Embedded finance reporting integrates financial services data directly into business platforms, enhancing real-time transaction monitoring and customer insights. Segment reporting, by contrast, disaggregates financial results by business units or geographic areas, providing detailed performance analysis across different company divisions. Explore further to understand the strategic benefits and applications of both reporting methods.

Why it is important

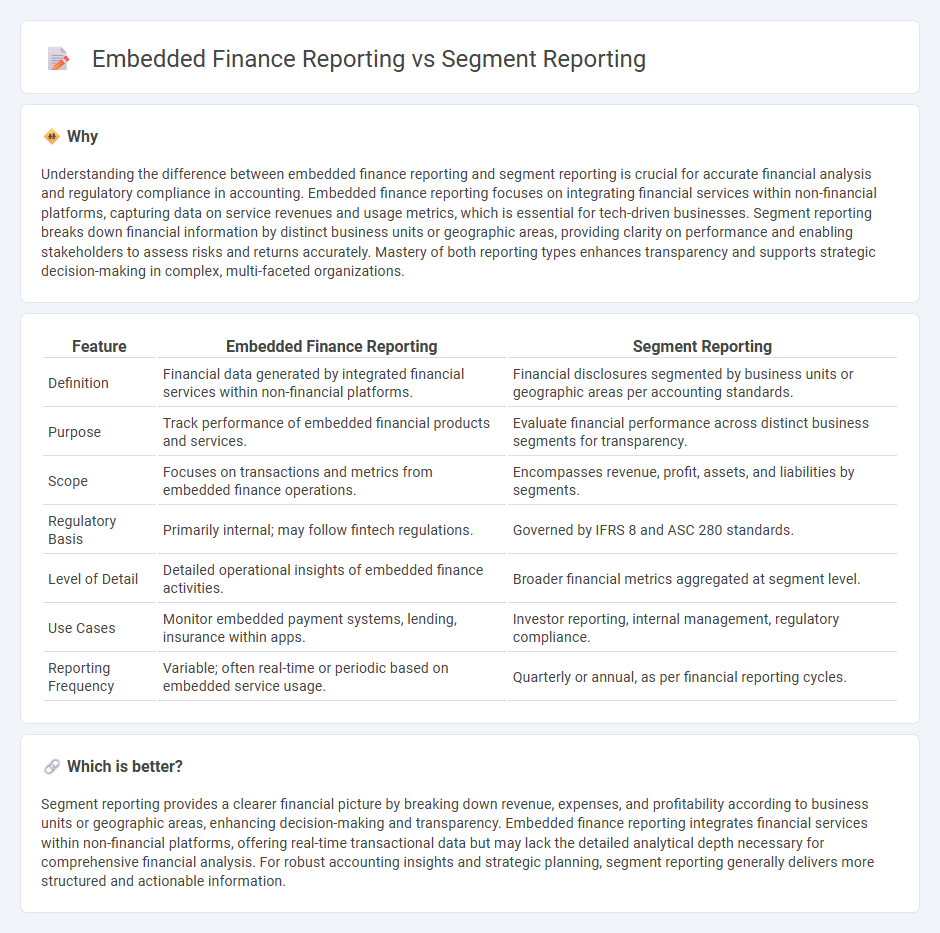

Understanding the difference between embedded finance reporting and segment reporting is crucial for accurate financial analysis and regulatory compliance in accounting. Embedded finance reporting focuses on integrating financial services within non-financial platforms, capturing data on service revenues and usage metrics, which is essential for tech-driven businesses. Segment reporting breaks down financial information by distinct business units or geographic areas, providing clarity on performance and enabling stakeholders to assess risks and returns accurately. Mastery of both reporting types enhances transparency and supports strategic decision-making in complex, multi-faceted organizations.

Comparison Table

| Feature | Embedded Finance Reporting | Segment Reporting |

|---|---|---|

| Definition | Financial data generated by integrated financial services within non-financial platforms. | Financial disclosures segmented by business units or geographic areas per accounting standards. |

| Purpose | Track performance of embedded financial products and services. | Evaluate financial performance across distinct business segments for transparency. |

| Scope | Focuses on transactions and metrics from embedded finance operations. | Encompasses revenue, profit, assets, and liabilities by segments. |

| Regulatory Basis | Primarily internal; may follow fintech regulations. | Governed by IFRS 8 and ASC 280 standards. |

| Level of Detail | Detailed operational insights of embedded finance activities. | Broader financial metrics aggregated at segment level. |

| Use Cases | Monitor embedded payment systems, lending, insurance within apps. | Investor reporting, internal management, regulatory compliance. |

| Reporting Frequency | Variable; often real-time or periodic based on embedded service usage. | Quarterly or annual, as per financial reporting cycles. |

Which is better?

Segment reporting provides a clearer financial picture by breaking down revenue, expenses, and profitability according to business units or geographic areas, enhancing decision-making and transparency. Embedded finance reporting integrates financial services within non-financial platforms, offering real-time transactional data but may lack the detailed analytical depth necessary for comprehensive financial analysis. For robust accounting insights and strategic planning, segment reporting generally delivers more structured and actionable information.

Connection

Embedded finance reporting integrates financial services data directly into business operations platforms, enhancing real-time visibility of transactional and financial metrics. Segment reporting dissects financial statements into distinct business units or product lines, revealing profitability and performance variations. The connection lies in embedded finance reporting providing granular, real-time data that enriches segment reporting accuracy and timeliness by enabling detailed, up-to-date financial analysis across different segments.

Key Terms

Segment Identification

Segment reporting involves identifying discrete business units or product lines to assess financial performance separately, enhancing transparency and managerial insight. Embedded finance reporting focuses on financial activities integrated within non-financial platforms, requiring identification of embedded services to track revenue streams accurately. Discover how precise segment identification improves financial clarity and strategic decision-making in both contexts.

Revenue Allocation

Revenue allocation in segment reporting involves distributing income across distinct business units or geographic areas to provide detailed financial insights. In contrast, embedded finance reporting focuses on attributing revenue generated from integrated financial services within non-financial platforms, highlighting the impact of these services on overall earnings. Explore the nuances between these reporting methods to optimize financial transparency and strategic decision-making.

Regulatory Compliance

Segment reporting requires detailed disclosure of financial performance and risks across business units, aligned with IFRS 8 standards to ensure transparency for investors. Embedded finance reporting emphasizes compliance with sector-specific regulations like PSD2 in Europe and FinCEN guidelines in the U.S., focusing on integrated financial services within non-financial platforms. Explore how both reporting frameworks impact regulatory adherence and operational strategy in fintech ecosystems.

Source and External Links

A Roadmap to Segment Reporting - Provides guidance on segment reporting under ASC 280, enhancing clarity on a company's financial performance and future cash flows.

What is Segment Reporting - Explains segment reporting as a process to break down a company's financial performance by business units, enabling detailed financial analysis.

Handbook: Segment Reporting - Discusses principles of ASC 280, including changes introduced by ASU 2023-07, and provides guidance on segment disclosure requirements.

dowidth.com

dowidth.com