Real-time expense reconciliation offers continuous tracking and immediate updates of financial transactions, enabling more accurate and up-to-date financial reporting compared to periodic reconciliation, which occurs at set intervals and may delay the detection of discrepancies. This approach enhances cash flow management, reduces errors, and supports faster decision-making for businesses aiming to maintain financial accuracy. Explore the benefits and applications of both reconciliation methods to improve your accounting processes.

Why it is important

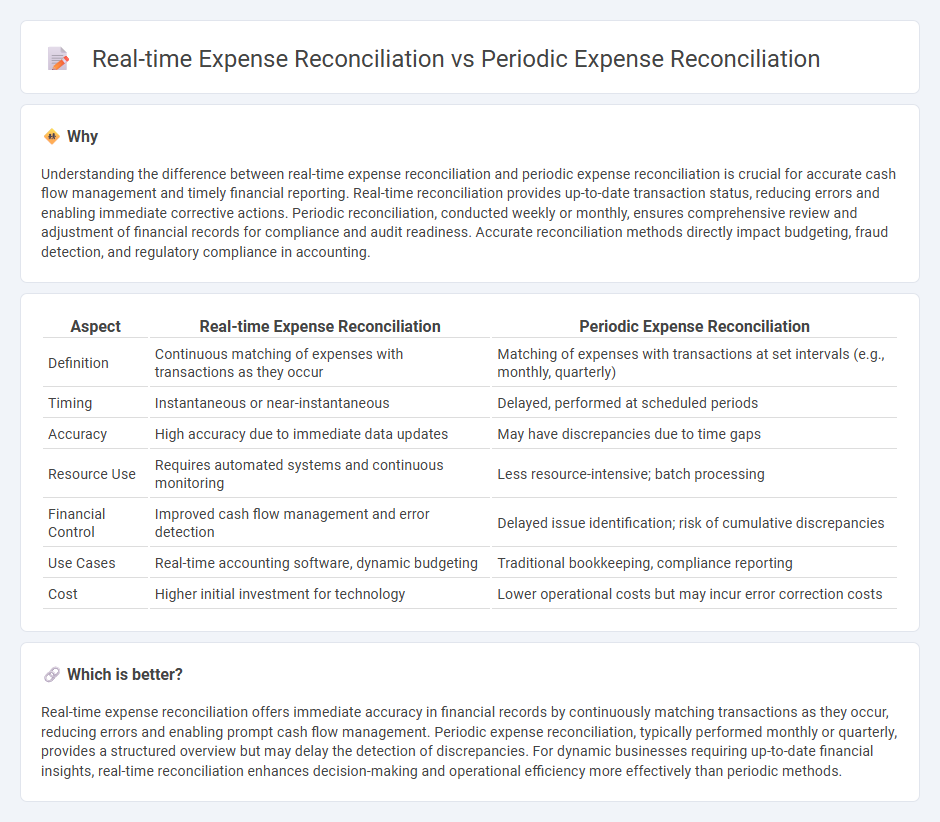

Understanding the difference between real-time expense reconciliation and periodic expense reconciliation is crucial for accurate cash flow management and timely financial reporting. Real-time reconciliation provides up-to-date transaction status, reducing errors and enabling immediate corrective actions. Periodic reconciliation, conducted weekly or monthly, ensures comprehensive review and adjustment of financial records for compliance and audit readiness. Accurate reconciliation methods directly impact budgeting, fraud detection, and regulatory compliance in accounting.

Comparison Table

| Aspect | Real-time Expense Reconciliation | Periodic Expense Reconciliation |

|---|---|---|

| Definition | Continuous matching of expenses with transactions as they occur | Matching of expenses with transactions at set intervals (e.g., monthly, quarterly) |

| Timing | Instantaneous or near-instantaneous | Delayed, performed at scheduled periods |

| Accuracy | High accuracy due to immediate data updates | May have discrepancies due to time gaps |

| Resource Use | Requires automated systems and continuous monitoring | Less resource-intensive; batch processing |

| Financial Control | Improved cash flow management and error detection | Delayed issue identification; risk of cumulative discrepancies |

| Use Cases | Real-time accounting software, dynamic budgeting | Traditional bookkeeping, compliance reporting |

| Cost | Higher initial investment for technology | Lower operational costs but may incur error correction costs |

Which is better?

Real-time expense reconciliation offers immediate accuracy in financial records by continuously matching transactions as they occur, reducing errors and enabling prompt cash flow management. Periodic expense reconciliation, typically performed monthly or quarterly, provides a structured overview but may delay the detection of discrepancies. For dynamic businesses requiring up-to-date financial insights, real-time reconciliation enhances decision-making and operational efficiency more effectively than periodic methods.

Connection

Real-time expense reconciliation enhances financial accuracy by instantly matching transactions with corresponding records, reducing errors and enabling timely decision-making. Periodic expense reconciliation compiles these reconciled transactions over a defined period to ensure overall ledger accuracy and compliance. Integrating real-time reconciliation data into periodic processes streamlines audit trails and optimizes accounting workflows for improved financial reporting.

Key Terms

Timing of Recording

Periodic expense reconciliation records transactions at set intervals, such as monthly or quarterly, causing potential delays in identifying discrepancies. Real-time expense reconciliation captures and records expenses instantly, enhancing accuracy and enabling immediate corrective actions. Explore how these approaches impact financial management and operational efficiency in detail.

Accuracy of Data

Periodic expense reconciliation involves reviewing and matching expenses at set intervals, which may lead to delayed identification of discrepancies and potential inaccuracies in the financial records. Real-time expense reconciliation continuously updates and verifies expenses as transactions occur, significantly enhancing data accuracy and reducing errors. Explore how real-time reconciliation can transform your financial accuracy and operational efficiency.

Cash Flow Management

Periodic expense reconciliation involves matching expenses against records at set intervals, which can delay the identification of discrepancies and impact cash flow forecasting accuracy. Real-time expense reconciliation continuously updates financial data, providing immediate visibility into cash outflows and enabling proactive management of working capital. Discover how integrating real-time reconciliation tools can enhance your cash flow management strategies.

Source and External Links

Expense Reconciliation: How to Reconcile Expenses Faster - Brex - Periodic expense reconciliation involves establishing consistent schedules, such as weekly for high-volume categories and monthly for others, to compare and match expense reports, receipts, and statements for accuracy and accountability, often leveraging automation tools for efficiency.

What is Expense Reconciliation? - Navan - Periodic expense reconciliation is the routine process of verifying business expenses against financial records to ensure accuracy, prevent fraud, maintain compliance, and derive spending insights for better financial planning.

Expense Reconciliation: A Guide to Reconcile Your ... - Happay - Expense reconciliation is regularly matching actual business expenses with accounting entries, performed weekly, bi-weekly, or monthly, to detect and resolve any discrepancies for accurate financial recordkeeping.

dowidth.com

dowidth.com