Blockchain reconciliation utilizes distributed ledger technology to provide transparent, immutable transaction records that enhance the accuracy and efficiency of financial data verification. Continuous reconciliation involves real-time matching and validation of transactions to maintain up-to-date financial records and quickly identify discrepancies. Explore the benefits and differences between blockchain reconciliation and continuous reconciliation to optimize your accounting processes.

Why it is important

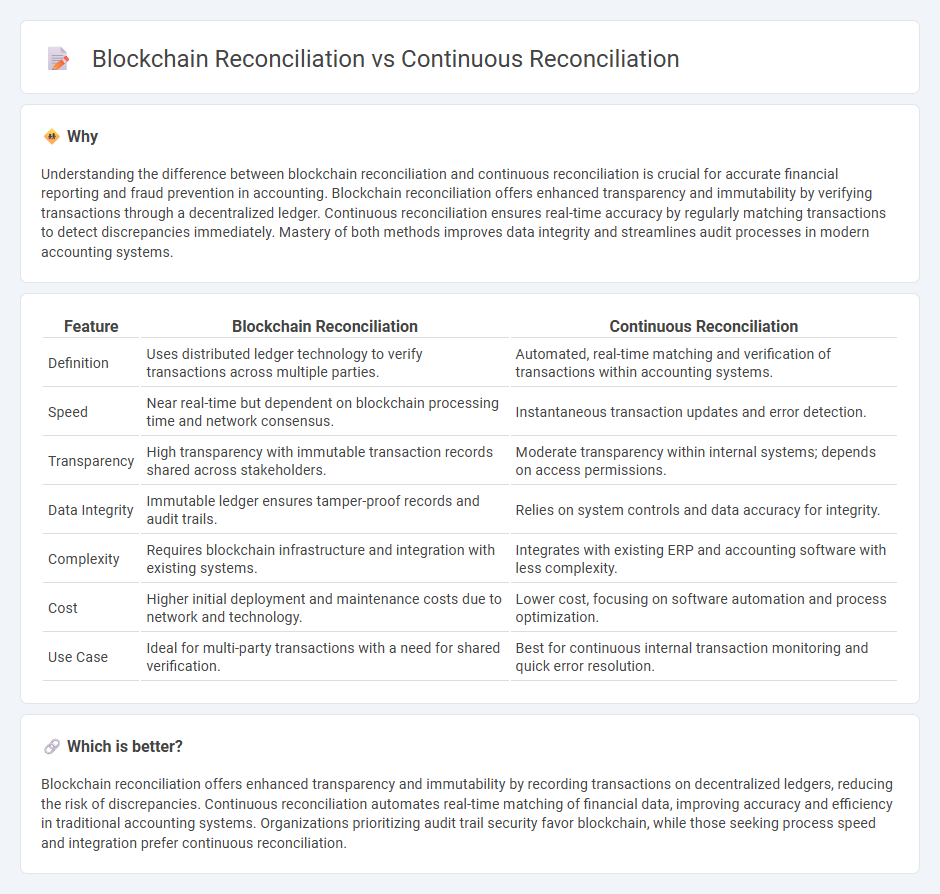

Understanding the difference between blockchain reconciliation and continuous reconciliation is crucial for accurate financial reporting and fraud prevention in accounting. Blockchain reconciliation offers enhanced transparency and immutability by verifying transactions through a decentralized ledger. Continuous reconciliation ensures real-time accuracy by regularly matching transactions to detect discrepancies immediately. Mastery of both methods improves data integrity and streamlines audit processes in modern accounting systems.

Comparison Table

| Feature | Blockchain Reconciliation | Continuous Reconciliation |

|---|---|---|

| Definition | Uses distributed ledger technology to verify transactions across multiple parties. | Automated, real-time matching and verification of transactions within accounting systems. |

| Speed | Near real-time but dependent on blockchain processing time and network consensus. | Instantaneous transaction updates and error detection. |

| Transparency | High transparency with immutable transaction records shared across stakeholders. | Moderate transparency within internal systems; depends on access permissions. |

| Data Integrity | Immutable ledger ensures tamper-proof records and audit trails. | Relies on system controls and data accuracy for integrity. |

| Complexity | Requires blockchain infrastructure and integration with existing systems. | Integrates with existing ERP and accounting software with less complexity. |

| Cost | Higher initial deployment and maintenance costs due to network and technology. | Lower cost, focusing on software automation and process optimization. |

| Use Case | Ideal for multi-party transactions with a need for shared verification. | Best for continuous internal transaction monitoring and quick error resolution. |

Which is better?

Blockchain reconciliation offers enhanced transparency and immutability by recording transactions on decentralized ledgers, reducing the risk of discrepancies. Continuous reconciliation automates real-time matching of financial data, improving accuracy and efficiency in traditional accounting systems. Organizations prioritizing audit trail security favor blockchain, while those seeking process speed and integration prefer continuous reconciliation.

Connection

Blockchain reconciliation enhances accounting accuracy by providing an immutable, transparent ledger that enables continuous reconciliation processes in real time. Continuous reconciliation leverages blockchain's decentralized validation to detect discrepancies instantly, reducing errors and improving financial reporting efficiency. This integration streamlines audit trails and ensures synchronized, up-to-date records across all stakeholders.

Key Terms

Real-time updates

Continuous reconciliation offers real-time updates by automatically matching transactions across systems, reducing delays and errors. Blockchain reconciliation enhances transparency and security with immutable ledger entries, but real-time data synchronization depends on network consensus speed. Explore how these technologies transform financial accuracy and operational efficiency in your business.

Decentralized ledger

Continuous reconciliation leverages real-time data integration to ensure financial records remain accurate and up-to-date, minimizing discrepancies between ledgers. Blockchain reconciliation uses a decentralized ledger, where transactions are immutably recorded across a distributed network, enhancing transparency and security by eliminating single points of failure. Explore the advantages of decentralized ledgers and how they revolutionize reconciliation processes.

Audit trail

Continuous reconciliation maintains a real-time audit trail by automatically matching transactions and updating records to ensure accuracy and compliance. Blockchain reconciliation enhances audit trail integrity through immutable, time-stamped ledger entries that provide transparent and tamper-proof records across all participants. Explore how these technologies transform audit trails and financial transparency.

Source and External Links

Continuous Reconciliation - Continuous reconciliation refers to an ongoing process of updating and verifying financial records in real-time, enhancing accuracy and reducing cash flow disruptions.

9 Best Continuous Reconciliation Platforms of 2024 - Continuous reconciliation platforms automate the reconciliation process, providing real-time financial views and reducing errors by flagging discrepancies immediately.

Continuous Accounting-Impact of Real-Time Reconciliation - Continuous accounting integrates real-time reconciliation to eliminate financial close bottlenecks, enhance financial transparency, and improve decision-making through accurate and timely data.

dowidth.com

dowidth.com