Blockchain audit trails provide immutable and transparent records of financial transactions, enhancing accuracy and trust in accounting processes. Automated compliance reporting streamlines regulatory adherence by utilizing software to generate precise, real-time reports that reduce human error and increase efficiency. Explore the differences and benefits of these technologies to optimize your accounting practices.

Why it is important

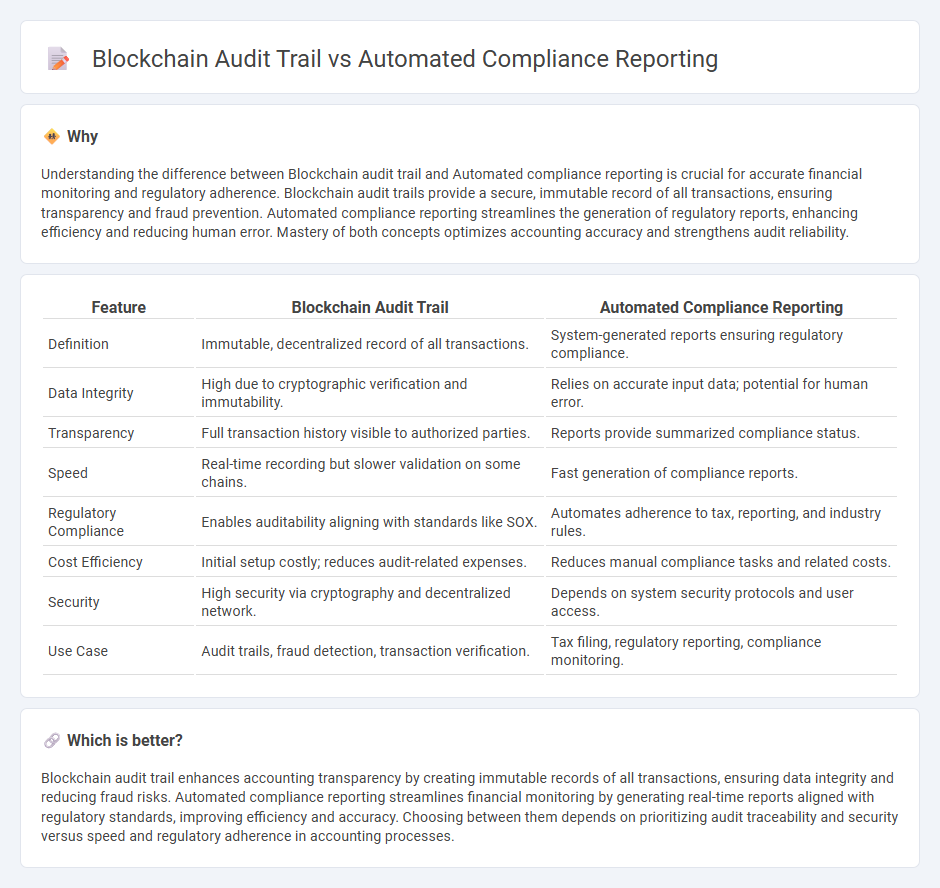

Understanding the difference between Blockchain audit trail and Automated compliance reporting is crucial for accurate financial monitoring and regulatory adherence. Blockchain audit trails provide a secure, immutable record of all transactions, ensuring transparency and fraud prevention. Automated compliance reporting streamlines the generation of regulatory reports, enhancing efficiency and reducing human error. Mastery of both concepts optimizes accounting accuracy and strengthens audit reliability.

Comparison Table

| Feature | Blockchain Audit Trail | Automated Compliance Reporting |

|---|---|---|

| Definition | Immutable, decentralized record of all transactions. | System-generated reports ensuring regulatory compliance. |

| Data Integrity | High due to cryptographic verification and immutability. | Relies on accurate input data; potential for human error. |

| Transparency | Full transaction history visible to authorized parties. | Reports provide summarized compliance status. |

| Speed | Real-time recording but slower validation on some chains. | Fast generation of compliance reports. |

| Regulatory Compliance | Enables auditability aligning with standards like SOX. | Automates adherence to tax, reporting, and industry rules. |

| Cost Efficiency | Initial setup costly; reduces audit-related expenses. | Reduces manual compliance tasks and related costs. |

| Security | High security via cryptography and decentralized network. | Depends on system security protocols and user access. |

| Use Case | Audit trails, fraud detection, transaction verification. | Tax filing, regulatory reporting, compliance monitoring. |

Which is better?

Blockchain audit trail enhances accounting transparency by creating immutable records of all transactions, ensuring data integrity and reducing fraud risks. Automated compliance reporting streamlines financial monitoring by generating real-time reports aligned with regulatory standards, improving efficiency and accuracy. Choosing between them depends on prioritizing audit traceability and security versus speed and regulatory adherence in accounting processes.

Connection

Blockchain audit trails enhance transparency and immutability in accounting records by providing a decentralized ledger that records every transaction securely and chronologically. Automated compliance reporting leverages these tamper-proof audit trails to generate accurate, real-time regulatory reports, reducing errors and ensuring adherence to accounting standards. Together, they streamline financial audits and regulatory compliance by integrating secure data verification with efficient report automation.

Key Terms

Automated compliance reporting:

Automated compliance reporting leverages advanced software to systematically collect, analyze, and submit regulatory data, ensuring accuracy and timely adherence to legal standards across industries. This technology reduces human error and accelerates the reporting process by integrating real-time data monitoring with compliance frameworks such as GDPR, SOX, or HIPAA. Explore the latest advancements in automated compliance reporting and how they revolutionize regulatory adherence.

Regulatory standards

Automated compliance reporting streamlines data aggregation and ensures adherence to regulatory standards such as GDPR, SOX, and HIPAA by generating real-time, accurate reports. Blockchain audit trails provide immutable, transparent records that enhance trust and facilitate verification processes mandated by regulatory bodies like the SEC and FCA. Explore how these technologies transform compliance frameworks and audit practices in detail.

Data validation

Automated compliance reporting leverages AI algorithms to efficiently validate data accuracy and regulatory adherence in real time, reducing human error and accelerating audit processes. Blockchain audit trails provide immutable, timestamped records of transactions, ensuring data integrity and transparency for enhanced trustworthiness in compliance verification. Explore the detailed benefits of data validation techniques in these technologies to optimize your organization's compliance strategy.

Source and External Links

Automated Compliance Reporting - Automated compliance reporting uses advanced software with components like regulatory databases, workflow automation, real-time reporting, and alerting mechanisms to streamline adherence to laws and regulations across jurisdictions, enabling efficient, accurate, and timely compliance management.

How Automated Compliance Reporting Can Save ... - ARMS - Automated compliance reporting reduces errors, saves administrative time, improves audit readiness, and helps agencies avoid costly fines by leveraging pre-configured workflows, real-time validation, and status tracking, resulting in significant cost and efficiency benefits.

Compliance Automation: How It Works and How to ... - Compliance automation employs technology and AI to streamline compliance tasks like data monitoring, reporting, and audit preparation, reducing manual effort and errors while ensuring continuous compliance, regulatory adaptability, and centralized audit-ready documentation.

dowidth.com

dowidth.com