Outcome-based budgeting focuses on allocating resources based on expected results and measurable performance indicators, enhancing accountability and strategic alignment in financial planning. Rolling forecasting continuously updates financial projections by regularly incorporating actual performance data, improving adaptability to changing business conditions. Explore the advantages and applications of both methods to optimize your organization's budgeting process.

Why it is important

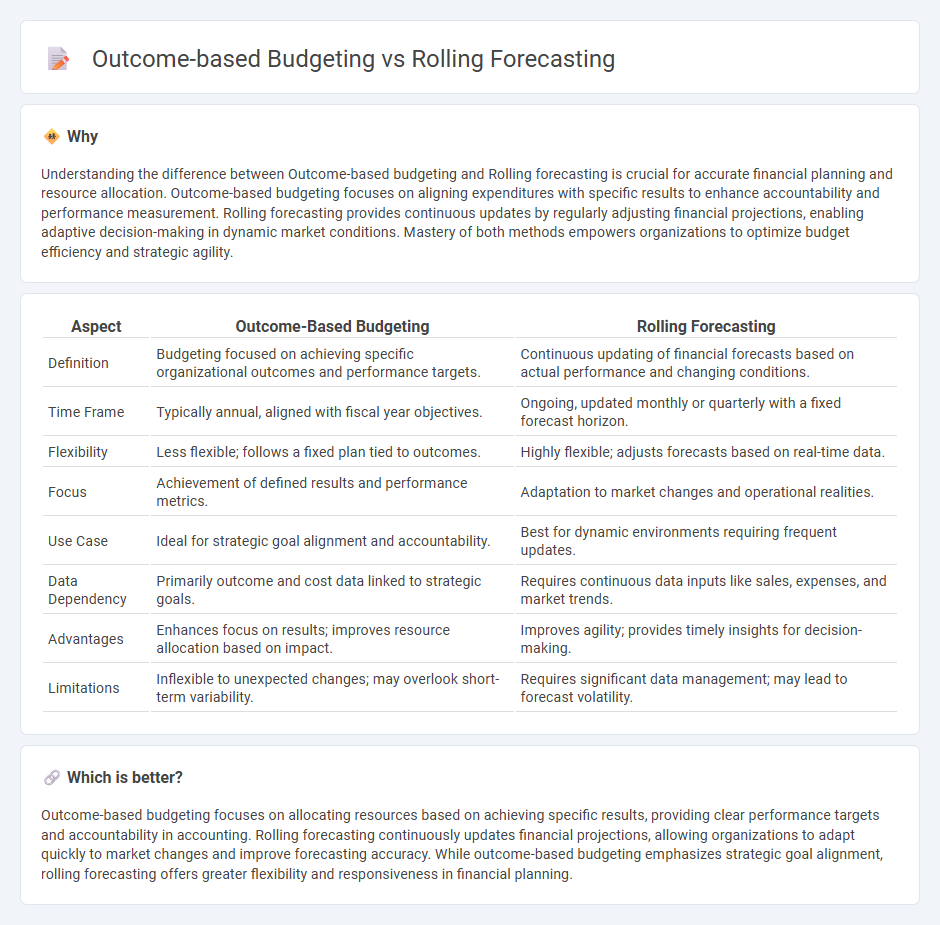

Understanding the difference between Outcome-based budgeting and Rolling forecasting is crucial for accurate financial planning and resource allocation. Outcome-based budgeting focuses on aligning expenditures with specific results to enhance accountability and performance measurement. Rolling forecasting provides continuous updates by regularly adjusting financial projections, enabling adaptive decision-making in dynamic market conditions. Mastery of both methods empowers organizations to optimize budget efficiency and strategic agility.

Comparison Table

| Aspect | Outcome-Based Budgeting | Rolling Forecasting |

|---|---|---|

| Definition | Budgeting focused on achieving specific organizational outcomes and performance targets. | Continuous updating of financial forecasts based on actual performance and changing conditions. |

| Time Frame | Typically annual, aligned with fiscal year objectives. | Ongoing, updated monthly or quarterly with a fixed forecast horizon. |

| Flexibility | Less flexible; follows a fixed plan tied to outcomes. | Highly flexible; adjusts forecasts based on real-time data. |

| Focus | Achievement of defined results and performance metrics. | Adaptation to market changes and operational realities. |

| Use Case | Ideal for strategic goal alignment and accountability. | Best for dynamic environments requiring frequent updates. |

| Data Dependency | Primarily outcome and cost data linked to strategic goals. | Requires continuous data inputs like sales, expenses, and market trends. |

| Advantages | Enhances focus on results; improves resource allocation based on impact. | Improves agility; provides timely insights for decision-making. |

| Limitations | Inflexible to unexpected changes; may overlook short-term variability. | Requires significant data management; may lead to forecast volatility. |

Which is better?

Outcome-based budgeting focuses on allocating resources based on achieving specific results, providing clear performance targets and accountability in accounting. Rolling forecasting continuously updates financial projections, allowing organizations to adapt quickly to market changes and improve forecasting accuracy. While outcome-based budgeting emphasizes strategic goal alignment, rolling forecasting offers greater flexibility and responsiveness in financial planning.

Connection

Outcome-based budgeting aligns financial resources with specific performance goals, enhancing transparency and accountability in public or corporate accounting. Rolling forecasting complements this approach by providing continuous updates on financial projections based on real-time data and changing conditions, allowing for more agile budget adjustments. Together, they enable organizations to link expenditures directly to results while maintaining flexibility in financial planning.

Key Terms

Flexibility

Rolling forecasting enhances financial flexibility by continuously updating projections based on real-time data, enabling organizations to adapt swiftly to market changes. Outcome-based budgeting prioritizes resource allocation toward achieving specific goals, promoting accountability but may reduce responsiveness to unexpected shifts. Explore how combining both approaches can optimize strategic planning and agility.

Performance metrics

Rolling forecasting continuously updates financial projections using real-time performance metrics, enabling organizations to adapt quickly to market changes. Outcome-based budgeting allocates resources based on measurable results and key performance indicators (KPIs), ensuring funds are directed towards initiatives with proven impact. Explore the benefits and differences of these approaches to enhance your organization's financial strategy.

Resource allocation

Rolling forecasting continuously updates financial projections based on real-time data, allowing for more flexible and adaptive resource allocation in dynamic environments. Outcome-based budgeting allocates resources by linking expenditures directly to specific results, ensuring funds are used efficiently to achieve predefined objectives. Explore the key differences and benefits of these approaches to optimize your organization's resource management strategy.

Source and External Links

What Is a Rolling Forecast? Pros, Cons, and Best Practices - This article discusses the concept of rolling forecasts, their mechanics, and how they are used to continuously update financial predictions in a dynamic business environment.

What Is a Rolling Forecast? - Rolling forecasts are dynamic, adaptive tools that help businesses create flexible, data-driven financial plans by focusing on key operational drivers and frequent updates.

Should You Use Rolling Forecasts? Weighing the Pros & Cons - This article weighs the advantages and challenges of using rolling forecasts, highlighting their ability to respond to changes and improve forecast accuracy with continuous updates.

dowidth.com

dowidth.com