Real-time audit leverages advanced technology and continuous data monitoring to provide instant insights and detect discrepancies as transactions occur, enhancing accuracy and decision-making efficiency. Internal audit focuses on comprehensive evaluations of financial records, internal controls, and compliance over a defined period to ensure organizational integrity and risk management. Explore the key differences and benefits of real-time audit versus internal audit to optimize your financial oversight strategies.

Why it is important

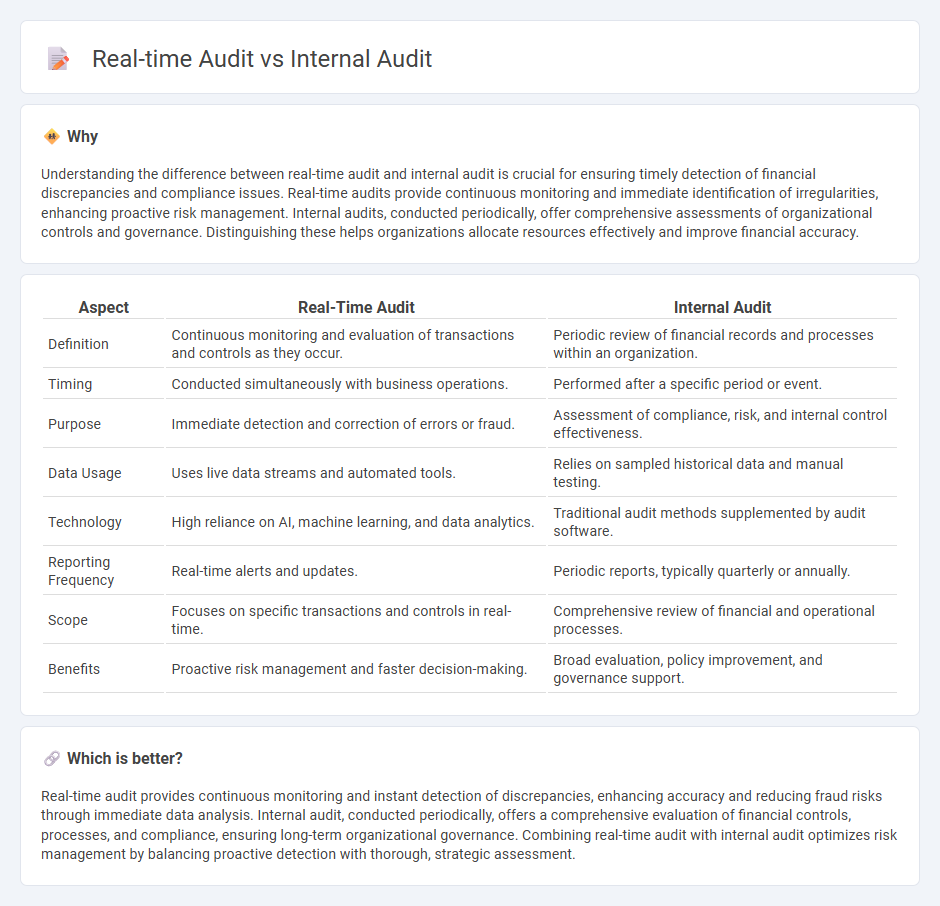

Understanding the difference between real-time audit and internal audit is crucial for ensuring timely detection of financial discrepancies and compliance issues. Real-time audits provide continuous monitoring and immediate identification of irregularities, enhancing proactive risk management. Internal audits, conducted periodically, offer comprehensive assessments of organizational controls and governance. Distinguishing these helps organizations allocate resources effectively and improve financial accuracy.

Comparison Table

| Aspect | Real-Time Audit | Internal Audit |

|---|---|---|

| Definition | Continuous monitoring and evaluation of transactions and controls as they occur. | Periodic review of financial records and processes within an organization. |

| Timing | Conducted simultaneously with business operations. | Performed after a specific period or event. |

| Purpose | Immediate detection and correction of errors or fraud. | Assessment of compliance, risk, and internal control effectiveness. |

| Data Usage | Uses live data streams and automated tools. | Relies on sampled historical data and manual testing. |

| Technology | High reliance on AI, machine learning, and data analytics. | Traditional audit methods supplemented by audit software. |

| Reporting Frequency | Real-time alerts and updates. | Periodic reports, typically quarterly or annually. |

| Scope | Focuses on specific transactions and controls in real-time. | Comprehensive review of financial and operational processes. |

| Benefits | Proactive risk management and faster decision-making. | Broad evaluation, policy improvement, and governance support. |

Which is better?

Real-time audit provides continuous monitoring and instant detection of discrepancies, enhancing accuracy and reducing fraud risks through immediate data analysis. Internal audit, conducted periodically, offers a comprehensive evaluation of financial controls, processes, and compliance, ensuring long-term organizational governance. Combining real-time audit with internal audit optimizes risk management by balancing proactive detection with thorough, strategic assessment.

Connection

Real-time audit and internal audit are connected through their focus on continuous monitoring and assessment of financial transactions and internal controls. Real-time audit provides immediate verification of data accuracy, enabling internal auditors to detect discrepancies and potential risks promptly. This integration enhances the effectiveness of internal audit by facilitating timely decision-making and ensuring compliance with regulatory standards.

Key Terms

**Internal Audit:**

Internal audit systematically evaluates an organization's internal controls, risk management, and governance processes to ensure accuracy and compliance with regulations. It typically involves periodic assessments, thorough documentation, and formal reporting to provide insights on operational efficiency and risk mitigation. Discover more about how internal audit strengthens organizational integrity and decision-making.

Compliance

Internal audits systematically assess compliance with established policies and regulations at scheduled intervals, identifying gaps and ensuring corrective actions. Real-time audits continuously monitor transactions and activities, enabling immediate detection and resolution of compliance issues to prevent risks. Explore deeper insights into optimizing compliance through internal and real-time audit strategies.

Risk Assessment

Internal audit primarily focuses on periodic risk assessments by evaluating historical data and control effectiveness to identify potential vulnerabilities within an organization's processes. Real-time audit emphasizes continuous monitoring and immediate risk detection through automated data analysis and transaction tracking, allowing prompt corrective actions. Explore detailed comparisons to enhance your organization's risk management strategy effectively.

Source and External Links

What is Internal Audit? Types, Value, Process & Standards - This article explores the types, value, processes, and standards of internal audits, including compliance, environmental, financial, IT, operational, and performance audits.

Internal audit - Internal auditing is an independent and objective activity designed to add value and improve an organization's operations through assurance and consulting services.

Internal Audit 101: Everything You Need to Know - This guide provides an overview of the internal auditing function, types of audits, best practices for the auditing process, and essential items for internal audit reports.

dowidth.com

dowidth.com