Intercompany automation streamlines financial transactions and reconciliations between affiliated entities, reducing manual errors and accelerating closing processes. Accounts receivable automation enhances cash flow management by optimizing invoice generation, payment tracking, and collections through digital workflows. Explore in-depth how these automation solutions can transform your accounting operations and boost efficiency.

Why it is important

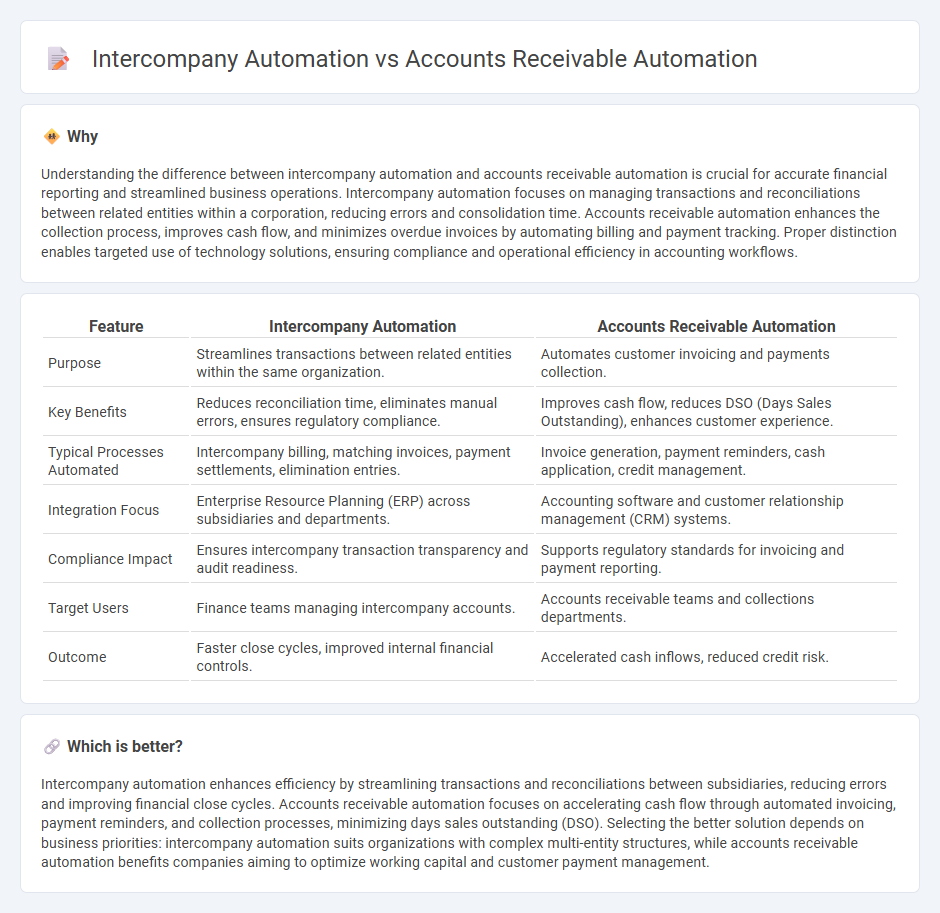

Understanding the difference between intercompany automation and accounts receivable automation is crucial for accurate financial reporting and streamlined business operations. Intercompany automation focuses on managing transactions and reconciliations between related entities within a corporation, reducing errors and consolidation time. Accounts receivable automation enhances the collection process, improves cash flow, and minimizes overdue invoices by automating billing and payment tracking. Proper distinction enables targeted use of technology solutions, ensuring compliance and operational efficiency in accounting workflows.

Comparison Table

| Feature | Intercompany Automation | Accounts Receivable Automation |

|---|---|---|

| Purpose | Streamlines transactions between related entities within the same organization. | Automates customer invoicing and payments collection. |

| Key Benefits | Reduces reconciliation time, eliminates manual errors, ensures regulatory compliance. | Improves cash flow, reduces DSO (Days Sales Outstanding), enhances customer experience. |

| Typical Processes Automated | Intercompany billing, matching invoices, payment settlements, elimination entries. | Invoice generation, payment reminders, cash application, credit management. |

| Integration Focus | Enterprise Resource Planning (ERP) across subsidiaries and departments. | Accounting software and customer relationship management (CRM) systems. |

| Compliance Impact | Ensures intercompany transaction transparency and audit readiness. | Supports regulatory standards for invoicing and payment reporting. |

| Target Users | Finance teams managing intercompany accounts. | Accounts receivable teams and collections departments. |

| Outcome | Faster close cycles, improved internal financial controls. | Accelerated cash inflows, reduced credit risk. |

Which is better?

Intercompany automation enhances efficiency by streamlining transactions and reconciliations between subsidiaries, reducing errors and improving financial close cycles. Accounts receivable automation focuses on accelerating cash flow through automated invoicing, payment reminders, and collection processes, minimizing days sales outstanding (DSO). Selecting the better solution depends on business priorities: intercompany automation suits organizations with complex multi-entity structures, while accounts receivable automation benefits companies aiming to optimize working capital and customer payment management.

Connection

Intercompany automation streamlines the reconciliation and settlement of transactions between related entities, reducing errors and accelerating financial close processes. Accounts receivable automation enhances cash flow management by automating invoice generation, payment processing, and collections, ensuring timely revenue recognition. Integrating both systems improves overall financial accuracy and efficiency by synchronizing intercompany balances with accounts receivable workflows, minimizing manual interventions and discrepancies.

Key Terms

**Accounts Receivable Automation:**

Accounts Receivable Automation streamlines the invoicing and payment collection process by using software to reduce manual data entry, enhance accuracy, and accelerate cash flow. This automation enables real-time tracking of outstanding invoices, improved customer communication, and seamless integration with accounting systems to optimize financial reporting. Explore how implementing Accounts Receivable Automation can transform your cash management and boost operational efficiency.

Invoice Processing

Accounts receivable automation streamlines invoice processing by reducing manual entry errors and accelerating payment collection through automated billing and reminders. In contrast, intercompany automation focuses on reconciling invoices between affiliated entities, ensuring accurate transaction matching and eliminating intercompany disputes. Explore how each automation type enhances invoice processing efficiency and financial accuracy.

Payment Matching

Payment matching in accounts receivable automation streamlines the reconciliation of incoming payments with outstanding invoices, reducing manual errors and accelerating cash flow management. In contrast, intercompany automation focuses on matching transactions between related entities to ensure accurate internal financial consolidation and eliminate intercompany discrepancies. Explore the benefits and best practices of payment matching technology in both domains to enhance your financial operations efficiency.

Source and External Links

Accounts Receivable (AR) Automation: A Complete Guide - AR automation streamlines invoicing, payment collection, reconciliation, and reporting to reduce errors, cut costs, and improve cash flow by automating manual steps in receivables management.

4 Ways Automation Improves Accounts Receivable - Automation improves AR by eliminating manual data entry, reducing errors, automating invoice delivery and payment matching with AI, enhancing accuracy and efficiency.

Accounts Receivable Automation: The Complete Guide - AR automation uses software to send invoices, track payments, and reconcile transactions, saving time, reducing costs, preventing errors, and improving cash flow management.

dowidth.com

dowidth.com