Cryptocurrency auditing focuses on verifying the authenticity, security, and compliance of digital asset transactions on blockchain networks, while cost auditing examines the accuracy and efficiency of cost records in traditional accounting systems. Both auditing types aim to ensure financial integrity, but cryptocurrency auditing requires specialized knowledge of cryptographic protocols and decentralized ledgers. Explore deeper insights into the distinctions and methodologies of cryptocurrency auditing versus cost auditing here.

Why it is important

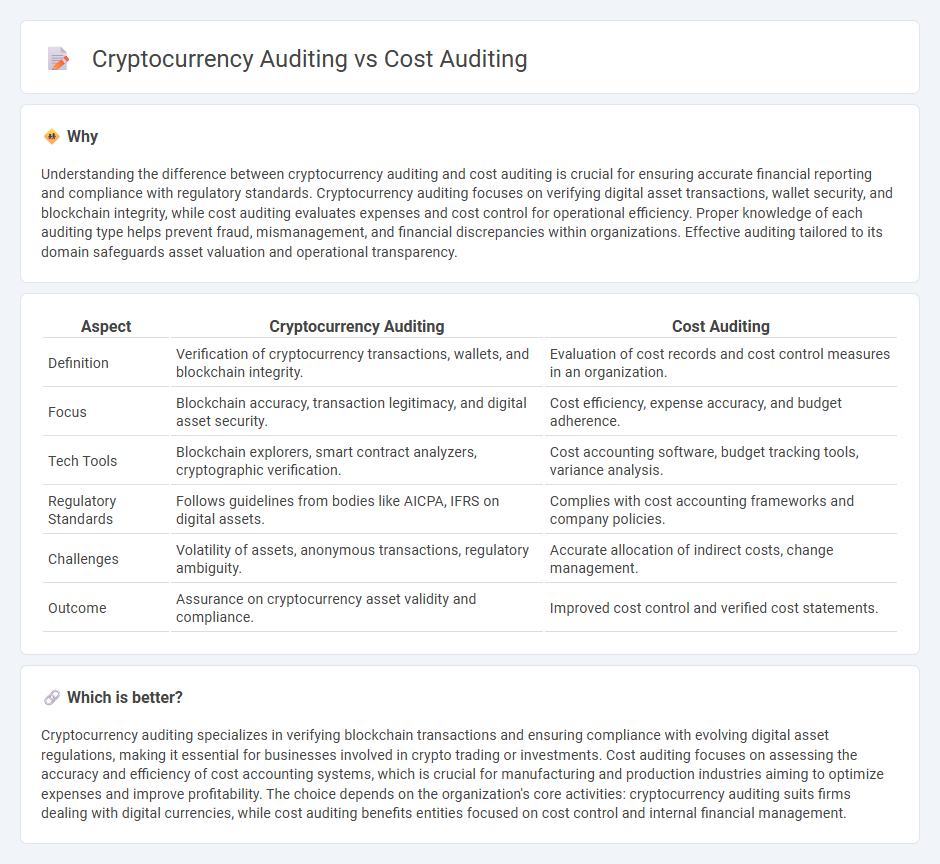

Understanding the difference between cryptocurrency auditing and cost auditing is crucial for ensuring accurate financial reporting and compliance with regulatory standards. Cryptocurrency auditing focuses on verifying digital asset transactions, wallet security, and blockchain integrity, while cost auditing evaluates expenses and cost control for operational efficiency. Proper knowledge of each auditing type helps prevent fraud, mismanagement, and financial discrepancies within organizations. Effective auditing tailored to its domain safeguards asset valuation and operational transparency.

Comparison Table

| Aspect | Cryptocurrency Auditing | Cost Auditing |

|---|---|---|

| Definition | Verification of cryptocurrency transactions, wallets, and blockchain integrity. | Evaluation of cost records and cost control measures in an organization. |

| Focus | Blockchain accuracy, transaction legitimacy, and digital asset security. | Cost efficiency, expense accuracy, and budget adherence. |

| Tech Tools | Blockchain explorers, smart contract analyzers, cryptographic verification. | Cost accounting software, budget tracking tools, variance analysis. |

| Regulatory Standards | Follows guidelines from bodies like AICPA, IFRS on digital assets. | Complies with cost accounting frameworks and company policies. |

| Challenges | Volatility of assets, anonymous transactions, regulatory ambiguity. | Accurate allocation of indirect costs, change management. |

| Outcome | Assurance on cryptocurrency asset validity and compliance. | Improved cost control and verified cost statements. |

Which is better?

Cryptocurrency auditing specializes in verifying blockchain transactions and ensuring compliance with evolving digital asset regulations, making it essential for businesses involved in crypto trading or investments. Cost auditing focuses on assessing the accuracy and efficiency of cost accounting systems, which is crucial for manufacturing and production industries aiming to optimize expenses and improve profitability. The choice depends on the organization's core activities: cryptocurrency auditing suits firms dealing with digital currencies, while cost auditing benefits entities focused on cost control and internal financial management.

Connection

Cryptocurrency auditing involves verifying digital asset transactions on blockchain networks to ensure accuracy and compliance, while cost auditing evaluates the efficiency of resource utilization and expense management within an organization. Both auditing types require meticulous examination of financial records to detect discrepancies and ensure transparency, leveraging data analysis and internal controls. Integration of cryptocurrency auditing into cost auditing enhances overall financial oversight by addressing emerging risks associated with digital asset valuation and cost allocation.

Key Terms

Cost Auditing:

Cost auditing involves systematically examining an organization's cost records to ensure accuracy and compliance with accounting standards, which helps in controlling and reducing costs effectively. It focuses on verifying cost statements, analyzing cost control measures, and identifying inefficiencies in production or services to enhance financial performance. Discover how cost auditing can optimize your business expenses and improve profitability with our in-depth resources.

Cost Records

Cost auditing meticulously examines cost records to verify accuracy, compliance, and efficiency in traditional financial systems. Cryptocurrency auditing requires specialized techniques to validate blockchain transaction histories and wallet balances, often complicated by the decentralized and pseudonymous nature of digital assets. Explore detailed methodologies and best practices for cost records in both auditing domains to enhance financial transparency.

Cost Verification

Cost auditing involves the detailed examination and verification of all expenses to ensure accuracy, compliance with standards, and prevention of misappropriation, often focusing on manufacturing or operational costs. Cryptocurrency auditing emphasizes the verification of blockchain transactions, wallet balances, and smart contract executions to ensure transparency and prevent fraud, leveraging cryptographic proof and decentralized ledger data. Explore more to understand the unique methodologies and tools used in both auditing domains.

Source and External Links

Cost Audit: Meaning, Objectives, Process, Advantages, and Legal ... - A cost audit is a systematic examination of cost records and accounts to verify their accuracy and ensure that cost accounting procedures are efficient, involving steps like planning, data collection, verification, analysis, reporting, and communication to stakeholders.

Cost auditing - Wikipedia - Cost auditing involves verifying cost accounts to ensure they conform to cost accounting principles and objectives, checking for accuracy, detecting errors or frauds, and reporting on optimal use of resources to management and government.

Cost Audit Process: Key Steps, Compliance, and Importance - Cost audit is a thorough review of a company's cost accounts and reports to confirm their accuracy and compliance with legal standards, helping firms control costs, uncover inefficiencies, and ensure financial transparency.

dowidth.com

dowidth.com