Payroll crypto taxation involves reporting earnings from cryptocurrency payments as taxable income, requiring accurate valuation and compliance with IRS guidelines. Payroll withholding, on the other hand, mandates employers to deduct appropriate federal, state, and local taxes from employee wages throughout the year. Explore the nuances between these payroll approaches to ensure tax compliance and optimized financial management.

Why it is important

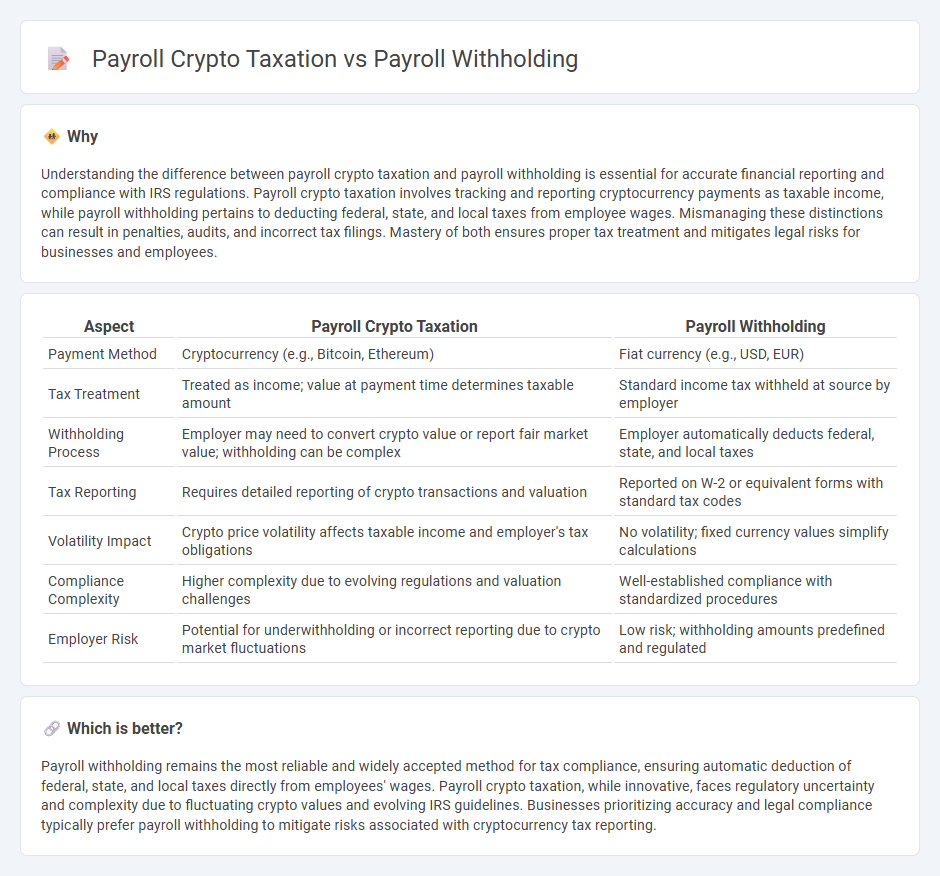

Understanding the difference between payroll crypto taxation and payroll withholding is essential for accurate financial reporting and compliance with IRS regulations. Payroll crypto taxation involves tracking and reporting cryptocurrency payments as taxable income, while payroll withholding pertains to deducting federal, state, and local taxes from employee wages. Mismanaging these distinctions can result in penalties, audits, and incorrect tax filings. Mastery of both ensures proper tax treatment and mitigates legal risks for businesses and employees.

Comparison Table

| Aspect | Payroll Crypto Taxation | Payroll Withholding |

|---|---|---|

| Payment Method | Cryptocurrency (e.g., Bitcoin, Ethereum) | Fiat currency (e.g., USD, EUR) |

| Tax Treatment | Treated as income; value at payment time determines taxable amount | Standard income tax withheld at source by employer |

| Withholding Process | Employer may need to convert crypto value or report fair market value; withholding can be complex | Employer automatically deducts federal, state, and local taxes |

| Tax Reporting | Requires detailed reporting of crypto transactions and valuation | Reported on W-2 or equivalent forms with standard tax codes |

| Volatility Impact | Crypto price volatility affects taxable income and employer's tax obligations | No volatility; fixed currency values simplify calculations |

| Compliance Complexity | Higher complexity due to evolving regulations and valuation challenges | Well-established compliance with standardized procedures |

| Employer Risk | Potential for underwithholding or incorrect reporting due to crypto market fluctuations | Low risk; withholding amounts predefined and regulated |

Which is better?

Payroll withholding remains the most reliable and widely accepted method for tax compliance, ensuring automatic deduction of federal, state, and local taxes directly from employees' wages. Payroll crypto taxation, while innovative, faces regulatory uncertainty and complexity due to fluctuating crypto values and evolving IRS guidelines. Businesses prioritizing accuracy and legal compliance typically prefer payroll withholding to mitigate risks associated with cryptocurrency tax reporting.

Connection

Payroll crypto taxation involves the reporting and calculation of tax obligations on employee compensation paid in cryptocurrencies, which requires precise payroll withholding to ensure compliance with tax regulations. Employers must accurately determine withholding amounts based on the fair market value of virtual currencies at the time of payment to fulfill IRS guidelines. Proper integration of payroll systems with crypto tax rules minimizes risks of penalties and streamlines employee tax reporting processes.

Key Terms

Withholding Tax

Payroll withholding tax requires employers to deduct income taxes from employees' wages and remit them to tax authorities, ensuring compliance with federal and state tax laws. In contrast, payroll crypto taxation involves withholding tax on cryptocurrency payments, which present unique challenges due to price volatility and regulatory uncertainties. Explore detailed guidance on managing payroll withholding tax obligations amid the rise of crypto compensation to ensure accurate reporting and compliance.

Cryptocurrency Valuation

Payroll withholding involves deducting accurate federal and state taxes from employees' earnings based on conventional income valuation methods, while payroll crypto taxation requires determining the fair market value of cryptocurrencies at the time of payment to comply with IRS reporting standards. Cryptocurrency valuation must consider price volatility and the specific moment the digital asset is received, converting it into USD to calculate taxable income correctly. Explore detailed strategies to optimize payroll compliance and cryptocurrency tax management to stay ahead of regulatory requirements.

Taxable Income

Payroll withholding involves employers deducting income taxes directly from employees' wages based on IRS tax brackets, accurately reflecting taxable income. Payroll crypto taxation treats cryptocurrency compensation as taxable income at the fair market value on the date received, requiring precise valuation for tax reporting. Explore in-depth comparisons to understand the implications of each method on your taxable income.

Source and External Links

Payroll Taxes | How Much Do Employers Take Out? - ADP - Payroll withholding includes federal income tax calculated using wage adjustments and IRS Publication 15-T tables, and payroll taxes like Social Security (6.2%) and Medicare (1.45%) withheld from employees and matched by employers.

Withholding | TaxEDU Glossary - Tax Foundation - Payroll withholding is the income employers take from employees' paychecks to remit federal, state, and local taxes, ensuring tax payments are spread throughout the year and often matching tax liabilities when filing.

Tax withholding | Internal Revenue Service - Payroll withholding refers to the federal income tax and employment taxes (Social Security and Medicare) employers are legally required to withhold from employees' paychecks, based on earnings and information on Form W-4.

dowidth.com

dowidth.com