Data lake auditing leverages advanced analytics and real-time data processing to enhance accuracy and efficiency in financial reviews, contrasting with traditional manual ledger reviews that are labor-intensive and prone to human error. By integrating machine learning algorithms, data lake auditing provides deeper insights and better compliance tracking across vast datasets. Explore how these innovative approaches are transforming accounting practices for improved financial governance.

Why it is important

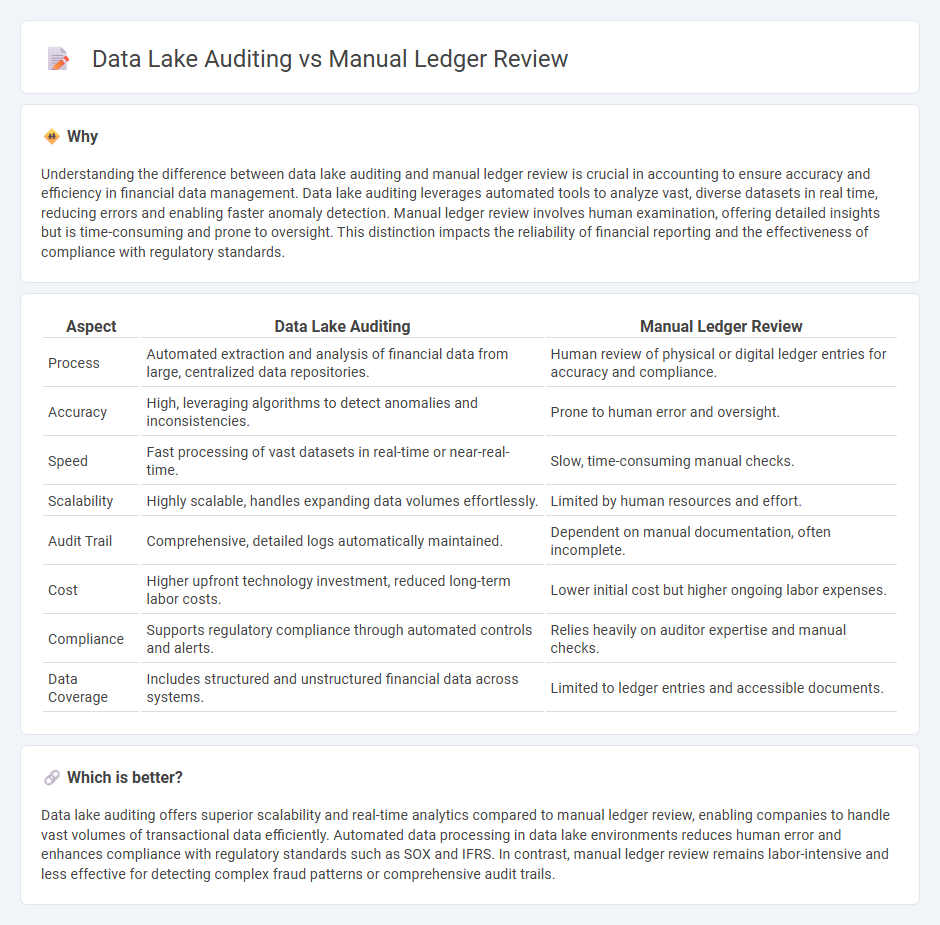

Understanding the difference between data lake auditing and manual ledger review is crucial in accounting to ensure accuracy and efficiency in financial data management. Data lake auditing leverages automated tools to analyze vast, diverse datasets in real time, reducing errors and enabling faster anomaly detection. Manual ledger review involves human examination, offering detailed insights but is time-consuming and prone to oversight. This distinction impacts the reliability of financial reporting and the effectiveness of compliance with regulatory standards.

Comparison Table

| Aspect | Data Lake Auditing | Manual Ledger Review |

|---|---|---|

| Process | Automated extraction and analysis of financial data from large, centralized data repositories. | Human review of physical or digital ledger entries for accuracy and compliance. |

| Accuracy | High, leveraging algorithms to detect anomalies and inconsistencies. | Prone to human error and oversight. |

| Speed | Fast processing of vast datasets in real-time or near-real-time. | Slow, time-consuming manual checks. |

| Scalability | Highly scalable, handles expanding data volumes effortlessly. | Limited by human resources and effort. |

| Audit Trail | Comprehensive, detailed logs automatically maintained. | Dependent on manual documentation, often incomplete. |

| Cost | Higher upfront technology investment, reduced long-term labor costs. | Lower initial cost but higher ongoing labor expenses. |

| Compliance | Supports regulatory compliance through automated controls and alerts. | Relies heavily on auditor expertise and manual checks. |

| Data Coverage | Includes structured and unstructured financial data across systems. | Limited to ledger entries and accessible documents. |

Which is better?

Data lake auditing offers superior scalability and real-time analytics compared to manual ledger review, enabling companies to handle vast volumes of transactional data efficiently. Automated data processing in data lake environments reduces human error and enhances compliance with regulatory standards such as SOX and IFRS. In contrast, manual ledger review remains labor-intensive and less effective for detecting complex fraud patterns or comprehensive audit trails.

Connection

Data lake auditing enhances accounting accuracy by systematically collecting, storing, and analyzing vast volumes of financial data, providing a comprehensive digital repository for ledger transactions. Manual ledger review relies on insights from data lakes to identify discrepancies, ensure compliance, and validate the integrity of financial records. Integrating data lake auditing with manual ledger review streamlines error detection and supports robust financial governance.

Key Terms

Double-entry bookkeeping

Manual ledger review involves meticulous examination of accounting entries, ensuring accuracy and compliance within the double-entry bookkeeping system where every debit has a corresponding credit. Data lake auditing leverages advanced analytics on vast, unstructured financial datasets, enabling real-time detection of discrepancies and improving the verification process of double-entry records. Explore more about enhancing financial accuracy through modern auditing techniques.

ETL (Extract, Transform, Load)

Manual ledger review involves painstakingly verifying financial entries line-by-line, often prone to human error and time-intensive processes, whereas data lake auditing leverages automated ETL tools to extract, transform, and load vast datasets for comprehensive and real-time analytics. ETL workflows in data lakes ensure data consistency, integrity, and scalability, streamlining compliance checks and fraud detection across multiple financial systems. Explore the advantages of integrating data lake auditing with your ETL processes to enhance accuracy and efficiency.

Anomaly detection

Manual ledger review involves human auditors examining financial records line by line to identify discrepancies, often limited by time and subjectivity. Data lake auditing leverages advanced algorithms and machine learning models to automatically detect anomalies across vast datasets, offering higher accuracy and scalability. Discover how integrating data lake auditing can revolutionize anomaly detection in financial processes.

Source and External Links

General Ledger Review: Ensuring Financial Accuracy - The manual ledger review process involves analyzing each account, reconciling transactions, and verifying financial records to ensure the accuracy of a general ledger, which is essential for informed business decisions and financial management.

Manual Journal Entry Review Policy | KnowledgeLeader - This outlines policies requiring that manual journal entries be reviewed independently in full for accuracy and completeness, with signoff by a reviewer as evidence of the review.

Departmental Ledger Review - Controller's Office - Monthly manual ledger review includes analyzing transactions and balances to ensure validity, appropriateness, compliance with policies, and helps maintain strong internal controls and auditability.

dowidth.com

dowidth.com