Forensic analytics employs advanced data examination techniques to detect fraud, misconduct, and financial discrepancies within accounting records, focusing on legal and investigative contexts. Financial analysis evaluates an organization's financial health through ratio analysis, trend evaluation, and forecasting to inform investment and business decisions. Discover more to understand how these distinct methods enhance accuracy and integrity in financial reporting.

Why it is important

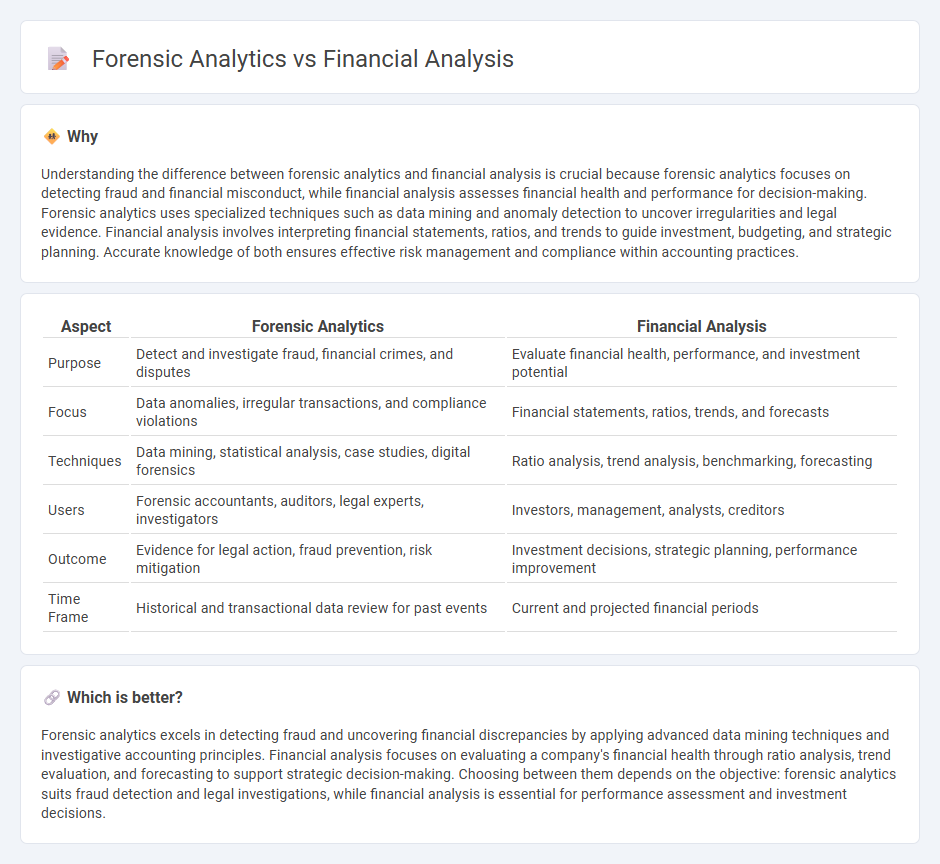

Understanding the difference between forensic analytics and financial analysis is crucial because forensic analytics focuses on detecting fraud and financial misconduct, while financial analysis assesses financial health and performance for decision-making. Forensic analytics uses specialized techniques such as data mining and anomaly detection to uncover irregularities and legal evidence. Financial analysis involves interpreting financial statements, ratios, and trends to guide investment, budgeting, and strategic planning. Accurate knowledge of both ensures effective risk management and compliance within accounting practices.

Comparison Table

| Aspect | Forensic Analytics | Financial Analysis |

|---|---|---|

| Purpose | Detect and investigate fraud, financial crimes, and disputes | Evaluate financial health, performance, and investment potential |

| Focus | Data anomalies, irregular transactions, and compliance violations | Financial statements, ratios, trends, and forecasts |

| Techniques | Data mining, statistical analysis, case studies, digital forensics | Ratio analysis, trend analysis, benchmarking, forecasting |

| Users | Forensic accountants, auditors, legal experts, investigators | Investors, management, analysts, creditors |

| Outcome | Evidence for legal action, fraud prevention, risk mitigation | Investment decisions, strategic planning, performance improvement |

| Time Frame | Historical and transactional data review for past events | Current and projected financial periods |

Which is better?

Forensic analytics excels in detecting fraud and uncovering financial discrepancies by applying advanced data mining techniques and investigative accounting principles. Financial analysis focuses on evaluating a company's financial health through ratio analysis, trend evaluation, and forecasting to support strategic decision-making. Choosing between them depends on the objective: forensic analytics suits fraud detection and legal investigations, while financial analysis is essential for performance assessment and investment decisions.

Connection

Forensic analytics and financial analysis intersect through their shared objective of examining financial data to detect irregularities and ensure accuracy. Forensic analytics applies advanced statistical techniques and data mining to identify fraudulent activities, while financial analysis evaluates financial statements to assess organizational performance and risks. Combining both approaches enhances the detection of financial crimes and supports more robust decision-making in accounting practices.

Key Terms

**Financial analysis:**

Financial analysis involves evaluating financial data, such as income statements, balance sheets, and cash flow reports, to assess a company's performance, stability, and profitability. Techniques include ratio analysis, trend analysis, and forecasting to support decision-making and strategic planning. Explore more to understand how financial analysis drives investment and business growth.

Ratio Analysis

Financial analysis employs ratio analysis to evaluate a company's overall performance, profitability, liquidity, and solvency using key financial ratios such as return on assets, current ratio, and debt-to-equity ratio. Forensic analytics uses ratio analysis to detect anomalies, irregularities, and potential fraud by scrutinizing financial ratios for inconsistencies that deviate from normal operational patterns. Explore further to understand how ratio analysis differentiates financial health assessment from forensic fraud detection.

Trend Analysis

Financial analysis primarily centers on evaluating historical financial data to identify patterns in revenue, expenses, and profitability for informed decision-making. Forensic analytics emphasizes detecting irregularities and fraudulent activities by scrutinizing financial transactions through trend analysis and anomaly detection. Explore how mastering these approaches can enhance financial oversight and fraud prevention strategies.

Source and External Links

12 Types of Financial Analysis - Financial analysis includes liquidity, solvency, profitability, and stability assessments to evaluate a company's ability to meet obligations, generate revenue, and maintain financial health over time.

Introduction to Financial Statement Analysis - Financial analysis interprets and evaluates a company's performance and position using financial reports to guide investment and credit decisions by assessing profitability, growth, and cash flow.

What is Financial Analysis? Types & Examples - Financial analysis examines income statements, balance sheets, and cash flow statements to assess profitability, liquidity, solvency, and cash management, often using horizontal analysis for performance over time.

dowidth.com

dowidth.com