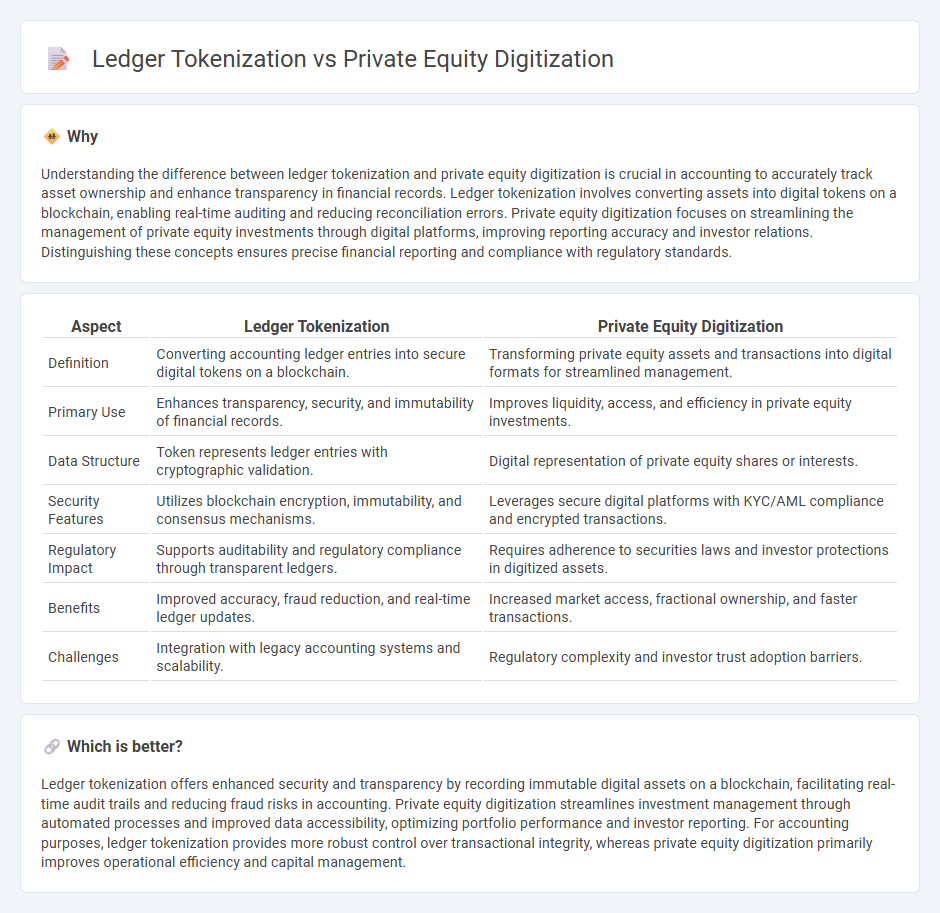

Understanding the difference between ledger tokenization and private equity digitization is crucial in accounting to accurately track asset ownership and enhance transparency in financial records. Ledger tokenization involves converting assets into digital tokens on a blockchain, enabling real-time auditing and reducing reconciliation errors. Private equity digitization focuses on streamlining the management of private equity investments through digital platforms, improving reporting accuracy and investor relations. Distinguishing these concepts ensures precise financial reporting and compliance with regulatory standards.

Comparison Table

| Aspect | Ledger Tokenization | Private Equity Digitization |

|---|---|---|

| Definition | Converting accounting ledger entries into secure digital tokens on a blockchain. | Transforming private equity assets and transactions into digital formats for streamlined management. |

| Primary Use | Enhances transparency, security, and immutability of financial records. | Improves liquidity, access, and efficiency in private equity investments. |

| Data Structure | Token represents ledger entries with cryptographic validation. | Digital representation of private equity shares or interests. |

| Security Features | Utilizes blockchain encryption, immutability, and consensus mechanisms. | Leverages secure digital platforms with KYC/AML compliance and encrypted transactions. |

| Regulatory Impact | Supports auditability and regulatory compliance through transparent ledgers. | Requires adherence to securities laws and investor protections in digitized assets. |

| Benefits | Improved accuracy, fraud reduction, and real-time ledger updates. | Increased market access, fractional ownership, and faster transactions. |

| Challenges | Integration with legacy accounting systems and scalability. | Regulatory complexity and investor trust adoption barriers. |

Which is better?

Ledger tokenization offers enhanced security and transparency by recording immutable digital assets on a blockchain, facilitating real-time audit trails and reducing fraud risks in accounting. Private equity digitization streamlines investment management through automated processes and improved data accessibility, optimizing portfolio performance and investor reporting. For accounting purposes, ledger tokenization provides more robust control over transactional integrity, whereas private equity digitization primarily improves operational efficiency and capital management.

Connection

Ledger tokenization enhances private equity digitization by converting ownership stakes into secure, tradable digital tokens on a blockchain, improving transparency and liquidity. This connection facilitates real-time transaction settlements and automated compliance through smart contracts, streamlining traditional private equity processes. Tokenized ledgers reduce administrative costs and enable fractional ownership, thereby expanding access to private equity markets.

Key Terms

Digital Securities

Private equity digitization transforms traditional ownership records into digital formats, enhancing transparency and efficiency by leveraging blockchain technology. Ledger tokenization represents private equity interests as security tokens on distributed ledgers, enabling fractional ownership, faster settlements, and increased liquidity. Explore how digital securities revolutionize private equity through secure, compliant, and accessible investment opportunities.

Smart Contracts

Private equity digitization enhances transaction efficiency by leveraging blockchain technology to streamline asset management and investor reporting. Ledger tokenization transforms private equity shares into digital tokens, enabling fractional ownership and improved liquidity through smart contracts that automate compliance and distribution processes. Explore further to understand how smart contracts revolutionize private equity by combining digitization and tokenization for seamless investment experiences.

Distributed Ledger Technology (DLT)

Private equity digitization leverages Distributed Ledger Technology (DLT) to streamline investment processes, enhance transparency, and improve asset management efficiency by converting traditional equity records into secure, immutable digital formats. Ledger tokenization, a subset of DLT, represents private equity shares as digital tokens on blockchain networks, enabling fractional ownership, faster settlement, and increased liquidity. Explore the transformative impact of DLT on private equity through comprehensive insights and innovative use cases.

Source and External Links

The Digital Transformation and AI Revolution in Private Equity - This article discusses how digital transformation and AI are transforming private equity firms, enhancing decision-making and operational efficiency through advanced analytics and machine learning.

Private Equity Is Ripe for Digital Transformation - This article highlights the importance of digitalization in private equity, noting its role in investment decisions and value creation across portfolio companies.

Fundamentals of Private Equity Digital Transformation - This blog post outlines best practices for private equity firms undergoing digital transformation, focusing on operational efficiency, customer experience, and accelerated growth.

dowidth.com

dowidth.com