Dark data auditing focuses on uncovering hidden or unstructured data within an organization to improve accuracy and compliance in financial reporting. Fraud examination investigates intentional deception or manipulation in accounting records to detect and prevent financial misconduct. Explore how integrating both approaches enhances organizational transparency and risk management.

Why it is important

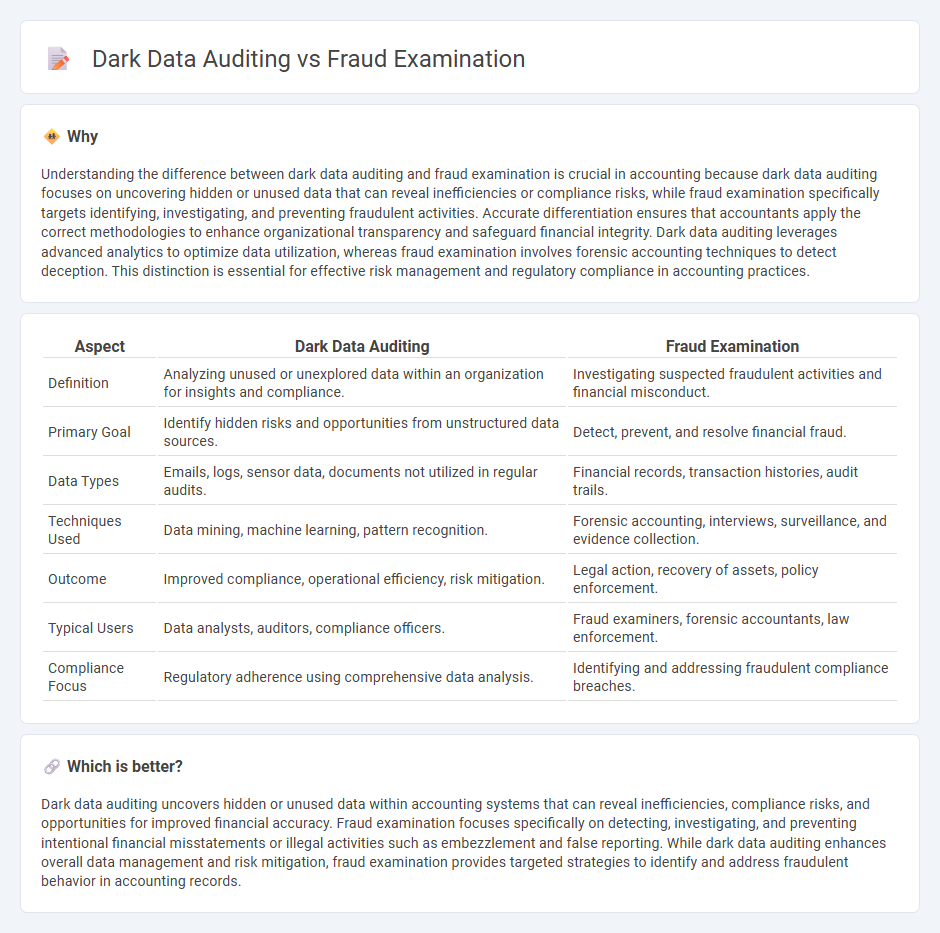

Understanding the difference between dark data auditing and fraud examination is crucial in accounting because dark data auditing focuses on uncovering hidden or unused data that can reveal inefficiencies or compliance risks, while fraud examination specifically targets identifying, investigating, and preventing fraudulent activities. Accurate differentiation ensures that accountants apply the correct methodologies to enhance organizational transparency and safeguard financial integrity. Dark data auditing leverages advanced analytics to optimize data utilization, whereas fraud examination involves forensic accounting techniques to detect deception. This distinction is essential for effective risk management and regulatory compliance in accounting practices.

Comparison Table

| Aspect | Dark Data Auditing | Fraud Examination |

|---|---|---|

| Definition | Analyzing unused or unexplored data within an organization for insights and compliance. | Investigating suspected fraudulent activities and financial misconduct. |

| Primary Goal | Identify hidden risks and opportunities from unstructured data sources. | Detect, prevent, and resolve financial fraud. |

| Data Types | Emails, logs, sensor data, documents not utilized in regular audits. | Financial records, transaction histories, audit trails. |

| Techniques Used | Data mining, machine learning, pattern recognition. | Forensic accounting, interviews, surveillance, and evidence collection. |

| Outcome | Improved compliance, operational efficiency, risk mitigation. | Legal action, recovery of assets, policy enforcement. |

| Typical Users | Data analysts, auditors, compliance officers. | Fraud examiners, forensic accountants, law enforcement. |

| Compliance Focus | Regulatory adherence using comprehensive data analysis. | Identifying and addressing fraudulent compliance breaches. |

Which is better?

Dark data auditing uncovers hidden or unused data within accounting systems that can reveal inefficiencies, compliance risks, and opportunities for improved financial accuracy. Fraud examination focuses specifically on detecting, investigating, and preventing intentional financial misstatements or illegal activities such as embezzlement and false reporting. While dark data auditing enhances overall data management and risk mitigation, fraud examination provides targeted strategies to identify and address fraudulent behavior in accounting records.

Connection

Dark data auditing involves analyzing unstructured and hidden data within an organization to uncover anomalies and inconsistencies. Fraud examination leverages insights from dark data to detect fraudulent activities by identifying unusual patterns and financial discrepancies. Integrating dark data auditing with fraud examination enhances the accuracy and effectiveness of identifying and preventing financial fraud in accounting processes.

Key Terms

Fraud examination:

Fraud examination involves systematically identifying, investigating, and preventing fraudulent activities using techniques such as forensic accounting, data analysis, and employee interviews to ensure compliance and reduce financial losses. Unlike dark data auditing, which focuses on uncovering unused, hidden, or unstructured data within an organization, fraud examination specifically targets intentional deception and financial misconduct. Discover comprehensive methodologies and best practices in fraud examination to safeguard your business assets.

Forensic accounting

Fraud examination in forensic accounting involves identifying, investigating, and preventing financial deceit through detailed analysis of transactions, while dark data auditing uncovers and analyzes hidden, unstructured, or unused data to detect potential risks and irregularities. Combining these approaches enhances forensic accountants' ability to reveal fraud schemes, improve compliance, and mitigate financial losses. Explore more about how forensic accounting integrates fraud examination and dark data auditing for comprehensive risk management.

Internal controls

Fraud examination concentrates on detecting, preventing, and investigating deceptive activities within an organization, emphasizing the evaluation of internal controls to identify weaknesses that could be exploited. Dark data auditing involves analyzing unstructured or hidden data that remains unmanaged to uncover risks and inefficiencies impacting internal controls and compliance. Explore the distinctions and integration strategies to enhance your organization's control framework and risk management.

Source and External Links

How to Become a Certified Fraud Examiner | Tiffin University - Fraud examination involves detecting, investigating, and preventing financial crimes by analyzing financial records, gathering evidence, and collaborating with law enforcement to recover assets and prosecute offenders.

What is Forensic Accounting and Fraud Examination | Embry-Riddle Aeronautical University - Fraud examination systematically examines financial and non-financial information to uncover fraud schemes and asset misappropriation, complementing forensic accounting by providing evidence for legal proceedings.

Forensic and Fraud Examination, M.S. | WVU Online - This graduate program prepares professionals to detect, investigate, and prevent financial fraud and white-collar crime through an interdisciplinary curriculum including business, law, accounting, and data technology.

dowidth.com

dowidth.com