Transfer pricing analytics focuses on evaluating intercompany transaction prices to ensure compliance with tax regulations and optimize tax liabilities across multinational corporations. Performance measurement examines financial and operational metrics to assess business efficiency, profitability, and strategic goal achievement. Explore deeper insights into how transfer pricing analytics and performance measurement interrelate and drive corporate financial strategy.

Why it is important

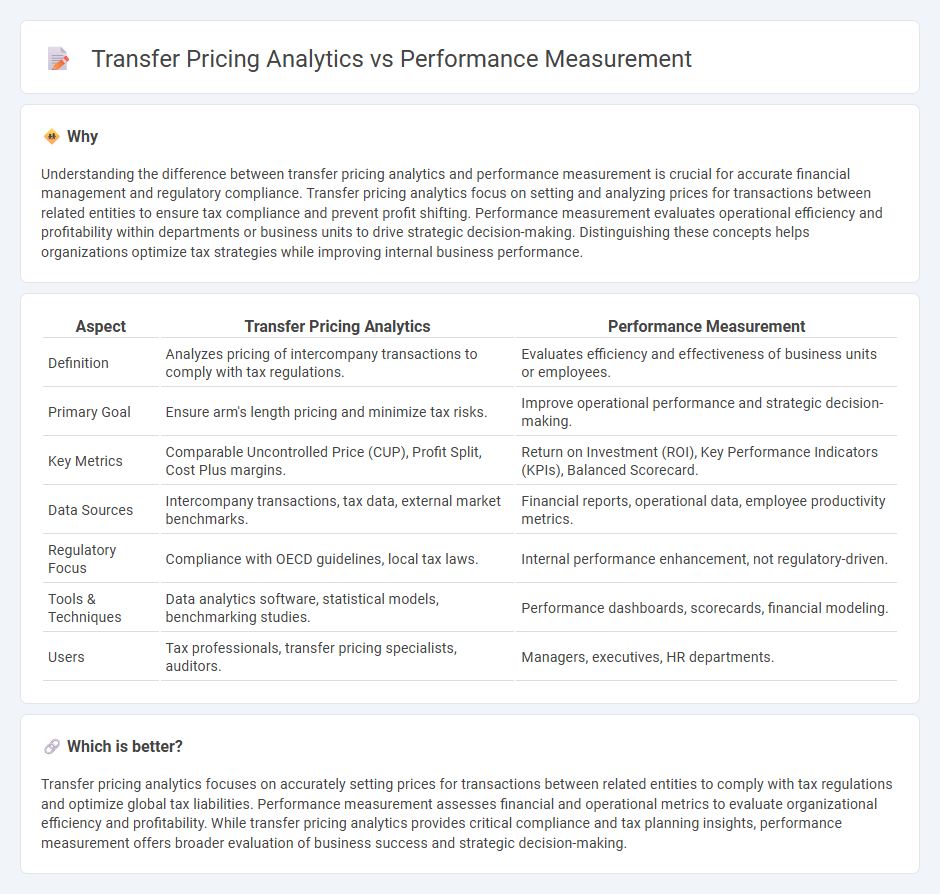

Understanding the difference between transfer pricing analytics and performance measurement is crucial for accurate financial management and regulatory compliance. Transfer pricing analytics focus on setting and analyzing prices for transactions between related entities to ensure tax compliance and prevent profit shifting. Performance measurement evaluates operational efficiency and profitability within departments or business units to drive strategic decision-making. Distinguishing these concepts helps organizations optimize tax strategies while improving internal business performance.

Comparison Table

| Aspect | Transfer Pricing Analytics | Performance Measurement |

|---|---|---|

| Definition | Analyzes pricing of intercompany transactions to comply with tax regulations. | Evaluates efficiency and effectiveness of business units or employees. |

| Primary Goal | Ensure arm's length pricing and minimize tax risks. | Improve operational performance and strategic decision-making. |

| Key Metrics | Comparable Uncontrolled Price (CUP), Profit Split, Cost Plus margins. | Return on Investment (ROI), Key Performance Indicators (KPIs), Balanced Scorecard. |

| Data Sources | Intercompany transactions, tax data, external market benchmarks. | Financial reports, operational data, employee productivity metrics. |

| Regulatory Focus | Compliance with OECD guidelines, local tax laws. | Internal performance enhancement, not regulatory-driven. |

| Tools & Techniques | Data analytics software, statistical models, benchmarking studies. | Performance dashboards, scorecards, financial modeling. |

| Users | Tax professionals, transfer pricing specialists, auditors. | Managers, executives, HR departments. |

Which is better?

Transfer pricing analytics focuses on accurately setting prices for transactions between related entities to comply with tax regulations and optimize global tax liabilities. Performance measurement assesses financial and operational metrics to evaluate organizational efficiency and profitability. While transfer pricing analytics provides critical compliance and tax planning insights, performance measurement offers broader evaluation of business success and strategic decision-making.

Connection

Transfer pricing analytics leverages data-driven insights to assess intercompany transaction prices, ensuring compliance with regulatory standards and optimizing tax efficiency. Performance measurement integrates these analytics to evaluate financial outcomes across divisions, aligning transfer pricing strategies with overall corporate profitability and risk management. This connection enhances transparency, accuracy, and strategic decision-making in multinational enterprises' financial operations.

Key Terms

**Performance Measurement:**

Performance measurement analyzes key performance indicators (KPIs) to evaluate operational efficiency, profitability, and strategic goal achievement within an organization. It relies on metrics such as return on investment (ROI), balanced scorecards, and benchmarking to provide actionable insights for management decision-making. Explore how advanced performance measurement tools can drive sustainable business growth.

Key Performance Indicators (KPIs)

Performance measurement emphasizes tracking key performance indicators (KPIs) such as profit margins, return on investment, and operational efficiency to evaluate organizational success. Transfer pricing analytics focuses on KPIs related to intercompany transactions, including compliance with tax regulations, cost allocation accuracy, and risk assessment to ensure arm's length pricing. Discover more about optimizing KPIs for enhanced financial and operational insights.

Benchmarking

Performance measurement centers on evaluating internal efficiency and productivity using benchmarks such as KPIs and ROI to drive operational improvements. Transfer pricing analytics emphasize benchmarking transaction prices against comparable market data to ensure compliance with tax regulations and optimize profitability. Explore in-depth methodologies and tools for effective benchmarking in both domains to enhance strategic decision-making.

Source and External Links

Performance Measurement - What Is It, Example, Methods, Types - Performance measurement quantifies and assesses the effectiveness and efficiency of an organization or individual, using methods like KPIs, Balanced Scorecard, Six Sigma, performance appraisals, customer satisfaction surveys, benchmarking, and ROI to track and improve performance.

Performance measurement - Wikipedia - Performance measurement involves collecting, analyzing, and reporting information about the performance of individuals, groups, organizations, or systems, focusing on efficiency, effectiveness, and value delivered to stakeholders, and is supported by standards and predefined indicators.

Effective performance measurement: Key to business growth - Performance measurement is a strategic tool that enables companies to benchmark against competitors, align business goals with metrics, uncover competitive advantages, adapt to market changes, and balance long-term vision with short-term actions.

dowidth.com

dowidth.com