Predictive close in accounting uses data analytics and machine learning algorithms to forecast and streamline the financial closing process, minimizing errors and improving accuracy. Automated close relies on software automation to execute routine closing tasks, reducing manual intervention and accelerating cycle times. Explore how combining predictive and automated close techniques can optimize your financial reporting efficiency.

Why it is important

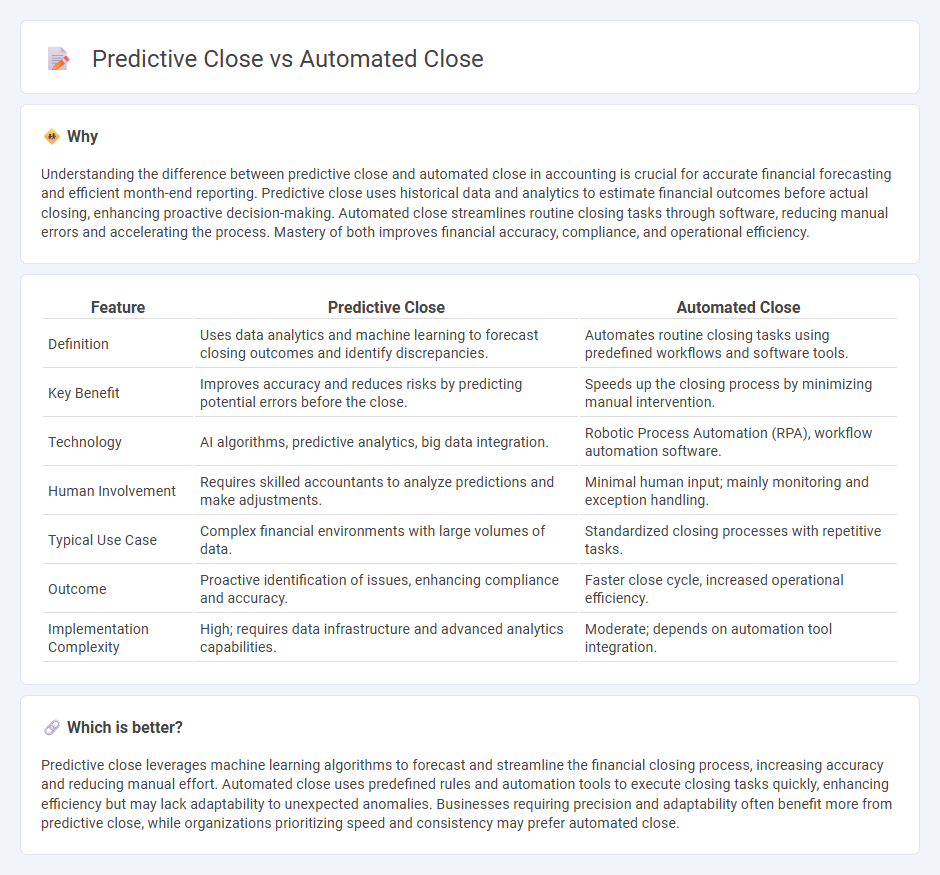

Understanding the difference between predictive close and automated close in accounting is crucial for accurate financial forecasting and efficient month-end reporting. Predictive close uses historical data and analytics to estimate financial outcomes before actual closing, enhancing proactive decision-making. Automated close streamlines routine closing tasks through software, reducing manual errors and accelerating the process. Mastery of both improves financial accuracy, compliance, and operational efficiency.

Comparison Table

| Feature | Predictive Close | Automated Close |

|---|---|---|

| Definition | Uses data analytics and machine learning to forecast closing outcomes and identify discrepancies. | Automates routine closing tasks using predefined workflows and software tools. |

| Key Benefit | Improves accuracy and reduces risks by predicting potential errors before the close. | Speeds up the closing process by minimizing manual intervention. |

| Technology | AI algorithms, predictive analytics, big data integration. | Robotic Process Automation (RPA), workflow automation software. |

| Human Involvement | Requires skilled accountants to analyze predictions and make adjustments. | Minimal human input; mainly monitoring and exception handling. |

| Typical Use Case | Complex financial environments with large volumes of data. | Standardized closing processes with repetitive tasks. |

| Outcome | Proactive identification of issues, enhancing compliance and accuracy. | Faster close cycle, increased operational efficiency. |

| Implementation Complexity | High; requires data infrastructure and advanced analytics capabilities. | Moderate; depends on automation tool integration. |

Which is better?

Predictive close leverages machine learning algorithms to forecast and streamline the financial closing process, increasing accuracy and reducing manual effort. Automated close uses predefined rules and automation tools to execute closing tasks quickly, enhancing efficiency but may lack adaptability to unexpected anomalies. Businesses requiring precision and adaptability often benefit more from predictive close, while organizations prioritizing speed and consistency may prefer automated close.

Connection

Predictive close uses historical accounting data and machine learning algorithms to forecast potential issues and accelerate the financial close process. Automated close leverages software automation to streamline repetitive tasks such as reconciliations and journal entries, reducing manual errors and cycle time. Together, they enhance the efficiency and accuracy of the accounting close by combining foresight with operational automation.

Key Terms

Workflow automation

Automated close leverages predefined rules and software to streamline and expedite the closing process in workflow automation, reducing manual tasks and errors. Predictive close uses AI-driven analytics to forecast the optimal timing and conditions for closing deals, enhancing decision-making and efficiency within automated workflows. Explore the benefits and best practices of integrating these technologies to optimize your sales and operational processes.

Machine learning analytics

Automated close leverages machine learning to streamline sales processes by automatically identifying ideal moments to finalize deals based on historical data patterns. Predictive close utilizes advanced analytics to forecast buyer behavior and optimal closing strategies, enhancing the accuracy of sales timing. Explore these cutting-edge machine learning applications to elevate your sales performance and close rates.

Real-time reconciliation

Automated close streamlines financial statement finalization through real-time reconciliation, reducing manual errors and accelerating the month-end close process. Predictive close leverages AI and machine learning to forecast potential discrepancies and optimize reconciliation flows before actual close, enhancing accuracy and efficiency. Explore how integrating these technologies can transform your financial operations with faster, error-free closes.

Source and External Links

The Power of Autonomous Financial Close - Autonomous financial close automates transaction entries, reconciliations, data consolidation, and reporting throughout the month, enabling faster, more accurate, and continuous financial close processes with human roles shifting to review rather than manual data entry.

Accelerate the Automated Close (Oracle) - Automated close uses cloud technology, machine learning, and intelligent process automation to speed up closing the books, reduce manual tasks, and enhance financial insights through continuous data flow and advanced analytics.

AI-Powered Financial Close Software (DOKKA) - Financial close automation software like DOKKA streamlines closing financial books by automating reconciliation, journal entries, report generation, and integrating with existing systems to increase efficiency and reduce errors.

dowidth.com

dowidth.com