On-demand accruals enable businesses to record revenues and expenses precisely when transactions occur, improving financial accuracy and cash flow management. The matching principle mandates that expenses be recognized in the same period as the related revenues, ensuring consistent and reliable financial statements. Explore how understanding these accounting methods can optimize your financial reporting strategies.

Why it is important

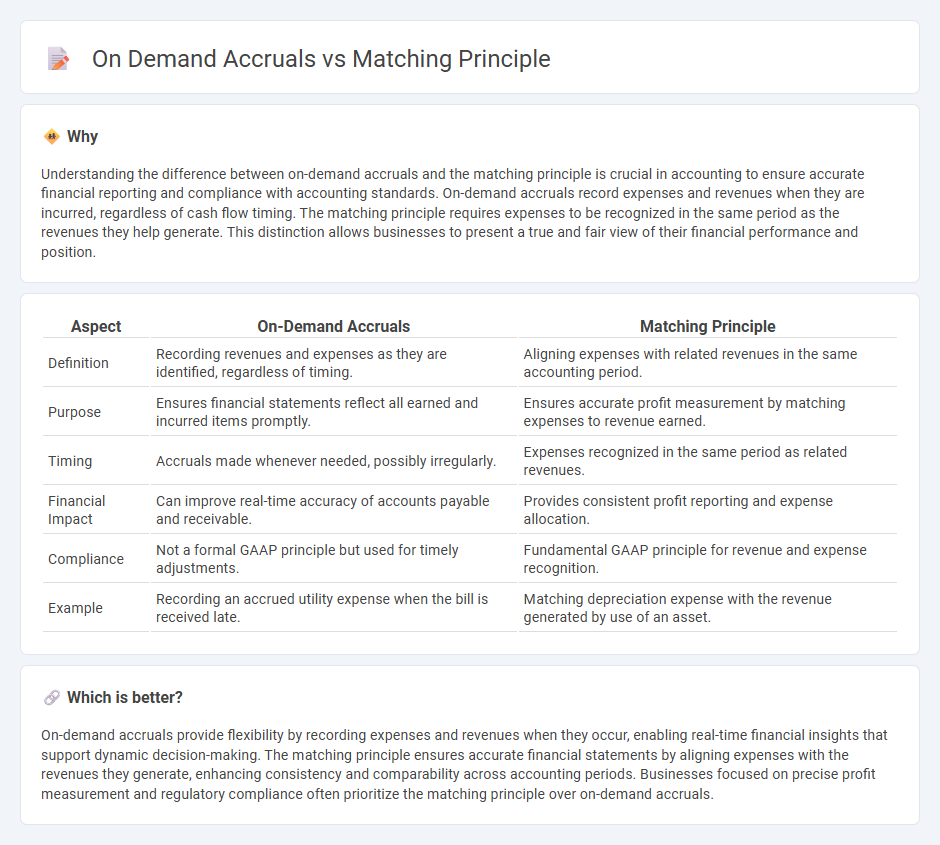

Understanding the difference between on-demand accruals and the matching principle is crucial in accounting to ensure accurate financial reporting and compliance with accounting standards. On-demand accruals record expenses and revenues when they are incurred, regardless of cash flow timing. The matching principle requires expenses to be recognized in the same period as the revenues they help generate. This distinction allows businesses to present a true and fair view of their financial performance and position.

Comparison Table

| Aspect | On-Demand Accruals | Matching Principle |

|---|---|---|

| Definition | Recording revenues and expenses as they are identified, regardless of timing. | Aligning expenses with related revenues in the same accounting period. |

| Purpose | Ensures financial statements reflect all earned and incurred items promptly. | Ensures accurate profit measurement by matching expenses to revenue earned. |

| Timing | Accruals made whenever needed, possibly irregularly. | Expenses recognized in the same period as related revenues. |

| Financial Impact | Can improve real-time accuracy of accounts payable and receivable. | Provides consistent profit reporting and expense allocation. |

| Compliance | Not a formal GAAP principle but used for timely adjustments. | Fundamental GAAP principle for revenue and expense recognition. |

| Example | Recording an accrued utility expense when the bill is received late. | Matching depreciation expense with the revenue generated by use of an asset. |

Which is better?

On-demand accruals provide flexibility by recording expenses and revenues when they occur, enabling real-time financial insights that support dynamic decision-making. The matching principle ensures accurate financial statements by aligning expenses with the revenues they generate, enhancing consistency and comparability across accounting periods. Businesses focused on precise profit measurement and regulatory compliance often prioritize the matching principle over on-demand accruals.

Connection

On-demand accruals ensure expenses and revenues are recorded when incurred, not when cash is exchanged, aligning directly with the matching principle that requires expenses to be recognized in the same period as the related revenues. This connection enhances the accuracy of financial statements by reflecting the true financial performance within a specific accounting period. Proper application of both concepts supports compliance with Generally Accepted Accounting Principles (GAAP) and improves decision-making based on up-to-date accrual-based reports.

Key Terms

Revenue Recognition

The matching principle mandates that expenses be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement and aligning costs with related income. On-demand accruals involve recognizing revenues and expenses when they are earned or incurred, regardless of cash flow, facilitating timely and precise financial reporting. Explore further to deepen your understanding of how these frameworks impact revenue recognition and financial statement accuracy.

Expense Matching

The matching principle in accounting ensures expenses are recorded in the same period as the revenues they help generate, providing accurate financial performance measurement. On-demand accruals recognize expenses as they are incurred, even if payment is deferred, enabling precise expense matching without waiting for cash transactions. Explore these concepts in-depth to enhance your understanding of expense matching in financial reporting.

Accrual Basis

The matching principle ensures that expenses are recognized in the same period as the related revenues, providing an accurate measure of profitability under the accrual basis of accounting. On-demand accruals involve recording expenses as they are incurred, even if payment is deferred, to reflect the true financial position. Explore how these concepts optimize financial statements and compliance with GAAP standards.

Source and External Links

Matching principle definition - AccountingTools - The matching principle requires revenues and any related expenses to be recognized together in the same reporting period to ensure that profits are accurately reported without being artificially accelerated or delayed, and it forms a key concept in accrual accounting.

What Is the Matching Principle and Why Is It Important? - FreshBooks - The matching principle is an accounting rule under GAAP that mandates recording expenses alongside the revenues they help generate within the same period to clearly track business performance, often applied through accrual accounting and adjustments.

What Is the Matching Principle? (Definition and Examples) - Indeed - This principle ensures that revenues and expenses are matched in the same period, enabling more accurate and meaningful financial reporting and profitability analysis, although it may lead to inaccuracies when estimates are involved.

dowidth.com

dowidth.com