Embedded finance reconciliation ensures seamless tracking of integrated financial services within non-financial platforms, optimizing transaction accuracy across payment gateways and banking APIs. Payroll reconciliation focuses on verifying employee compensation records against disbursed payments, tax deductions, and benefits to maintain compliance and financial integrity. Explore further to understand the distinct processes and benefits of embedded finance and payroll reconciliation.

Why it is important

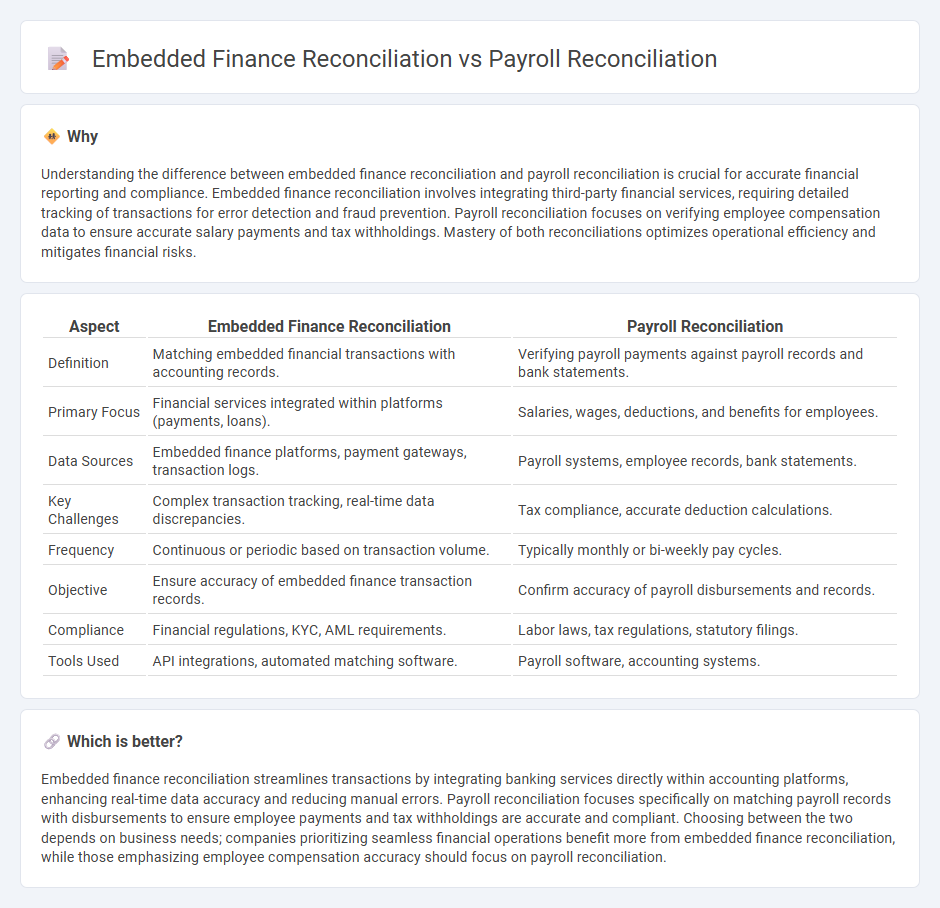

Understanding the difference between embedded finance reconciliation and payroll reconciliation is crucial for accurate financial reporting and compliance. Embedded finance reconciliation involves integrating third-party financial services, requiring detailed tracking of transactions for error detection and fraud prevention. Payroll reconciliation focuses on verifying employee compensation data to ensure accurate salary payments and tax withholdings. Mastery of both reconciliations optimizes operational efficiency and mitigates financial risks.

Comparison Table

| Aspect | Embedded Finance Reconciliation | Payroll Reconciliation |

|---|---|---|

| Definition | Matching embedded financial transactions with accounting records. | Verifying payroll payments against payroll records and bank statements. |

| Primary Focus | Financial services integrated within platforms (payments, loans). | Salaries, wages, deductions, and benefits for employees. |

| Data Sources | Embedded finance platforms, payment gateways, transaction logs. | Payroll systems, employee records, bank statements. |

| Key Challenges | Complex transaction tracking, real-time data discrepancies. | Tax compliance, accurate deduction calculations. |

| Frequency | Continuous or periodic based on transaction volume. | Typically monthly or bi-weekly pay cycles. |

| Objective | Ensure accuracy of embedded finance transaction records. | Confirm accuracy of payroll disbursements and records. |

| Compliance | Financial regulations, KYC, AML requirements. | Labor laws, tax regulations, statutory filings. |

| Tools Used | API integrations, automated matching software. | Payroll software, accounting systems. |

Which is better?

Embedded finance reconciliation streamlines transactions by integrating banking services directly within accounting platforms, enhancing real-time data accuracy and reducing manual errors. Payroll reconciliation focuses specifically on matching payroll records with disbursements to ensure employee payments and tax withholdings are accurate and compliant. Choosing between the two depends on business needs; companies prioritizing seamless financial operations benefit more from embedded finance reconciliation, while those emphasizing employee compensation accuracy should focus on payroll reconciliation.

Connection

Embedded finance reconciliation streamlines the integration of financial services within accounting systems, ensuring accurate transaction tracking and real-time data synchronization. Payroll reconciliation depends on this seamless integration to verify employee payments, tax deductions, and benefits disbursements against financial records. This connection enhances financial accuracy, reduces discrepancies, and supports compliance with regulatory accounting standards.

Key Terms

**Payroll Reconciliation:**

Payroll reconciliation involves verifying employee compensation records against actual payments processed, ensuring accuracy in wages, taxes, and deductions. This process is critical for compliance and financial reporting within organizations managing payroll data. Explore further to understand how advanced payroll reconciliation tools can streamline accuracy and regulatory adherence.

Gross Pay

Payroll reconciliation focuses on accurately matching employee gross pay records with payroll liabilities to ensure correct tax withholdings, benefits deductions, and net pay calculations, enhancing financial accuracy and compliance. Embedded finance reconciliation integrates payroll data within broader financial platforms, automating gross pay validation against bank transactions and accounting entries to streamline cash flow and reduce manual errors. Explore how these reconciliation processes optimize payroll workflows and financial operations for your business.

Deductions

Payroll reconciliation involves verifying employee deductions such as taxes, benefits, and garnishments to ensure accuracy in net pay calculations. Embedded finance reconciliation integrates financial services within payroll platforms, automating deduction processes and enhancing real-time tracking for compliance and reporting. Explore how leveraging embedded finance can optimize deduction management and streamline overall payroll reconciliation.

Source and External Links

What is Payroll Reconciliation? | How it Works - Trintech - Payroll reconciliation is the process of comparing employee compensation data, such as payroll registers, timesheets, and pay rates, to ensure accuracy and detect inconsistencies like unusual hours or pay changes.

What is Payroll Reconcilliation | F&A Glossary - BlackLine - Payroll reconciliation involves verifying that payroll records, including hours worked, pay rates, tax withholdings, and deductions, match across all relevant data like payroll registers and timesheets to ensure correct employee compensation.

A detailed Guide on Payroll Reconciliation Process - Payroll reconciliation consists of comparing financial records related to employee pay and benefits with other data sources at regular intervals to identify discrepancies, enabling correction and regulatory compliance.

dowidth.com

dowidth.com