Microtransaction accounting focuses on tracking and recording numerous small-value transactions efficiently, ensuring accuracy in volume-driven financial data. Payment gateway reconciliation involves matching payment processor records with internal transaction logs to identify discrepancies and prevent revenue loss. Explore our detailed comparison to understand the best practices and tools for optimizing financial accuracy in digital payments.

Why it is important

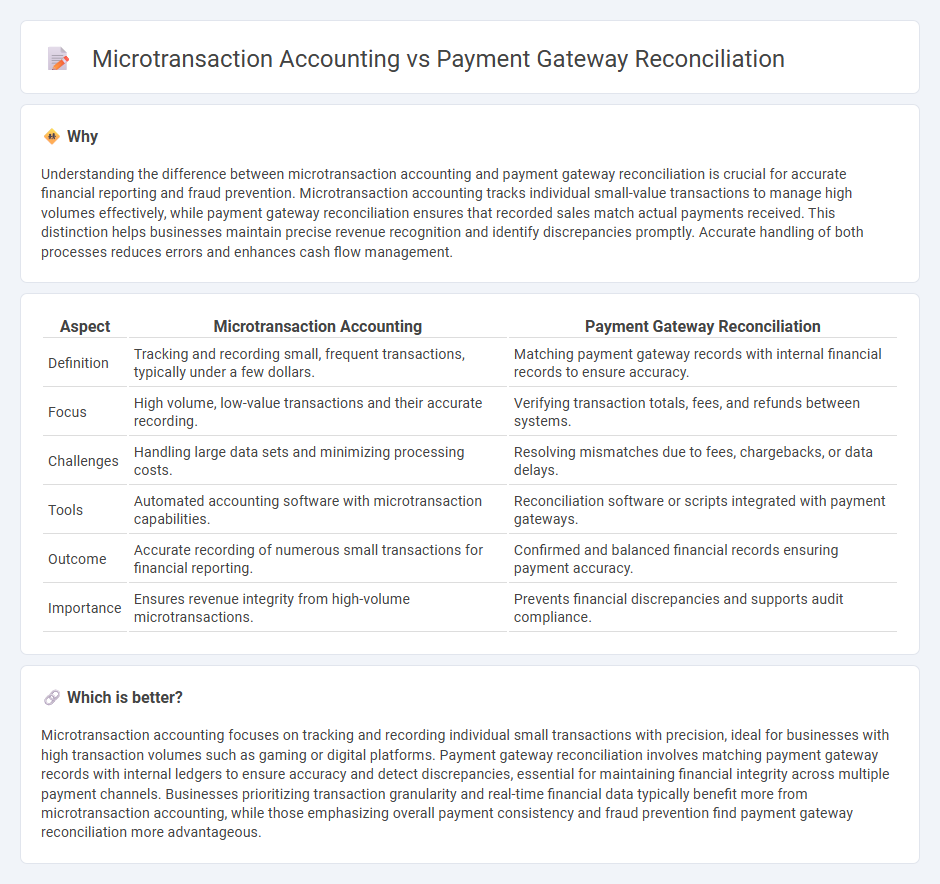

Understanding the difference between microtransaction accounting and payment gateway reconciliation is crucial for accurate financial reporting and fraud prevention. Microtransaction accounting tracks individual small-value transactions to manage high volumes effectively, while payment gateway reconciliation ensures that recorded sales match actual payments received. This distinction helps businesses maintain precise revenue recognition and identify discrepancies promptly. Accurate handling of both processes reduces errors and enhances cash flow management.

Comparison Table

| Aspect | Microtransaction Accounting | Payment Gateway Reconciliation |

|---|---|---|

| Definition | Tracking and recording small, frequent transactions, typically under a few dollars. | Matching payment gateway records with internal financial records to ensure accuracy. |

| Focus | High volume, low-value transactions and their accurate recording. | Verifying transaction totals, fees, and refunds between systems. |

| Challenges | Handling large data sets and minimizing processing costs. | Resolving mismatches due to fees, chargebacks, or data delays. |

| Tools | Automated accounting software with microtransaction capabilities. | Reconciliation software or scripts integrated with payment gateways. |

| Outcome | Accurate recording of numerous small transactions for financial reporting. | Confirmed and balanced financial records ensuring payment accuracy. |

| Importance | Ensures revenue integrity from high-volume microtransactions. | Prevents financial discrepancies and supports audit compliance. |

Which is better?

Microtransaction accounting focuses on tracking and recording individual small transactions with precision, ideal for businesses with high transaction volumes such as gaming or digital platforms. Payment gateway reconciliation involves matching payment gateway records with internal ledgers to ensure accuracy and detect discrepancies, essential for maintaining financial integrity across multiple payment channels. Businesses prioritizing transaction granularity and real-time financial data typically benefit more from microtransaction accounting, while those emphasizing overall payment consistency and fraud prevention find payment gateway reconciliation more advantageous.

Connection

Microtransaction accounting involves tracking and recording small, frequent financial transactions crucial for businesses with high-volume sales models. Payment gateway reconciliation ensures accuracy by matching transaction records from payment processors with internal accounting data, detecting discrepancies and preventing revenue loss. Integrating microtransaction accounting with payment gateway reconciliation streamlines financial audits, enhances cash flow management, and improves overall accounting accuracy.

Key Terms

Transaction Matching

Payment gateway reconciliation primarily involves verifying and matching transaction records between the payment processor and the merchant's accounting system to ensure accuracy in reporting and settlement. Microtransaction accounting focuses on detailed tracking and categorization of small-value transactions to manage revenue recognition and fraud detection efficiently. Explore more to understand how precise transaction matching enhances both reconciliation accuracy and microtransaction management.

Settlement Reports

Settlement reports in payment gateway reconciliation provide detailed summaries of transaction batches that enable businesses to verify and match payments received with bank deposits accurately. In microtransaction accounting, these reports help track high volumes of low-value transactions, ensuring precise revenue recognition and minimizing discrepancies. Explore more to understand how leveraging settlement reports can streamline financial accuracy and operational efficiency.

Fee Structures

Payment gateway reconciliation involves verifying transactions and associated fees to ensure accurate financial records, while microtransaction accounting focuses on managing numerous small-value transactions and their aggregated fees for profitability analysis. Fee structures in payment gateways typically include per-transaction fees, percentage-based fees, and monthly charges, all of which impact reconciliation accuracy and microtransaction cost management. Explore detailed comparisons of fee structures to optimize your financial processes effectively.

Source and External Links

Batch Gateway Reconciliation overview - Knowledge Center - Zuora - Payment gateway reconciliation is the process of verifying that electronic payment and refund transactions processed match those reported by the payment gateway, including processing, settlement, and post-settlement events such as chargebacks or reversals.

What is payment reconciliation? | Payments 101 - Payrails - Payment reconciliation confirms that transaction records align between internal systems and payment gateways or banks, helping spot inaccuracies, fraud, and ensuring a reliable audit trail through detailed transaction verification.

Payment gateway reconciliation: what you need to know - Payment gateway reconciliation is a complex process that matches financial records between parties, handling large volumes, fees, chargebacks, and delays, often aided by automated software to enable real-time reconciliation and reliable financial analytics.

dowidth.com

dowidth.com