Continuous auditing leverages real-time data analysis and automated tools to provide ongoing assurance on financial transactions, enhancing accuracy and timely detection of discrepancies. Periodic auditing, conducted at set intervals, offers a comprehensive review of financial statements but may miss emerging issues between audits. Explore the key differences and benefits of each auditing approach to optimize your financial oversight strategy.

Why it is important

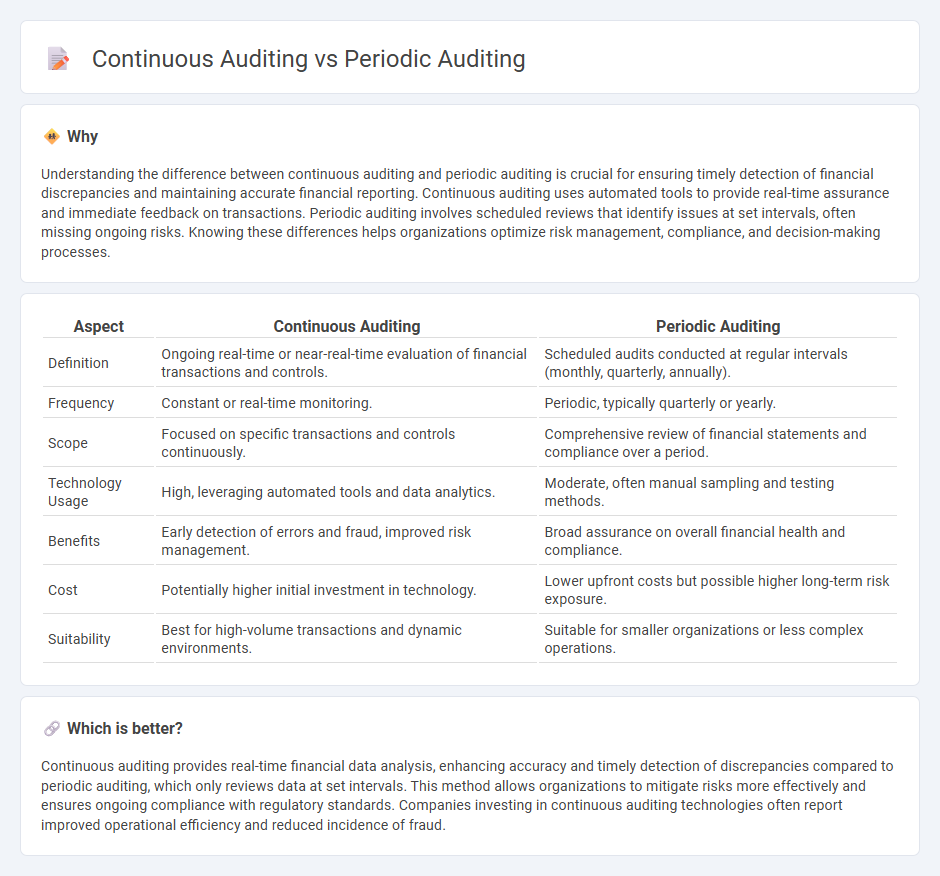

Understanding the difference between continuous auditing and periodic auditing is crucial for ensuring timely detection of financial discrepancies and maintaining accurate financial reporting. Continuous auditing uses automated tools to provide real-time assurance and immediate feedback on transactions. Periodic auditing involves scheduled reviews that identify issues at set intervals, often missing ongoing risks. Knowing these differences helps organizations optimize risk management, compliance, and decision-making processes.

Comparison Table

| Aspect | Continuous Auditing | Periodic Auditing |

|---|---|---|

| Definition | Ongoing real-time or near-real-time evaluation of financial transactions and controls. | Scheduled audits conducted at regular intervals (monthly, quarterly, annually). |

| Frequency | Constant or real-time monitoring. | Periodic, typically quarterly or yearly. |

| Scope | Focused on specific transactions and controls continuously. | Comprehensive review of financial statements and compliance over a period. |

| Technology Usage | High, leveraging automated tools and data analytics. | Moderate, often manual sampling and testing methods. |

| Benefits | Early detection of errors and fraud, improved risk management. | Broad assurance on overall financial health and compliance. |

| Cost | Potentially higher initial investment in technology. | Lower upfront costs but possible higher long-term risk exposure. |

| Suitability | Best for high-volume transactions and dynamic environments. | Suitable for smaller organizations or less complex operations. |

Which is better?

Continuous auditing provides real-time financial data analysis, enhancing accuracy and timely detection of discrepancies compared to periodic auditing, which only reviews data at set intervals. This method allows organizations to mitigate risks more effectively and ensures ongoing compliance with regulatory standards. Companies investing in continuous auditing technologies often report improved operational efficiency and reduced incidence of fraud.

Connection

Continuous auditing leverages automated systems to provide real-time data analysis and monitoring of financial transactions, enhancing accuracy and timeliness in identifying discrepancies. Periodic auditing complements this by conducting comprehensive, scheduled reviews that validate the ongoing integrity of financial records and internal controls. Both methods integrate to improve overall audit quality, risk management, and regulatory compliance within accounting frameworks.

Key Terms

Audit Frequency

Periodic auditing typically occurs at fixed intervals, such as quarterly or annually, providing a snapshot of an organization's financial health and compliance status at a specific point in time. Continuous auditing involves real-time or near-real-time monitoring, enabling immediate detection of anomalies and more proactive risk management. Explore deeper insights into how audit frequency impacts organizational transparency and control effectiveness.

Real-time Monitoring

Periodic auditing involves scheduled assessments of financial records at specific intervals, often quarterly or annually, which may delay the detection of discrepancies or fraud. Continuous auditing utilizes automated tools and real-time data analysis to provide ongoing oversight, enabling immediate identification and resolution of issues as they arise. Explore how integrating continuous auditing can enhance real-time monitoring and improve organizational compliance.

Compliance Verification

Periodic auditing involves scheduled reviews at set intervals to assess compliance with regulatory standards and internal policies, often relying on sample-based data evaluation. Continuous auditing leverages real-time data monitoring and automated tools to provide ongoing compliance verification, enabling quicker identification and resolution of discrepancies. Explore how integrating these auditing approaches can enhance your organization's compliance strategy effectively.

Source and External Links

Ensuring AML/BSA Compliance - Periodic auditing involves conducting independent compliance tests at regular intervals (such as every 12-18 months) to maintain awareness of AML/BSA program health, with financial institutions often adopting an annual schedule, while considering additional audits when there are significant operational changes.

Periodic Audit: Understanding Its Legal Definition and Role - A periodic audit is an evaluation conducted at regular intervals to ensure that an organization is properly managing federal awards and complying with the related terms and conditions, focusing on overall compliance rather than individual awards.

What is periodic audit? Simple Definition & Meaning - Periodic auditing is a regular formal examination of an organization's financial records, regulatory compliance, and overall condition, designed to detect and address issues early, prevent fraud, and ensure adherence to legal requirements.

dowidth.com

dowidth.com