Algorithmic compliance employs automated systems and predefined rules to ensure adherence to accounting standards with precision and efficiency. Principles-based compliance focuses on the application of broad accounting concepts and professional judgment to interpret regulations in varying contexts. Explore the advantages and challenges of both approaches to understand their impact on modern accounting practices.

Why it is important

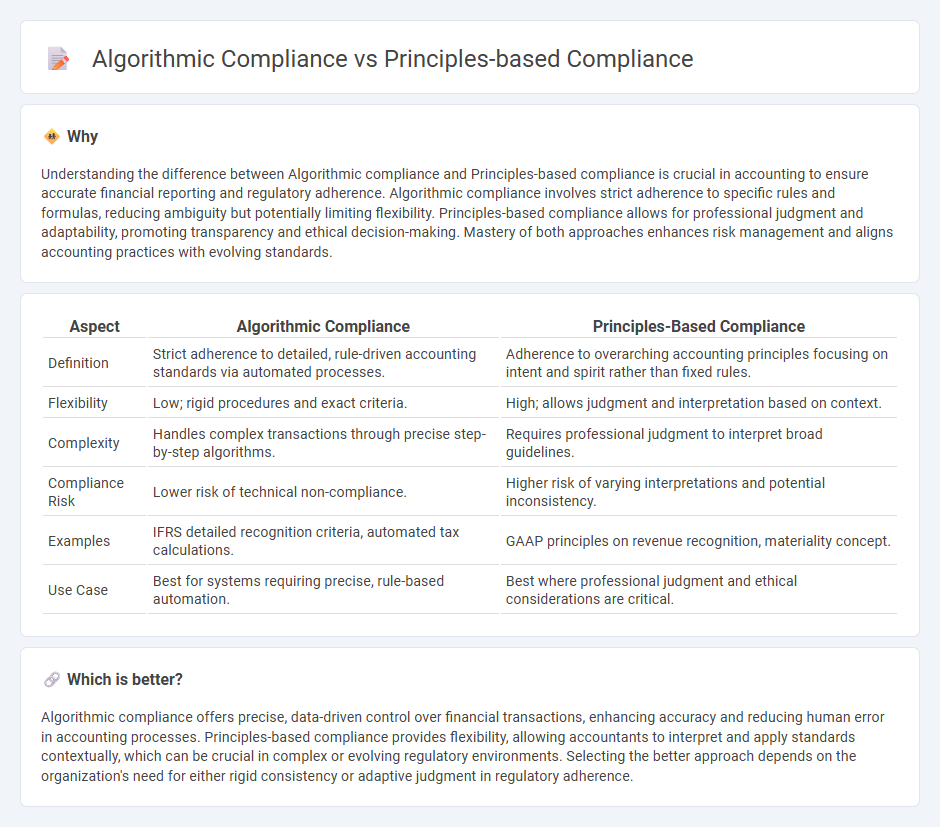

Understanding the difference between Algorithmic compliance and Principles-based compliance is crucial in accounting to ensure accurate financial reporting and regulatory adherence. Algorithmic compliance involves strict adherence to specific rules and formulas, reducing ambiguity but potentially limiting flexibility. Principles-based compliance allows for professional judgment and adaptability, promoting transparency and ethical decision-making. Mastery of both approaches enhances risk management and aligns accounting practices with evolving standards.

Comparison Table

| Aspect | Algorithmic Compliance | Principles-Based Compliance |

|---|---|---|

| Definition | Strict adherence to detailed, rule-driven accounting standards via automated processes. | Adherence to overarching accounting principles focusing on intent and spirit rather than fixed rules. |

| Flexibility | Low; rigid procedures and exact criteria. | High; allows judgment and interpretation based on context. |

| Complexity | Handles complex transactions through precise step-by-step algorithms. | Requires professional judgment to interpret broad guidelines. |

| Compliance Risk | Lower risk of technical non-compliance. | Higher risk of varying interpretations and potential inconsistency. |

| Examples | IFRS detailed recognition criteria, automated tax calculations. | GAAP principles on revenue recognition, materiality concept. |

| Use Case | Best for systems requiring precise, rule-based automation. | Best where professional judgment and ethical considerations are critical. |

Which is better?

Algorithmic compliance offers precise, data-driven control over financial transactions, enhancing accuracy and reducing human error in accounting processes. Principles-based compliance provides flexibility, allowing accountants to interpret and apply standards contextually, which can be crucial in complex or evolving regulatory environments. Selecting the better approach depends on the organization's need for either rigid consistency or adaptive judgment in regulatory adherence.

Connection

Algorithmic compliance leverages automated systems to ensure adherence to accounting standards, while principles-based compliance emphasizes interpretation and judgment aligned with overarching accounting principles. Both approaches intersect by integrating technology with professional discretion to enhance accuracy and reliability in financial reporting. This connection supports dynamic, real-time compliance with evolving accounting regulations and standards.

Key Terms

Judgment

Principles-based compliance emphasizes the use of professional judgment and flexible interpretation of regulatory standards to adapt to complex, evolving scenarios, whereas algorithmic compliance relies on rigid, rule-based automated systems to ensure adherence through predefined criteria. This approach fosters a deeper understanding of ethical implications and context-specific decisions, enhancing risk management and organizational integrity. Explore how leveraging judgment within compliance frameworks can transform regulatory adherence strategies.

Flexibility

Principles-based compliance emphasizes flexibility by allowing organizations to interpret and apply regulatory guidelines based on their specific context, promoting innovation and adaptability in dynamic markets. Algorithmic compliance relies on predefined, rigid rules and automated checks to ensure consistent adherence, which can limit responsiveness to unique situations. Explore deeper insights into how flexibility impacts compliance strategies and organizational effectiveness.

Standardization

Principles-based compliance emphasizes flexibility by allowing organizations to interpret and apply broad regulatory standards tailored to specific contexts, while algorithmic compliance relies on standardized rules encoded into automated systems to ensure consistent enforcement. Embracing standardization through algorithmic compliance enhances efficiency, reduces human error, and facilitates real-time monitoring across industries such as finance and healthcare. Explore how integrating principles-based insights with algorithmic standardization can transform your compliance strategy.

Source and External Links

Regulatory Law: Principles-Based Approach - This article explores how the principles-based approach offers flexibility and promotes responsible behavior in regulatory contexts.

Build A Culture of Compliance Through Principle-Based Policy Governance - This white paper discusses adopting principle-based policy governance to streamline policy creation and build a compliance culture.

Making the Shift to Principles-Based Compliance Programs - This article highlights how principles-based compliance programs empower organizations to make ethical decisions and address emerging risks.

dowidth.com

dowidth.com