Forensic analytics focuses on detecting and investigating financial fraud, employing data analysis techniques to uncover irregularities and suspicious transactions. Operational review evaluates business processes and financial performance to enhance efficiency and ensure compliance with internal controls. Explore the key differences and applications of forensic analytics and operational review to strengthen your accounting strategies.

Why it is important

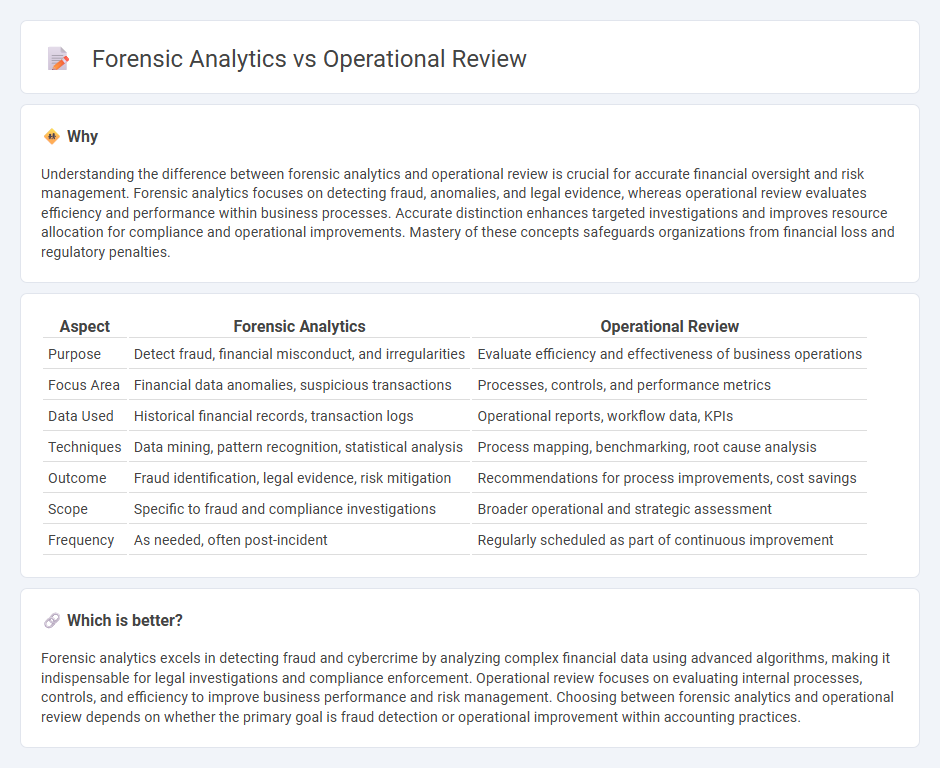

Understanding the difference between forensic analytics and operational review is crucial for accurate financial oversight and risk management. Forensic analytics focuses on detecting fraud, anomalies, and legal evidence, whereas operational review evaluates efficiency and performance within business processes. Accurate distinction enhances targeted investigations and improves resource allocation for compliance and operational improvements. Mastery of these concepts safeguards organizations from financial loss and regulatory penalties.

Comparison Table

| Aspect | Forensic Analytics | Operational Review |

|---|---|---|

| Purpose | Detect fraud, financial misconduct, and irregularities | Evaluate efficiency and effectiveness of business operations |

| Focus Area | Financial data anomalies, suspicious transactions | Processes, controls, and performance metrics |

| Data Used | Historical financial records, transaction logs | Operational reports, workflow data, KPIs |

| Techniques | Data mining, pattern recognition, statistical analysis | Process mapping, benchmarking, root cause analysis |

| Outcome | Fraud identification, legal evidence, risk mitigation | Recommendations for process improvements, cost savings |

| Scope | Specific to fraud and compliance investigations | Broader operational and strategic assessment |

| Frequency | As needed, often post-incident | Regularly scheduled as part of continuous improvement |

Which is better?

Forensic analytics excels in detecting fraud and cybercrime by analyzing complex financial data using advanced algorithms, making it indispensable for legal investigations and compliance enforcement. Operational review focuses on evaluating internal processes, controls, and efficiency to improve business performance and risk management. Choosing between forensic analytics and operational review depends on whether the primary goal is fraud detection or operational improvement within accounting practices.

Connection

Forensic analytics leverages data analysis techniques to detect financial fraud and irregularities within accounting records. Operational review assesses internal processes and controls to identify inefficiencies and risks impacting financial accuracy. Combining forensic analytics with operational review enhances the detection of discrepancies and strengthens organizational financial integrity through improved control systems.

Key Terms

**Operational review:**

Operational review involves systematically evaluating business processes and performance metrics to identify inefficiencies, compliance gaps, and opportunities for improvement. It utilizes data analytics and performance indicators to enhance internal controls, streamline operations, and ensure alignment with organizational objectives. Explore in-depth methodologies and best practices to optimize your operational review processes.

Efficiency

Operational review evaluates business processes and performance metrics to identify inefficiencies and optimize resource allocation, enhancing overall operational efficiency. Forensic analytics examines financial data to detect fraud, irregularities, and compliance breaches that can cause financial losses and operational disruptions. Explore further to understand how these methods uniquely improve organizational efficiency and risk management.

Internal controls

Operational review assesses the effectiveness and efficiency of an organization's internal controls to ensure smooth business processes and risk mitigation. Forensic analytics delves deeper into transaction data to detect anomalies, fraud, or compliance breaches, providing detailed insights into control weaknesses. Explore more to understand how these approaches strengthen your internal control framework.

Source and External Links

How to carry out an Operational Review - An operational review is a structured process involving six key steps, from initial management meetings to identify issues, through data collection and analysis, to the presentation of a final report with actionable recommendations.

What are Operational Reviews - An operational review is an in-depth, objective assessment of an organization's day-to-day functions, designed to identify operational weaknesses, evaluate compliance with internal procedures, and uncover opportunities to improve efficiency, reduce costs, and enhance profitability.

Strategy Reviews vs. Operational Reviews - Unlike strategy reviews that focus on long-term goals and progress, operational reviews concentrate on the immediate effectiveness of processes, communication, and procedures to ensure the business runs smoothly and addresses current challenges.

dowidth.com

dowidth.com