Digital ledger technology revolutionizes auditing by providing immutable, real-time transaction records that enhance accuracy and transparency compared to traditional auditing methods relying on manual verification and periodic sampling. Blockchain-based ledgers reduce fraud risks and streamline audit trails through decentralized validation, minimizing human error and delays. Explore how integrating digital ledgers transforms accounting practices and elevates audit reliability.

Why it is important

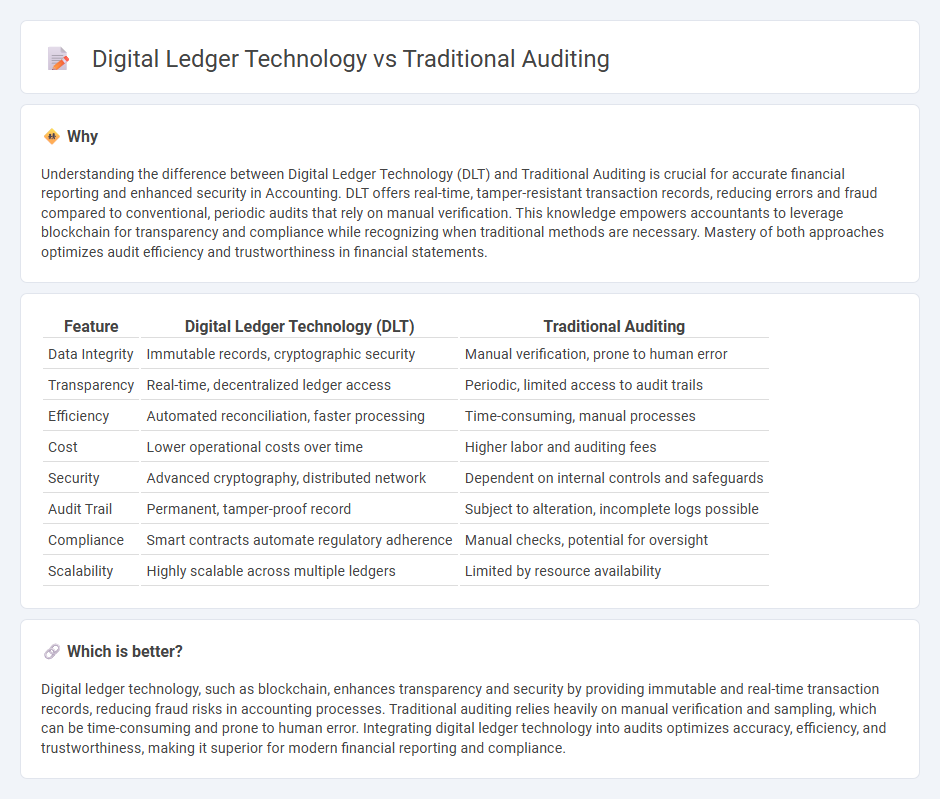

Understanding the difference between Digital Ledger Technology (DLT) and Traditional Auditing is crucial for accurate financial reporting and enhanced security in Accounting. DLT offers real-time, tamper-resistant transaction records, reducing errors and fraud compared to conventional, periodic audits that rely on manual verification. This knowledge empowers accountants to leverage blockchain for transparency and compliance while recognizing when traditional methods are necessary. Mastery of both approaches optimizes audit efficiency and trustworthiness in financial statements.

Comparison Table

| Feature | Digital Ledger Technology (DLT) | Traditional Auditing |

|---|---|---|

| Data Integrity | Immutable records, cryptographic security | Manual verification, prone to human error |

| Transparency | Real-time, decentralized ledger access | Periodic, limited access to audit trails |

| Efficiency | Automated reconciliation, faster processing | Time-consuming, manual processes |

| Cost | Lower operational costs over time | Higher labor and auditing fees |

| Security | Advanced cryptography, distributed network | Dependent on internal controls and safeguards |

| Audit Trail | Permanent, tamper-proof record | Subject to alteration, incomplete logs possible |

| Compliance | Smart contracts automate regulatory adherence | Manual checks, potential for oversight |

| Scalability | Highly scalable across multiple ledgers | Limited by resource availability |

Which is better?

Digital ledger technology, such as blockchain, enhances transparency and security by providing immutable and real-time transaction records, reducing fraud risks in accounting processes. Traditional auditing relies heavily on manual verification and sampling, which can be time-consuming and prone to human error. Integrating digital ledger technology into audits optimizes accuracy, efficiency, and trustworthiness, making it superior for modern financial reporting and compliance.

Connection

Digital ledger technology, such as blockchain, enhances traditional auditing by providing immutable, transparent, and real-time transaction records that auditors can verify with increased accuracy. This integration reduces the risk of errors and fraud while streamlining the verification process through automated data validation. Consequently, auditors can deliver more reliable financial reports and ensure compliance with regulatory standards efficiently.

Key Terms

Source and External Links

Six Biggest Challenges of Traditional Audit Techniques - Letsbloom - Traditional auditing relies heavily on manual processes prone to human error, uses sample-based testing limiting scope, and is time-consuming due to labor-intensive evidence collection, making it less efficient and potentially less accurate.

Continuous vs. Traditional Auditing: Which Is Best? - CertPro - Traditional auditing is typically performed annually or biannually, relies on manual review of policies and controls, and has a limited scope focused on specific periods rather than continuous monitoring, which can miss evolving risks.

The Traditional Audit Vs. the Fraud Audit - Leonard Vona - Traditional audits aim to assure the adequacy of internal controls through phases of planning, sampling, testing, and reporting, and differ from fraud audits mainly in their focus and techniques used to detect fraud risks.

dowidth.com

dowidth.com